Chemical Industry

Toray Advanced Materials reviews film line expansion in S.Korea

The subsidiary of Japan’s chemical giant Toray Group has tripled this year’s capex from 2022

By Aug 06, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Toray Advanced Materials Korea Inc. (TAK) is reviewing its film line expansion in South Korea as part of its 300 billion won ($229 million) capital expenditure plan for this year, unlike other chemical firms that have frozen their investments due to an industry slowdown amid the economic downturn.

According to sources in the chemical industry on Sunday, Japanese chemical giant Toray Group’s Korean subsidiary is in the final review stage for investment to add film lines at its plant in Gumi, North Gyeongsang Province.

The move goes against its peers’ decisions to either sell off their film businesses or lower their film line utilization rate due to dwindling global demand for TVs and other appliances amid lingering concerns over the economic downturn.

In general, petrochemical companies expand their facility investments during an industry upturn but tighten their belts and sit on their money for future investments during a downturn.

It is also a time when most Korean chemical companies remain especially cautious about capex expansion as their Chinese peers have been aggressively expanding their capacity to reduce reliance on imports.

“This is part of the company’s strategy to boost its market share later by making a pre-emptive investment when its rivals remain shy about investment,” said an unnamed official from TAK. “Film orders are now low but TV demand will improve should the economy recover.”

This is part of TAK's 300 billion won facility and stake investment earmarked for this year, a more than threefold jump from last year.

Amid lingering economic uncertainty stemming from the COVID-19 outbreak, the company cut investment to 90 billion won in 2022 from 190 billion won in 2021 and 170 billion won in 2020.

INVESTMENT IN ADVANCED MATERIALS AND TECHNOLOGIES

TAK has been lavishly spending on advanced materials and products with higher technological barriers.

In February, it announced a plan to expand its annual production capacity of polyphenylene sulfide (PPS) resins by 5,000 tons at its Gunsan plant in North Jeollar Province. PPS is a super engineering plastic resin boasting excellent heat resistance, strength, chemical resistance and processability.

It also unveiled another plan last month to expand its carbon fiber’s annual production capacity by 3,300 tons at a Gumi plant to 8,000 tons in total by the second half of 2025.

Toray Group is the unrivaled leader in the global carbon fiber market.

TAK will use some of this year’s capex to buy Hanmee Entec Co., Korea’s oldest water treatment facility operating and managing company, which it in March announced to take over.

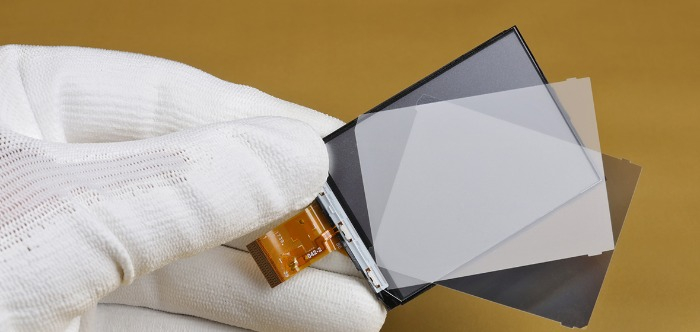

It entered the battery separator film market after it in early June agreed to acquire a 70% stake in Toray Battery Separator Film Korea Ltd. from its Japanese parent.

Battery separator films are used in lithium-ion secondary batteries.

Write to Hyung-Kyu Kim at khk@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

Waste managementToray Advanced Materials acquires S.Korea's water treatment company

Waste managementToray Advanced Materials acquires S.Korea's water treatment companyMar 20, 2023 (Gmt+09:00)

1 Min read -

Chemical IndustryToray Korea to boost PPS resin production with expansion plan

Chemical IndustryToray Korea to boost PPS resin production with expansion planFeb 06, 2023 (Gmt+09:00)

1 Min read -

Fiber & TextileEnvioneer, Toray to make super fibers for EV insulators

Fiber & TextileEnvioneer, Toray to make super fibers for EV insulatorsJun 16, 2022 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN