SK Pharmteco launches new viral vector platforms, key for CGT

The Korean CDMO’s new viral vector platforms can significantly save production time and cost in manufacturing AAVs and lentiviral vectors

By Nov 22, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Pharmteco Co., South Korean conglomerate SK Group’s contract development and manufacturing organization (CDMO), has recently introduced two new viral vector platforms expected to save time and cost in the manufacturing of innovative cell and gene therapies (CGTs).

The company said on Wednesday that it launched two viral vector manufacturing platforms called LentiSure and AAVelocity in June and November, respectively.

AAVelocity is “a plug-and-play suspension platform” to produce adeno-associated virus (AAV) vectors, and it can “provide a 12-month turnaround on large volume programs,” explained the company, adding that it lowers “the industry average standard bioprocessing timeframe by at least six months.”

LentiSure is a platform to produce lentiviral vectors, which is expected to significantly speed up the lentiviral vector production time.

“We will continue to expand our portfolio of development and manufacturing platforms as our commitment to lowering cost of goods sold for our client, thereby expanding patient access to these therapies,” John T. Lee, the global head of Cell and Gene Therapies at SK Pharmteco, said in a statement.

KEY TO CGT

Viral vectors are vehicles to deliver genes into target cells and the entire body, the key step in gene therapy. They are considered the most effective means of gene transfer to modify specific cell types or tissues and can be manipulated to express therapeutic genes.

AAV and lentiviral vectors are the most widely used platforms for gene delivery for gene therapies and cell-based immune oncology, which is highly sought after in line with the rapid expansion of the CAR-T cell therapy market.

Both AAVelocity and LentiSure are developed by SK Pharmteco’s European CGT clinical and commercial viral vector manufacturing subsidiary Yposkesi. The Korean parent acquired the Paris, France-based company in 2021.

Saving time and costs in producing viral vectors is significant in gene therapies, which are in growing demand.

According to Evaluate Pharma, a global pharmaceutical industry tracker, the global CGT market will grow at a compound annual growth rate (CAGR) of 50% from 2022 to 2027.

The US Food and Drug Administration has already introduced a set of guidelines to expedite the approval of novel CGTs.

In line with the growing CGT market, the global viral vector market is also forecast to grow to $12.8 billion in 2028 at a CAGR of 18% from 2023, according to the global research firm MarketsandMarkets.

However, the biggest hurdle to the development and manufacturing of cell and gene therapies is their high manufacturing and R&D costs that increase the life-saving gene therapy cost burden on patients.

According to SK Pharmteco, the cost of goods and manufacturing of a gene therapy can be between $500,000 and $1 million, excluding costs for R&D and the costs to run crucial clinical trials.

RELIABLE CGT CDMO PARTNER

The Korean CDMO company expects its new viral vector platforms to eventually contribute to lowering patients’ financial burden by enabling CGT developers to save in their cell and gene therapy development and manufacturing costs.

As a major active pharmaceutical ingredient (API) and advanced intermediate CDMO, SK Pharmteco can also offer its CGT-developing customers a one-stop drug mass-production solution, as well as development and clinical solutions, including early process development and modular cleanrooms.

Its expanded global footprint is also a plus to its customers.

On top of Yposkesi, the Korean CDMO took over a controlling stake in the Pennsylvania-based Center for Breakthrough Medicines (CBM) this year.

With them under its wings, SK Pharmteco can allow its biotech customers to access more diverse CGT manufacturing and testing facilities and technologies, including good manufacturing practice (GMP)-certified facilities with cross-functional support in advanced analytical development.

The company also provides its customers with complete cell banking facilities and testing services for their GMP products.

Its innovative cell lines and manufacturing platforms for AAV vectors allow it to produce 100 batches of viral vectors for four clinical phase programs.

Combined with Yposkesi and CBM’s manufacturing operation systems, SK Pharmteco’s total CGT production facility site will reach 800,000 square feet in 2026 when CBM is due to complete the world’s largest single CGT manufacturing site of more than 700,000 square feet.

Yposkesi is also preparing for mass production at its second facility in 2024.

SK Pharmteco, wholly owned by SK Group’s holding firm SK Inc., was officially launched in 2019 by SK as the group’s CDMO unit.

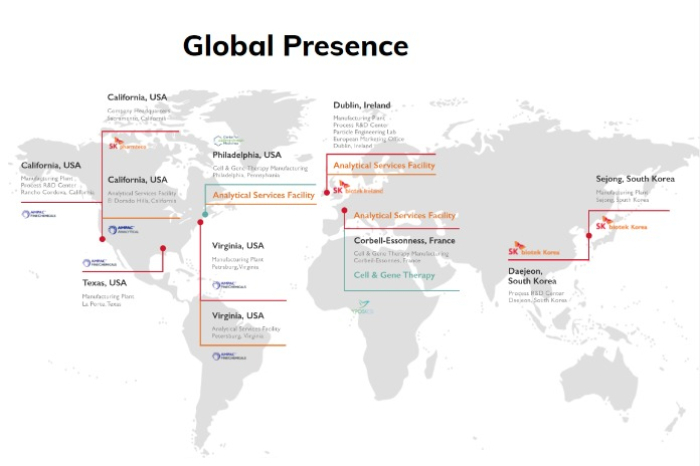

It currently operates seven production facilities in the US, Europe and South Korea, as well as five R&D centers worldwide.

Write to Ji-Hyun Lee at bluesky@hankyung.com

Sookyung Seo edited this article.

-

Bio & PharmaSK Pharmteco gears up for big leap in advanced biotherapies

Bio & PharmaSK Pharmteco gears up for big leap in advanced biotherapiesAug 17, 2023 (Gmt+09:00)

6 Min read -

Bio & PharmaSK Pharmteco secures 12 global pharma clients, sets up US R&D center

Bio & PharmaSK Pharmteco secures 12 global pharma clients, sets up US R&D centerAug 09, 2023 (Gmt+09:00)

1 Min read -

Pre-IPOsSK Pharmteco to raise $500 mn in pre-IPO, aims for 2025 listing

Pre-IPOsSK Pharmteco to raise $500 mn in pre-IPO, aims for 2025 listingJul 18, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaSK Pharmteco opens 2nd biomanufacturing plant in France

Bio & PharmaSK Pharmteco opens 2nd biomanufacturing plant in FranceJun 23, 2023 (Gmt+09:00)

2 Min read