SK Siltron to ramp up silicon wafer output from 2024

The semiconductor wafer manufacturer plans to spend $800 mn on domestic capacity expansion

By Mar 16, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

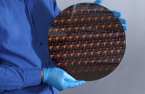

South Korean silicon wafer maker SK Siltron Co. on Wednesday announced a plan to spend 1 trillion won ($810 million) on its domestic capacity expansion by the first half of 2024, from which it plans to ramp up output.

It will kick off construction of the new 300-millimeter wafter production lines during the first half of this year. Wafers with a 300-mm diameter are used for making microprocessor unit chips and CMOS image sensors.

"Once the capacity expansion is completed, we will be able to respond more comfortably to customer demand," said an SK Siltron official.

Over the past two years, the world's No. 5 wafer manufacturer has operated at full capacity to meet surging demand. But the company did not specify the extent of additional volume of wafers it would produce from 2024.

The new production facility, measuring 42,716 square meters, will be built within the National Industrial Complex in Gumi, North Gyeongsang Province, where its headquarters are located.

Related to the capacity increase, the SK Group arm plans to hire 1,000 new employees.

"With this capacity expansion, we will make accurate predictions on and respond preemptively to the changing market environment," SK Siltron Chief Executive Chang Yong-ho said in a statement.

"We will renovate our technology in cooperation with global chipmakers and take a leap forward to become a market leader with the manufacturing capacity to produce high-quality wafers."

A wafer is part of the semiconductor value chain that starts with polysilicon and is used as a substrate where multiple microchips are printed before dicing.

SK Siltron controls 10.6% of the $11.2 billion wafer market as of 2020, in which five players have a combined 94% share.

Two Japanese firms Shin-Etsu Chemical and Sumco Corporation hold more than a 55% share of the global wafer market as of 2020, according to the research house Omdia.

Taiwan's GlobalWafers and Germany's Siltronic come third and fourth, controlling 16.7% and 12.3% of the wafer market, respectively.

In January of this year, the US Commerce Department said that a global supply shortage of semiconductor chips was primarily sparked by wafer production capacity constraints, based on its global survey of semiconductor chip producers and users.

Last month, Germany blocked GlobalWafers’ $4.9 billion deal to buy Munich-based rival Siltronic on fears over possible semiconductor technology leakage to Taiwan.

Global wafter manufacturers are in a rush to increase capacity expansion.

Industry watchers expect global wafer supply to remain tight through 2026, driven by the higher demand from 5G mobile gadgets and electric vehicles. The mushrooming growth of data centers is adding to the semiconductor wafer demand.

SK Siltron, 51% owned by the parent group's holding company SK Inc., will finance the capacity expansion with its cash reserves, borrowings and other funding sources, according to a regulatory filing on Wednesday.

Write to Hyung-Suk Song at click@hankyung.com

Yeonhee Kim edited this article.

-

Corporate restructuringSK's 5-year journey toward batteries, bio and chips

Corporate restructuringSK's 5-year journey toward batteries, bio and chipsJan 23, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersChina, Japan, Korea race for wafer capacity expansion

Korean chipmakersChina, Japan, Korea race for wafer capacity expansionOct 05, 2021 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Siltron to ramp up wafer production from 2022

Korean chipmakersSK Siltron to ramp up wafer production from 2022Jul 02, 2021 (Gmt+09:00)

2 Min read