Bio & Pharma

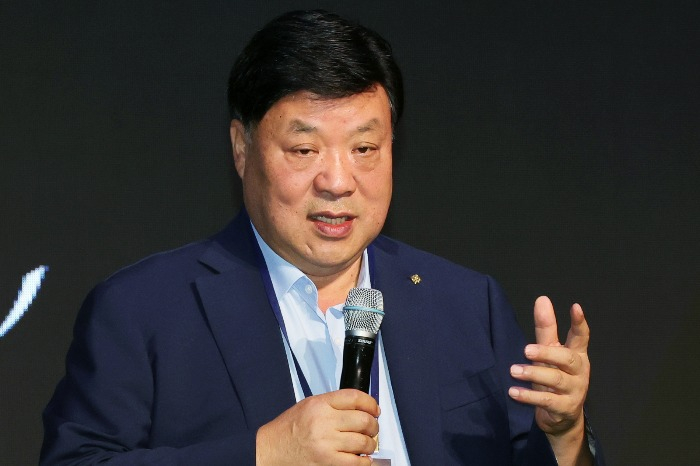

Celltrion to break ground on CDMO plant in 2025: Chairman Seo

The South Korean biosimilar giant is on course to meet its 2025 sales target of 5 trillion won on strong biosimilar sales abroad

By Nov 28, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s leading biosimilar developer Celltrion Inc. will break ground on its first contract development and manufacturing organization (CDMO) plant in Korea next year, said its chairman about three months after the company unveiled a plan to venture into the CDMO market.

For that, Celltrion will pick a site for a CDMO plant with a production capacity of 200,000 liters in Korea before the end of this year, added its founder and Chairman Seo Jung-jin.

The biosimilar giant also plans to operate research and development centers in India, the US and Europe for its CDMO business, according to the company’s CDMO business strategy unveiled by Seo at its investment roadshow held in Hong Kong on Wednesday.

“We need approximately 500 researchers with doctoral degrees to expand our CDMO business but our R&D human resources fall short of that,” said Seo. “We will open new R&D centers with more staff and plan to conduct research requiring repetitive tasks in India.”

Seo expects Celltrion to start generating revenue from CDMO operations in 2028.

The chairman disclosed the company’s plan to advance into the CDMO market with a wholly owned CDMO subsidiary for the first time at the Morgan Stanley 22nd Annual Global Healthcare Conference in New York City in early September.

The CDMO market has emerged as a blue ocean for Korean biologics companies.

Samsung Biologics Co. is the country’s leading CDMO player, chased by smaller cross-town rivals like Lotte Biologics Co. and stem-cell therapy company Medipost Co.

Seo said Celltrion will produce a wide range of CDMO drugs including monoclonal to trispecific antibody drugs as well as peptide and microbiome drugs to beat competitors like Switzerland-headquartered Lonza, the world’s No. 1 CDMO company.

BRISK SALES OF FLAGSHIP BIOSIMILARS

Seo reiterated that the Korean biosimilar giant is poised to meet its sales target of 5 trillion won ($3.9 billion) for 2025 thanks to the brisk sales of its flagship copycat drugs, especially Remsima, the world’s first biosimilar referencing Janssen’s Remicade, a treatment for rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis and severe or disabling plaque psoriasis in adults.

“We have sold more than 1 trillion won worth of Remsima so far this year, and its sales are expected to exceed 1 trillion won again next year,” said Seo. “We are on course to meet our 5 trillion won sales target for next year.”

He projected 730 billion won in sales of Remsima SC, the world's first subcutaneous formulation of biosimilar infliximab developed by Celltrion, in 2025.

The chairman also expected more than 700 billion won in sales of Zymfentra, a subcutaneously administered biosimilar to Remicade sold in the US, and about 400 billion won in sales of Truxima, its biosimilar to cancer treatment Rituxan, next year.

“Celltrion is forecast to reap 700 to 800 billion won in sales in 2026,” said Seo, adding he hopes to rake in 10 trillion won in sales in 2027.

“We will prove the company’s value with sales and profit by sustaining our high growth,” said Seo.

Celltrion is expected to report 3.5 trillion won in sales in 2024 after earning 2.2 trillion won in 2023.

Write to Jeong Min Nam and Dae-Kyu Ahn at peux@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Bio & PharmaCelltrion’s Remsima on course to become Korea’s 1st blockbuster drug

Bio & PharmaCelltrion’s Remsima on course to become Korea’s 1st blockbuster drugNov 25, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaCelltrion's Zymfentra gets 90% distribution channel in US

Bio & PharmaCelltrion's Zymfentra gets 90% distribution channel in USOct 30, 2024 (Gmt+09:00)

1 Min read -

-

Bio & PharmaCelltrion chairman announces venture into CDMO market

Bio & PharmaCelltrion chairman announces venture into CDMO marketSep 09, 2024 (Gmt+09:00)

2 Min read -

Bio & PharmaCelltrion's Zymfentra joins US insurance-covered drug lists

Bio & PharmaCelltrion's Zymfentra joins US insurance-covered drug listsAug 06, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaCelltrion's Remsima SC breaks 20% market share in Europe

Bio & PharmaCelltrion's Remsima SC breaks 20% market share in EuropeJul 17, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaCelltrion eyes M&A in Europe, $3.3 bn Zymfentra sales: chairman

Bio & PharmaCelltrion eyes M&A in Europe, $3.3 bn Zymfentra sales: chairmanMay 23, 2024 (Gmt+09:00)

4 Min read

Comment 0

LOG IN