August inflation puts BOK under fire for delayed pivot

Market consensus is that the Bank of Korea will slash interest rates in October

By Sep 04, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

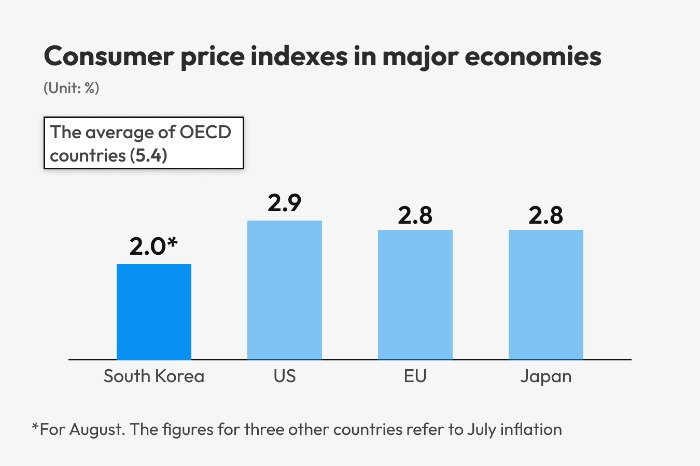

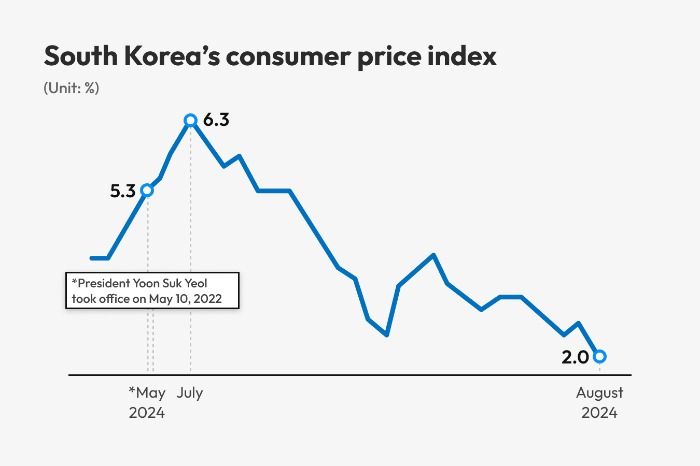

South Korea’s inflation moderated to the government’s target of 2.0% in August, its slowest increase in three years and five months, putting greater pressure on the Bank of Korea to pivot toward monetary easing before it is too late.

The August inflation bolstered views that the central bank might have missed the right time to slash interest rates, with the presidential office and the ruling People Power Party recommending the BOK lower the policy rate to revive domestic demand.

Last month, the BOK kept interest rates unchanged at 3.50% for the 13th straight month.

Tamed inflation has reinforced expectations for a pivot toward monetary loosening. But soaring household debts that leapt to a record high in the second quarter of this year and rising home prices outweighed decelerating inflation in the rate decision.

After the August monetary policy meeting, BOK Governor Rhee Chang-yong hinted at an interest rate cut as early as next month, citing the downward trend in inflation.

August’s inflation reading of 2.0% marked its slowest pace of year-on-year increase since recording 1.9% in March 2021 and came on the heels of a 2.6% gain in July, according to Statistics Korea.

It remained below the 3% level for the fifth straight month thanks to a fall in crude oil prices and stable agricultural prices.

The Ministry of Economy and Finance predicts the country’s inflation to hover at the low end of 2% for the rest of this year.

But rapid household debt growth poses a dilemma for the BOK before its shift to monetary easing. It is understood to prioritize housing prices and debts over domestic demand in rate moves.

Home prices, particularly in the Seoul Metropolitan Area, have recovered, or surpassed pre-pandemic levels.

To cool the housing market, domestic banks have hiked mortgage rates, going against market expectations of imminent rate cuts. But it failed to reverse the borrowing spree by home buyers.

Under growing pressure to curb mortgage loan growth from financial regulators, banks have taken additional steps to tighten lending: reducing the maximum term on mortgage loans and setting limits on home-secured personal loans.

Market consensus is the BOK will make its first rate cut in more than a year in October. It will skip a monetary policy meeting this month, as the Korean Thanksgiving Chuseok holidays fall in September this year.

The presidential office and the ruling People Power Party are adding to pressure on the central bank to trim interest rates. They recently delivered rare public comments about monetary policy, saying that interest rate cuts would be the only policy tool to shore up the economy at this point.

Write to Kyung-Min Kang and Jin-Gyu Kang at Kkm1026@hankyung.com

Yeonhee Kim edited this article

-

Banking & FinanceKookmin to tighten loan limits to cool housing market

Banking & FinanceKookmin to tighten loan limits to cool housing marketAug 26, 2024 (Gmt+09:00)

3 Min read -

Central bankBOK signals autumn rate cut as inflation, economic growth slow

Central bankBOK signals autumn rate cut as inflation, economic growth slowAug 22, 2024 (Gmt+09:00)

3 Min read -

EconomyKorea’s household debt hits record high on mortage loans

EconomyKorea’s household debt hits record high on mortage loansAug 20, 2024 (Gmt+09:00)

2 Min read -

EconomyBOK in limbo on rate decison with July inflation below 3%

EconomyBOK in limbo on rate decison with July inflation below 3%Aug 02, 2024 (Gmt+09:00)

3 Min read -

Central bankBOK chief signals rate cut; warns of rising housing prices

Central bankBOK chief signals rate cut; warns of rising housing pricesJul 11, 2024 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s July household debt grows at fastest pace in over 3 years

EconomyS.Korea’s July household debt grows at fastest pace in over 3 yearsAug 01, 2024 (Gmt+09:00)

2 Min read -

EconomyKorean banks raise mortgage rates despite looming rate cut

EconomyKorean banks raise mortgage rates despite looming rate cutJul 17, 2024 (Gmt+09:00)

2 Min read -

Foreign exchangeWon to soften past 1,400, BOK rate cut likely in Oct: poll

Foreign exchangeWon to soften past 1,400, BOK rate cut likely in Oct: pollJul 10, 2024 (Gmt+09:00)

4 Min read -

EconomyS.Korea’s inflation holds below 3% for 3rd straight month

EconomyS.Korea’s inflation holds below 3% for 3rd straight monthJul 02, 2024 (Gmt+09:00)

2 Min read -

Central bankBOK chief’s top mission: Soft landing for household debt

Central bankBOK chief’s top mission: Soft landing for household debtAug 24, 2023 (Gmt+09:00)

2 Min read