SK Pharmteco gears up for big leap in advanced biotherapies

SK Group’s CDMO unit will use the proceeds from a $500 million stake sale to bolster CGT and other biotherapeutic capabilities

By Aug 17, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Pharmteco Co., South Korean conglomerate SK Group’s contract development and manufacturing organization (CDMO), is upping the ante in its biotechnology capabilities to bolster its biologic and advanced therapy pipelines after taking a great leap in the small molecule active pharmaceutical ingredient business.

The company is considering the operation integration of biomanufacturing facilities of Yposkesi and the Center for Breakthrough Medicines (CBM) to beef up its cell and gene therapy (CGT) contract manufacturing capabilities, Joerg Ahlgrimm, the chief executive officer of SK Pharmtech, said in an interview earlier this month with The Korea Economic Daily.

It will actively seek to take advantage of running biomanufacturing facilities in the world’s two largest CGT markets, the US and Europe, by boosting production flexibility, added Ahlgrimm.

He also unveiled for the first time the company’s plan to actively expand other bio-therapeutic modalities, especially oligonucleotide, messenger RNA (mRNA) and antibody-drug conjugates (ADC) therapeutics.

As part of such efforts, SK Pharmteco, wholly owned by the group holding company SK Inc., plans to use the proceeds from its $500 million worth stake sale in integrating the operation of the CGT manufacturing facilities in Europe and the US and building a good manufacturing practice (GMP)-certified factory to produce oligo nucleic acid-based therapeutics.

The Korean CDMO is in talks with preferred bidder Seoul-based Brain Asset Management Co. to sell its stake worth $500 million in a pre-initial public offering funding with a targeted 2025 listing.

Its big bet on emerging biologic and advanced therapies comes as the respective markets are set to grow rapidly thanks to the fast advancement in biotechnology in the past few decades.

CGT SET TO BURGEON

Of them, CGTs are the most promising sector in the near future amid the burgeoning demand.

Evaluate Pharma, a global pharmaceutical industry tracker, forecast the global CGT market will grow at a compound annual growth rate of 50% from 2022 to 2027 after the US Food and Drug Administration has introduced a slew of guidelines to expedite the approval of novel CGTs.

In response to this, the CGT industry is actively recruiting biotech engineers and developers to meet the growing CGT demand.

SK Pharmteco has CGT CDMO manufacturing facilities in Europe and the US after its parent SK acquired France-based clinical and commercial viral vector company Yposkesi in 2021 and has become the second largest stakeholder in CBM, a US-based cell therapy developer and CDMO, after investing $350 million in 2022.

If the Korean company integrates their manufacturing operation systems, its total CGT production facility site would reach 800,000 square feet in 2026 when CBM is due to complete the world’s largest single CGT manufacturing site with more than 700,000 square feet.

CBM aims to maximize CGT production efficiency with the complete supply chain under one roof, said Ahlgrimm, adding that the company targets to produce about 200 to 300 batches of viral vectors per day.

Viral vectors are vehicles to deliver genetic cargo into cells.

CBM's existing viral vector plant mainly focuses on the production of adeno-associated virus (AAV), lentivirus (LV), HSV, adenovirus, other vectors and non-viral modalities.

CBM can offer an end-to-end CGT CDMO service, encompassing process development, analytical development & testing, as well as plasma DNA, viral vector and cell therapy manufacturing. This service is expected to significantly save CGT production time by more than a year to four to five months.

SK Pharmteco’s other CGT CDMO site is located in Corbeil-Essonnes, France, run by Yposkesi, which can also produce high-yield viral vectors such as AAV and LV.

The French unit in June completed the second plant on a 5,000-square-meter (53,820 square feet) site, which is slated to fully operate early next year.

There are only a few CDMOs running CGT manufacturing sites in both Europe and North America so having them in both continents must be a big advantage to SK Pharmteco, the Korean CDMO said.

Especially, its high-yield AAV and LV production and GMP mass production capability are expected to help the company join the frontrunner group in the global CGT CDMO market.

SK Pharmteco is going all-out to become a major player in the CGT market despite its late start compared with its rivals, and such efforts are expected to pay off soon, said CEO Ahlgrimm.

FORAYS INTO ADVANCED THERAPIES

The Korean CDMO is also actively seeking new opportunities in other advanced therapies such as oligonucleotide, mRNA and ADC medicines.

It operates a research & development center for oligonucleotide therapies and is reviewing a site for oligonucleotide GMP manufacturing, the CEO confirmed.

Oligonucleotide has been mainly used as an ingredient for rare disease treatments but it has emerged as a promising cure for chronic diseases.

There are only three oligonucleotide GMP manufacturing sites across the world, according to SK Pharmteco.

The Korean company is also mulling partnerships with biotech companies boasting leading mRNA platform technologies and ADC production capability to expand the company’s presence in the related markets, Ahlgrimm said.

Following the success of Moderna’s mRNA-based COVID-19 vaccine, global R&D on related biotechnology has become more active.

ADC is a new class of biopharmaceutical drugs whose demand is set to grow as cancer treatments. ADCs are medications specifically designed to administer chemotherapy to cancer cells.

As SK Pharmteco already produces some of those three modalities, a move to expand their businesses is a “very logical step,” stressed the CEO.

STELLAR SMALL MOLECULE CDMO BUSINESS

SK Pharmteco’s stellar performance in the small molecule API sector has paved the way for its aggressive venture into biological and advanced therapeutics.

The company leaped to one of the global top five small molecule API players after two major M&As - the acquisition of Bristol-Myers Squibb (BMS)’s manufacturing facility in Ireland in 2017 and California-based CDMO major AMPAC Fine Chemicals in 2018.

Since then, the Korean company has secured 12 of the top 20 global pharmaceutical companies as its customers in the small molecules business.

Thanks to the brisk small molecule CMO sales, SK Pharmteco’s overall sales more than octupled to about 910 billion won ($678.5 million) in 2022 from 2017.

It plans to further ramp up its small molecule CMO facilities to 1,320 square meters by 2026 from the current 1,075 square meters.

Earlier this year, Ahlgrimm also said that SK Pharmteco aims to achieve $2 billion in annual sales by 2025 and expand its CMO production capacity to 75,000 square meters through a facility ramp-up by 2026.

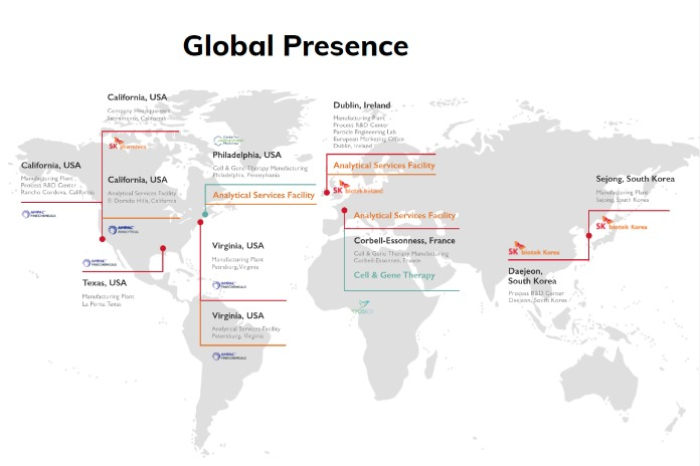

SK Pharmteco, officially founded in 2019 by SK as SK Group’s CDMO unit, currently operates seven production facilities in the US, Europe and South Korea, as well as five research centers worldwide.

Write to Jeong Min Nam at peux@hankyung.com

Sookyung Seo edited this article.

-

Bio & PharmaSK Pharmteco secures 12 global pharma clients, sets up US R&D center

Bio & PharmaSK Pharmteco secures 12 global pharma clients, sets up US R&D centerAug 09, 2023 (Gmt+09:00)

1 Min read -

Pre-IPOsSK Pharmteco to raise $500 mn in pre-IPO, aims for 2025 listing

Pre-IPOsSK Pharmteco to raise $500 mn in pre-IPO, aims for 2025 listingJul 18, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaSK Pharmteco opens 2nd biomanufacturing plant in France

Bio & PharmaSK Pharmteco opens 2nd biomanufacturing plant in FranceJun 23, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaSK Inc. eyes significant growth in bio business from 2024

Bio & PharmaSK Inc. eyes significant growth in bio business from 2024Jan 13, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaSK bio families to present visions to global investors at SK Bio Night

Bio & PharmaSK bio families to present visions to global investors at SK Bio NightJan 10, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaK-bio firms embrace gene therapy CDMO as Samsung looks the other way

Bio & PharmaK-bio firms embrace gene therapy CDMO as Samsung looks the other wayAug 05, 2022 (Gmt+09:00)

3 Min read -

Korean foodSK acquires 70% stake in Yposkesi to jump into cell, gene CMO business

Korean foodSK acquires 70% stake in Yposkesi to jump into cell, gene CMO businessMar 31, 2021 (Gmt+09:00)

2 Min read