Hyundai to spend $30 bn on improving quality of combustion engine cars

The spending, following the $10.5 billion US project, aims to make Korea's production facilities its 'future business hub'

By May 25, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

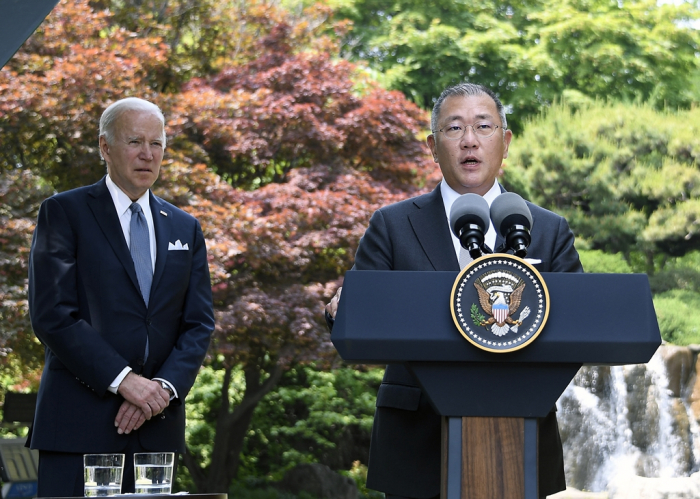

Hyundai Motor Group will invest 63 trillion won ($50 billion) in its domestic businesses through 2025 to strengthen its competitiveness in electrification, robotics and urban air mobility (UAM) as well as gasoline cars.

The conglomerate said on Tuesday three-fifths of the huge spending will go to improving the quality of combustion engine vehicles, which are expected to account for a considerable portion of its cars sold until 2025.

The automotive group, which owns South Korea’s two largest carmakers – Hyundai Motor Co. and Kia Corp. and auto parts maker Hyundai Mobis Co. – said the investment is aimed at turning its local facilities into the group’s “future business hub.”

The investment plan comes days after the group unveiled a plan to spend $10.5 billion on its US business, including $5.5 billion dedicated electric vehicle and battery manufacturing facilities in Savannah, Bryan County of Georgia, by 2025.

Regarding its Korean business plans, the group said its three flagship units will invest a combined 16.2 trillion won in all-electric and other eco-friendly vehicles, including fuel cell hydrogen cars, plug-in hybrids and purpose-built vehicles (PBVs).

NEW PLATFORMS

As part of its electrification plan, the group said it will develop a new EV platform, “eM,” which will replace the current EV platform, E-GMP, and a PBV-only platform, “eS,” by 2025.

The two new platforms will be based on its integrated modular architecture (IMA), according to Hyundai.

The group said it will also partner with other companies to install some 5,000 fast-charging stations across the country by 2025. Hyundai has built 100 high-speed chargers and plans to raise the number to 120 by the end of this year.

Kia, Korea’s second-largest automaker, has said it plans to break ground on the construction of its first PBV factory next year with an aim to start mass production in the second half of 2025.

Kia expects purpose-built vehicles to account for about a quarter of all cars sold globally by 2030.

The three Hyundai Motor Group units will inject 8.9 trillion won in future mobility technology such as UAM, wearable robots, autonomous driving and artificial intelligence.

BIG SPENDING ON COMBUSTION ENGINE CARS

Some 38 trillion won, or the lion’s share of its total domestic investment, will go to improving the quality of combustion engine vehicles, the group said.

“We understand a lot of people still prefer gasoline and diesel cars over electric vehicles. We’ll meet their requests to improve our customer satisfaction,” it said.

It expects eight of 10 vehicles sold by Hyundai and Kia by 2025 will still be powered by combustion engines.

Hyundai Motor plans to roll out 17 new battery EV models by 2030, including six premium Genesis cars, while affiliate Kia plans to release 14 EVs by 2027.

Hyundai Motor and Kia aim to sell a combined 3.23 million EVs annually, including 840,000 units in the US, by 2030 to account for 12% of the global EV market from the current 5%.

With the new EV plant in the US state of Georgia, Hyundai Motor Group expects to see what it terms a “Savannah effect,” meaning its increased market share in the global EV market as well as benefits for its parts suppliers, especially EV component producers.

Korean parts suppliers’ exports have been on the rise since the group started building overseas plants in 2005, it said.

Write to Il-Gue Kim at Black0419@hankyung.com

In-Soo Nam edited this article.

-

Electric vehiclesGeorgia state to provide $1.6 bn in incentives to Hyundai

Electric vehiclesGeorgia state to provide $1.6 bn in incentives to HyundaiMay 23, 2022 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai to invest $10.5 bn in US EV, future mobility sectors

Electric vehiclesHyundai to invest $10.5 bn in US EV, future mobility sectorsMay 22, 2022 (Gmt+09:00)

5 Min read -

AutomobilesKia chooses Coupang as first partner for purpose-built vehicle rollout

AutomobilesKia chooses Coupang as first partner for purpose-built vehicle rolloutApr 15, 2022 (Gmt+09:00)

2 Min read -

AutomobilesHyundai Motor, Kia rank fifth in global electric vehicle sales

AutomobilesHyundai Motor, Kia rank fifth in global electric vehicle salesApr 06, 2022 (Gmt+09:00)

2 Min read -

AutomobilesKia set to break ground on purpose-built vehicle plant in 2023

AutomobilesKia set to break ground on purpose-built vehicle plant in 2023Mar 30, 2022 (Gmt+09:00)

2 Min read -

Electric vehiclesKia aims to launch 14 all-electric models by 2027

Electric vehiclesKia aims to launch 14 all-electric models by 2027Mar 03, 2022 (Gmt+09:00)

3 Min read