Kookmin to tighten loan limits to cool housing market

Regulatory FSS chief urges banks to contain household loan growth with measures other than raising lending rates

By Aug 26, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Kookmin Bank, South Korea’s largest lender under KB Financial Group, will tighten lending to curb mortgage loan growth in line with the government's efforts to contain housing price rises, according to financial industry sources on Monday.

The new measures, the first of their kind among local banks, follow a string of consecutive mortgage rate hikes since July of this year to tamp down loan growth.

But rising borrowing costs have failed to cool the housing market, which financial authorities said were being driven by speculative demand in anticipation of interest rate cuts. Housing prices, particularly in the Seoul metropolitan area, have recovered, or surpassed pre-pandemic levels.

Starting on August 29, Kookmin will reduce the maximum term on all mortgage loans to 30 years from 50 years for buyers under age 34 of homes in the Seoul metropolitan area.

It will also introduce limits on home-secured personal loans to 100 million won ($75,500) per project such as buying a car or doing a home renovation.

In addition, Kookmin will scrap the grace period granted to mortgage and secured-loan borrowers that allows them to delay principal repayment for up to one and three years, respectively. During a grace period, only interest on loans has to be paid.

New mortgage loans being extended as of August 29 will not be eligible for mortgage indemnity guarantees, which will result in loan limits being cut by 55 million won for the purchase of a home in Seoul; by 48 million won in surrounding Gyeonggi Province; and by 28 million won in other metropolitan cities, according to the sources.

For example, for home buyers in Seoul with an annual salary of 50 million won, the maximum secured loan they can obtain will be cut by more than 100 million won, after applying both the reduced mortgage loan term and the absence of a mortgage insurance guarantee.

Kookmin will also reduce credit loan limits to 50 million won per borrower from the current 100 million to 150 million won.

Kookmin’s move to apply stricter lending criteria came after Lee Bok-hyun, governor of the Financial Supervisory Service (FSS), said in a radio program on Sunday he felt a strong need to intervene in curbing home price hikes in the Seoul region.

On the radio show, he criticized domestic banks for using lending rate hikes as their only tool to slow household loan growth, saying: "Banks' mortgage rate hikes are not what the [financial] authorities wanted."

Lee warned of further regulatory steps unless household loan growth is kept in check. Industry observers said new policy measures could include reductions in loan-to-value and debt service ratios.

In response to Lee's comments, lending officials at Kookmin and other domestic banks such as Shinhan, Hana, Woori and NongHyup went to work over the weekend drafting measures to contain household loan growth.

"We're perplexed that the financial authorities are blaming the rapid increase in household loans on the banks' management failure,” said a deputy president at a major Korean bank. "We're reviewing every possible measure except for lending rate hikes."

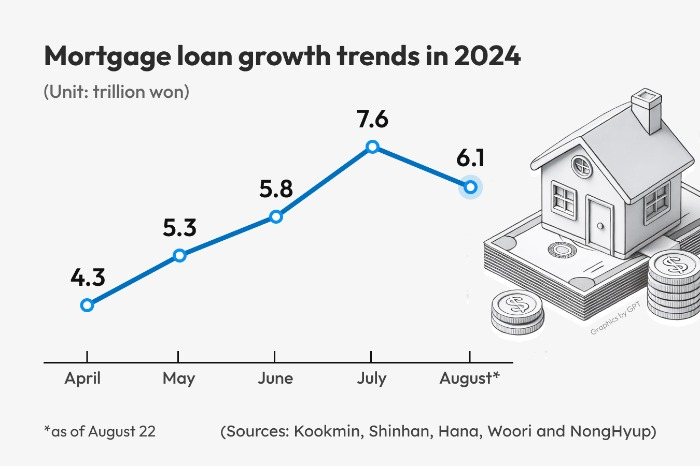

The balance of mortgage loans, including loans used to pay a lump-sum payment as a rental deposit, swelled by 7.6 trillion won to 559.8 trillion won at Korea’s top five banks in July alone. It marked the largest monthly expansion in the combined balance of the five lenders.

That record looks set to be broken this month, however. In August, their combined mortgage loan balance increased by 6.1 trillion won to 565.9 trillion won as of August 22.

Soaring household debt and rising home prices pose headaches for the Bank of Korea, putting it on the fence on a rate decision despite moderating inflation.

Write to Bo-Hyung Kim at Kph21c@hankyung.com

Yeonhee Kim edited this article

-

Central bankBOK signals autumn rate cut as inflation, economic growth slow

Central bankBOK signals autumn rate cut as inflation, economic growth slowAug 22, 2024 (Gmt+09:00)

3 Min read -

EconomyKorea’s household debt hits record high on mortage loans

EconomyKorea’s household debt hits record high on mortage loansAug 20, 2024 (Gmt+09:00)

2 Min read -

EconomyBOK in limbo on rate decison with July inflation below 3%

EconomyBOK in limbo on rate decison with July inflation below 3%Aug 02, 2024 (Gmt+09:00)

3 Min read -

Central bankBOK chief signals rate cut; warns of rising housing prices

Central bankBOK chief signals rate cut; warns of rising housing pricesJul 11, 2024 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s July household debt grows at fastest pace in over 3 years

EconomyS.Korea’s July household debt grows at fastest pace in over 3 yearsAug 01, 2024 (Gmt+09:00)

2 Min read -

EconomyKorean banks raise mortgage rates despite looming rate cut

EconomyKorean banks raise mortgage rates despite looming rate cutJul 17, 2024 (Gmt+09:00)

2 Min read -

EconomyKorea’s household debt growth at 5-month high on mortgages

EconomyKorea’s household debt growth at 5-month high on mortgagesMay 13, 2024 (Gmt+09:00)

2 Min read -

Central bankBOK chief’s top mission: Soft landing for household debt

Central bankBOK chief’s top mission: Soft landing for household debtAug 24, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK warns of household lending risk on growth, inequality

Central bankBOK warns of household lending risk on growth, inequalityJul 17, 2023 (Gmt+09:00)

3 Min read -

EconomyMortgage loan growth slows to near four-year low in November

EconomyMortgage loan growth slows to near four-year low in NovemberDec 09, 2021 (Gmt+09:00)

2 Min read