Central bank

South Koreans expect inflation to slow, relief to BOK’s hawkish stance

The December reading is the lowest since April 2022, lending support to the rate-cut view. But the BOK chief thinks otherwise

By Dec 27, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Koreans expect inflation to slow over the next 12 months, providing relief to the central bank’s hawkish stance that policy rates should remain high longer despite the sluggish domestic economy, Asia’s fourth largest.

Inflation expectations among consumers for the year ahead stood at 3.2% in December, down 0.2 of a percentage point from the previous month, Bank of Korea (BOK) data showed Wednesday.

The December reading is the lowest since April 2022, when the consumer inflation outlook stood at 3.1%.

Inflation expectations have been moving sideways, hovering around the mid-3% range this year after peaking at 4.7% in July 2022.

Hwang Hee-jin, head of the BOK’s statistics research team, said at a media briefing that the lowered inflation expectations were influenced by a recent slowdown in consumer prices following a decline in petroleum prices caused by the international oil price drop.

But he warned of the resilience of rising consumer prices.

“Prices of agricultural products, processed foods and eating out remain elevated. The expected rise in public transport and utility rates is also a variable. We certainly need to watch if the (downward) price trend will continue,” he said.

SENTIMENT IS IMPROVING, FOR SURE

Wednesday’s BOK data show consumers have turned less pessimistic about their spending and the overall economy amid moderating inflation and a recovery in exports.

The central bank’s survey showed the composite consumer sentiment index stood at 99.5 in December, up from 97.2 in November and ending four straight months of declines.

A reading below 100 indicates there are still more pessimists than optimists.

Korea’s current account balance, the broadest measure of cross-border trade, posted the largest surplus in more than a year in October as goods exports reported their first on-year growth in 14 months.

Analysts said consumer sentiment is also improving on the belief that the US Fed’s rate-hike cycle is nearing its end.

The BOK said on Wednesday that the consumer interest rate outlook index significantly dropped to 107 in December from 119 in the previous month, indicating that an increasing number of people are betting on a BOK rate cut in the near term.

"The significant drop is due to expectations of an imminent end of US interest rate hikes,” Hwang said.

In November, Korea’s headline inflation eased for the first time in four months. The benchmark consumer price index rose 3.3% from a year earlier in November, following the previous month’s 3.8% rise, according to Korea’s statistics office. Nevertheless, the November reading is well above the central bank’s 2% target.

BOK CHIEF THINKS OTHERWISE

Despite all those bullish signs of easing inflation, however, BOK Gov. Rhee Chang-yong is among those most pessimistic.

After standing pat at the BOK’s policy interest rate of 3.5% for a seventh straight month on Nov. 30 – the central bank’s final rate review day of the year – Rhee said Korea’s interest rates will have to stay high for a “sufficiently long period.”

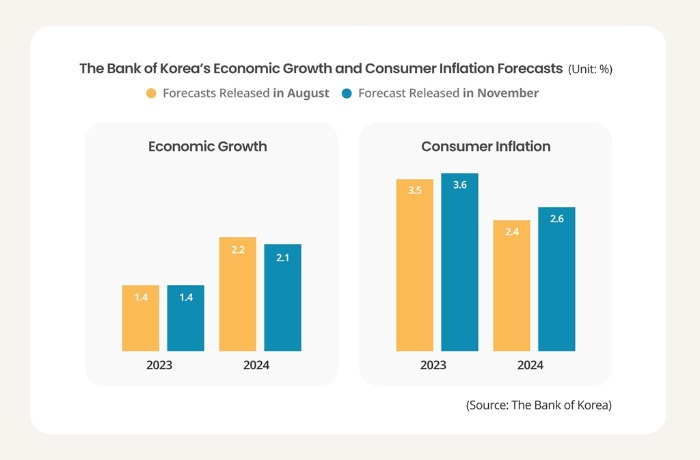

At the Nov. 30 meeting, the central bank ramped up its consumer inflation forecasts for this year and 2024 to 3.6% and 2.6%, respectively. In August, the BOK predicted that inflation would likely stand at 3.5% this year and 2.4% in 2024.

Meanwhile, it lowered its economic growth forecast for 2024 to 2.1% from the previous 2.2% while maintaining its prediction for this year at 1.4%.

“We plan to maintain our tightening bias until we are confident that inflation will converge at the target level,” said Gov. Rhee.

Market analysts expect the BOK to turn to an easing bias and start cutting rates in the second half of next year to boost economic growth.

Write to Jin-gyu Kang at josep@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Central bankBOK chief says rates need to stay high for over 6 months

Central bankBOK chief says rates need to stay high for over 6 monthsNov 30, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK governor named chair of BIS financial system committee

Central bankBOK governor named chair of BIS financial system committeeNov 15, 2023 (Gmt+09:00)

2 Min read -

EconomyKDI cuts Korea growth forecasts, ups inflation predictions

EconomyKDI cuts Korea growth forecasts, ups inflation predictionsNov 09, 2023 (Gmt+09:00)

2 Min read -

Food & BeverageKorea steps up pressure on private sector to ease inflation

Food & BeverageKorea steps up pressure on private sector to ease inflationOct 20, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK chief says inflation may ease more slowly than expected

Central bankBOK chief says inflation may ease more slowly than expectedOct 19, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN