Business & Politics

Korea’s SK Siltron receives $544 mn loan from DOE for wafer investment

SK Chair Chey Tae-won welcomes the move as SK Siltron is one of the few global firms that can make SiC wafers

By Nov 13, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

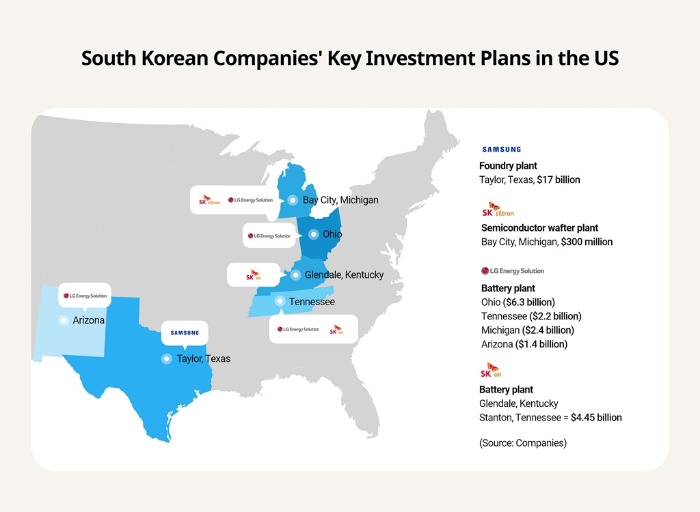

South Korea’s SK Siltron Co. has secured a $544 million loan from the US Department of Energy (DOE) to invest in a high-quality silicon carbide (SiC) wafer manufacturing facility in Bay City, Michigan.

Industry sources said on Wednesday that SK’s US affiliate SK Siltron CSS LLC last week signed a formal contract to secure the loan under the Advanced Technology Vehicles Manufacturing Loan Program (ATVM).

The DOE, which gave conditional approval for the loan in February, has also made it official through its Loan Program Office (LPO) blog.

The loan – $481.5 million principal and $62.5 million capitalized interest – is part of the Biden administration’s “Investing in America” agenda that supports the onshoring and re-shoring of domestic manufacturing technologies critical to meeting the US government’s goal that half of all new vehicles sold in 2030 are zero-emissions vehicles.

SK Siltron plans to use the loan to expand SiC wafer production facility in Bay City. The Korean company aims to begin mass production of the material in 2025 at its plant in Gumi, Korea and the expanded facility in Bay City.

HIGHLY VALUABLE PRODUCT

SK Siltron CSS manufactures SiC wafers, ideal for a wide range of semiconductor applications due to their high thermal resistance and hardness.

SiC semiconductors are designed for high-power and high-voltage applications, where efficiency and reliability are key. They are critical components of EV drivetrains, including inverters, and electrical distribution systems like onboard chargers and DC-to-DC converters.

SiC wafers have significant advantages over silicon wafers, such as withstanding 10 times higher voltage and three times higher temperatures, making them invaluable for power semiconductors used in electric vehicles and renewable energy generation.

SiC semiconductors enhance the charging speed of EVs by 75%, increase mileage by 7.5% and reduce inverter module weight and volume by over 40% compared with traditional silicon semiconductors.

Due to the high technological barriers of SiC wafer production, only a handful of companies have the design and manufacturing capabilities to make them.

Major SiC wafer makers include SK Siltron, Japan’s Shin-Etsu Chemical Co. and Sumco Corp., Taiwan’s GlobalWafers Co. and Germany’s Siltronic AG.

In 2023, SK Siltron CSS clinched a long-term supply contract with Germany’s Infineon Technologies AG, a leading SiC power semiconductor maker.

SK Siltron controls 6% of the global SiC wafer market as of end-2023.

According to market research firm Yole Group, the SiC device market is forecast to grow to $990 million by 2029 from $270 million in 2023, driven by the growth of the EV market, expanded charging infrastructure and increased renewable energy generation like solar and wind.

SK CHAIR CHEY TAE-WON WELCOMES THE DOE MOVE

SK Siltron, 51% owned by the parent group's holding company SK Inc., bought the Bay City, Auburn plant from US industrial materials maker DuPont for $450 million in 2020.

The Korean company has invested $630 million over six years to build new SiC wafer facilities in Bay City and expand its Gumi plant.

Production of next-generation 200-millimeter SiC wafers is expected to begin in 2025.

SK Group Chairman Chey Tae-won has been leading the business cooperation push between the US and Korea.

SK has invested $30 billion in US companies in future-oriented industries such as semiconductors, renewable energy and life sciences since 2019.

Chey was part of Korea’s economic delegation to the US in April 2023 when Korean President Yoon Suk Yeol visited Washington for a summit meeting with Biden.

“SK Siltron CSS is the proof of a successful US-Korea partnership,” said the SK chairman.

With the US loan to SK Siltron finalized, industry officials are now looking to see how much Samsung Electronics Co. can receive from the US government in chip subsidies.

The US government is reportedly working to finalize subsidy agreements with Samsung, Intel Corp., Micron Technology Inc. and others.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Leadership & ManagementSK Group’s Chey Tae-won heads to Europe, seeks AI partnerships at MWC

Leadership & ManagementSK Group’s Chey Tae-won heads to Europe, seeks AI partnerships at MWCFeb 13, 2024 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Siltron, UK's IQE to produce high-efficiency wafers for Asian market

Korean chipmakersSK Siltron, UK's IQE to produce high-efficiency wafers for Asian marketOct 11, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersKorea's SK Siltron to invest $597 mn in silicon wafer production

Korean chipmakersKorea's SK Siltron to invest $597 mn in silicon wafer productionSep 30, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersSK Siltron to invest $300 mn in US capacity expansion

Korean chipmakersSK Siltron to invest $300 mn in US capacity expansionMar 18, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Siltron to ramp up silicon wafer output from 2024

Korean chipmakersSK Siltron to ramp up silicon wafer output from 2024Mar 16, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN