K-Beauty defies seasonal slump with record $980 mn in April exports

South Korea’s two largest beauty companies, Amorepacific and LG H&H, reported solid 1Q earnings

By 5 HOURS AGO

Samsung steps up AR race with advanced microdisplay for smart glasses

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Mubadala, Goldman Sachs to invest $700 mn in Kakao Mobility

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Seoul-backed K-beauty brands set to make global mark

According to trade data from the Korea Customs Service on Thursday, South Korea’s exports of cosmetics in April amounted to $980 million, up 20.1% from the same month last year.

This marked the highest ever April export value for Korean beauty products, driven by insatiable global demand for Korean skincare and color cosmetics.

Shipments to the US and China grew 10.0% and 11.6%, respectively, while those to Indonesia skyrocketed 145%.

In the January-March period, typically the slow season for cosmetics sales, the country’s beauty products’ exports hit a historic quarterly high of $2.49 billion, up 12.9% on-year.

At this pace, Korea’s annual cosmetics exports are on track to top $10 billion this year.

KOREA’S TOP 2 BEAUTY GIANTS STAGE A COMEBACK

Thanks to firm overseas demand, Korea’s top two cosmetics giants reported solid earnings in the first three months of this year after turning around last year on robust global sales.

Amorepacific Corp., the flagship cosmetics manufacturing unit under Amorepacific Group, logged 117.7 billion won ($85 million) in operating profit in the January-March period this year, surging 62% from the same period last year.

Sales rose 17.1% to 1.07 trillion won over the same period.

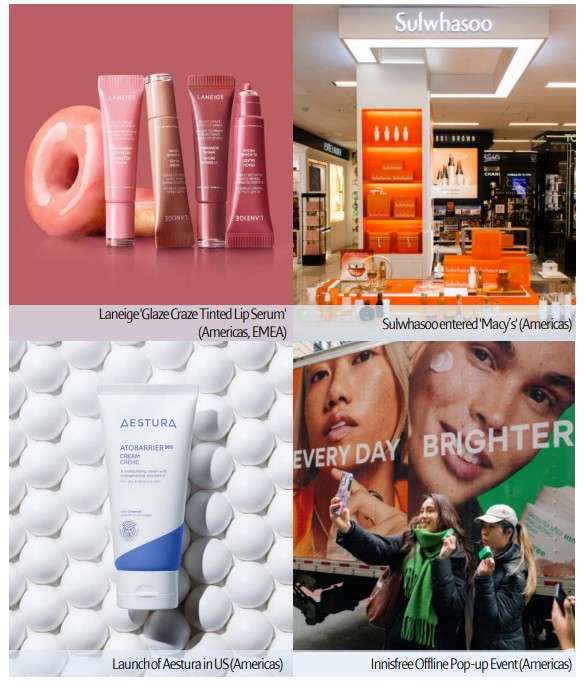

The company attributed the stellar performance to a 40.5% on-year increase in offshore sales, especially in North America, Europe and Asian markets excluding China, thanks to diversified brand and product portfolios.

Its overseas sales in the quarter reached 473 billion won, particularly led by Cosrx Inc., which was fully integrated as Amorepacific’s subsidiary in 2023 following a series of stake acquisitions.

The Korea-origin Cosrx has earned international recognition for its hypoallergenic skincare products designed for sensitive skin.

LG H&H Co., formerly LG Household & Health Care, reported consolidated operating profit of 142.4 billion won in the first quarter, down 5.7% from a year ago. Total revenue inched down 1.8% to 1.70 trillion won over the same period.

Its overseas sales, accounting for 32% of its total sales, added 4.2% on-year to 536 billion won, propelled by a 3.1% gain in North America and a 23.2% jump in Japan.

Derma and color cosmetics from its sub-brands – CNP, Hince and VDL – flew off the shelves in Japan.

Its home care and daily beauty products, specializing in hair care, oral care and body care, also recorded 36.6 billion won in operating profit for the quarter, up 13.7% on-year on sales of 573.3 billion won, up 2.2% across China, Japan and North America.

REVIVAL BY SMALLER INDIE BRANDS

Korea’s top two cosmetics conglomerates have bounced back from years of sluggish performance caused by a plunge in sales in their once biggest market, China.

Their revival comes amid a broader K-beauty boom outside China, led by smaller crosstown rivals known as "indie brands," which have gained in popularity on online shopping platforms like Amazon.com.

Since 2023, several K-beauty products have ranked top in cosmetics sales during Amazon’s Prime Day event, with brands like Cosrx leading the pack.

Other Korean bestsellers on Amazon include Beauty Selection, VT Co., Goodal, Tirtir, Anua, d'Alba and Beauty of Joseon.

Bolstered by brisk overseas sales, Korea’s fast-growing beauty company APR Co. reported an operating profit of 54.6 billion won for the first quarter, nearly double that of a year ago.

Mostly emerging in the 2010s, these brands leveraged low-cost, high-efficiency marketing campaigns through social media platforms like Instagram and TikTok, expanding their presence beyond China to developed countries, including the US and Japan.

Analysts said they are leading the K-beauty boom by diversifying their offerings beyond basic skincare to color cosmetics and beauty devices.

Especially agile in responding to market shifts, Korean cosmetics companies also leverage extensive value chains to bring products from concept to launch – including development, production and digital marketing – within three to four months.

In the 2010s, the K-beauty boom was fueled largely by explosive demand from China, powered by the so-called Korean Wave or Hallyu, while their presence in other foreign markets remained limited.

But that is changing. In the first quarter of this year, China accounted for 20.0% of Korea’s total cosmetics exports, closely followed by the US at 16.9% and Japan at 10.4%, according to data released by Korea’s Ministry of Food and Drug Safety last month.

Write to Yun-Sang Ko at kys@hankyung.com

Sookyung Seo edited this article.

-

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declines

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declinesMar 12, 2025 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsKorean beauty giants Amorepacific, LG H&H come back from China woes

Beauty & CosmeticsKorean beauty giants Amorepacific, LG H&H come back from China woesFeb 06, 2025 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsAmorePacific to rebalance China-heavy global business

Beauty & CosmeticsAmorePacific to rebalance China-heavy global businessNov 13, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platforms

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platformsSep 26, 2024 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsKorean cosmetics, Amazon Prime Day’s top beauty products

Beauty & CosmeticsKorean cosmetics, Amazon Prime Day’s top beauty productsAug 02, 2024 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsChina is LG H&H’s headache amid global K-beauty boom

Beauty & CosmeticsChina is LG H&H’s headache amid global K-beauty boomJul 26, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reach

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reachJun 26, 2024 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsHeyday over for Amorepacific, LG Household in China’s beauty market

Beauty & CosmeticsHeyday over for Amorepacific, LG Household in China’s beauty marketJun 26, 2023 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsLG Household to lower reliance on Chinese market as shares slump

Beauty & CosmeticsLG Household to lower reliance on Chinese market as shares slumpMar 25, 2022 (Gmt+09:00)

4 Min read