South Korean bio, pharma industry set to take leap

Cancer treatments, overseas medical businesses and CDMO have driven the country’s bio and pharma boom

By Nov 15, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s chemical maker LG Chem Ltd. is expected to reap more than 1 trillion won ($768.5 million) in sales this year from its new growth driver, bio and medicine development, thanks to AVEO Oncology, a US cancer therapy developer that joined its Korean parent earlier this year.

Meanwhile, Korea’s leading stem cell therapeutics developer, CHA Biotech Co., is expected to join LG Chem’s Life Sciences division in Korea’s 1-trillion-won pharmaceutical sales club, driven by rapid expansion of its overseas hospitals business.

The country’s bio and pharma industry — led by the bio contract development and manufacturing organization (CDMO) sector — is enjoying a boom, according to industry observers.

AVEO LEADS LG CHEM’S BIO DREAM

The key driver of sales growth at LG Chem’s Life Sciences was AVEO’s lead product FOTIVDA, developed with a targeted kidney cancer treatment tivozanib.

The Boston, Massachusetts-based, oncology-focused biopharma company officially joined the Korean company’s bio and pharmaceuticals division in January.

Sales of Its kidney cancer treatment FOTIVDA are forecast to reach 200 billion won ($153.4 million) this year.

On top of that, brisk sales of the Korean company’s human growth hormone replacement therapy, diabetes treatment Zemiglo and vaccines are expected to lift the revenue of LG Chem’s Life Sciences to 1.2 trillion won in 2023, up 30% from the previous year.

This would mark the first time that LG Chem rakes in more than 1 trillion won in annual sales from its pharma business, since venturing into the medicine business 42 years ago.

The chemical giant formed the Life Sciences Division in 2002 and recently designated the business as one of its core future-growth engines.

OVERSEAS CLINIC BUSINESS DRIVES CHA BIOTECH’S GROWTH

Joining LG Chem, CHA Biotech is also expected to report more than 1 trillion won in annual sales this year for the first time thanks to the stellar performance of its international clinics abroad.

It reported 844.6 billion won in annual sales last year.

The company’s —and Korea’s — first medical services export case, CHA Hollywood Presbyterian Medical Center in Los Angeles, California, ranks No. 2 in terms of the number of babies delivered in that area.

City Fertilizer Center, one of Australia’s leading in vitro fertilization (IVF) and fertility service groups, has seen its revenue triple in four years after being acquired by CHA Biotech.

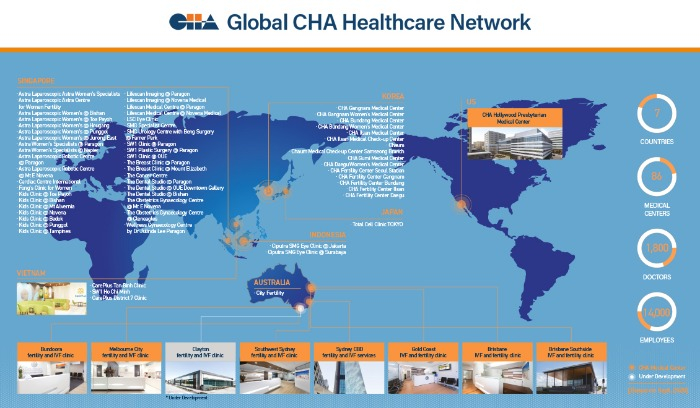

CHA Biotech boasts globally renowned IVF and fertility technology and owns 10 affiliates covering cell therapeutics, cord blood banks and medical and healthcare services around the world.

CHA Healthcare operates medical centers and cell and IVF clinics in Korea, the US, Singapore, Vietnam, Indonesia, Japan and Australia.

CDMOS AND BIOSIMILARS LEAD THE KOREAN BIO SECTOR

SK Pharmteco Co., the CDMO of Korean conglomerate SK Group, and Samsung Bioepis Co., Samsung Group’s biosimilar unit, could also top 1 trillion won in sales this year depending on their fourth-quarter earnings and the Korean won-US dollar exchange rate.

SK Pharmteco has set the goal of earning 1 trillion won in sales from its new growth driver, cell and gene therapy (CGT) contract manufacturing, within five years.

To accomplish that, the company in September acquired the US-based Center for Breakthrough Medicines boasting the world’s largest CGT CDMO capacity.

Brisk sales of autoimmune disease biosimilar products — Embrel, Remicade and Humira — are expected to lift Samsung Bioepis’ sales above 1 trillion won this year. The company recorded 946.3 billion won in sales last year.

With more biotech and pharma companies successfully bulking up, the Korean bio and pharmaceuticals industry is poised to take a new leap.

Led by the industry's top two, Samsung Biologics Co. and Celltrion Inc., with revenue of more than 3 trillion won and 2 trillion won, respectively, the Korean bio and pharma sectors are ready to welcome others, including Hanmi Pharmaceutical Co. and GC Biopharma Co., to join the big sales club this year.

Write to Dae-Kyu Ahn at powerzanic@hankyung.com

Sookyung Seo edited this article.

-

-

Bio & PharmaSamsung Biologics wins $242 mn order from Bristol Myers Squibb

Bio & PharmaSamsung Biologics wins $242 mn order from Bristol Myers SquibbSep 18, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaSK Pharmteco gears up for big leap in advanced biotherapies

Bio & PharmaSK Pharmteco gears up for big leap in advanced biotherapiesAug 17, 2023 (Gmt+09:00)

6 Min read -

Pre-IPOsSK Pharmteco to raise $500 mn in pre-IPO, aims for 2025 listing

Pre-IPOsSK Pharmteco to raise $500 mn in pre-IPO, aims for 2025 listingJul 18, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaLG Chem to launch new diabetes combination drug Zemidapa

Bio & PharmaLG Chem to launch new diabetes combination drug ZemidapaApr 04, 2023 (Gmt+09:00)

1 Min read -

Bio & PharmaLG Chem mulls shuttering in-vitro diagnostics business

Bio & PharmaLG Chem mulls shuttering in-vitro diagnostics businessMar 13, 2023 (Gmt+09:00)

2 Min read -

Upcoming IPOsKorea’s sole foreign clinic operator CHA Healthcare to go public in 2025

Upcoming IPOsKorea’s sole foreign clinic operator CHA Healthcare to go public in 2025Mar 08, 2023 (Gmt+09:00)

3 Min read -

Bio & PharmaLG Chem builds S.Korea's first plant for clinical trials

Bio & PharmaLG Chem builds S.Korea's first plant for clinical trialsFeb 14, 2023 (Gmt+09:00)

2 Min read -

Bio & PharmaLG Chem completes acquisition of US biotech firm AVEO

Bio & PharmaLG Chem completes acquisition of US biotech firm AVEOJan 19, 2023 (Gmt+09:00)

2 Min read -

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plans

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plansFeb 24, 2022 (Gmt+09:00)

3 Min read -