Beauty & Cosmetics

K-beauty shake-up: APR, Shinsegae rise as Aekyung declines

In Korea’s retail segment, dollar store Daiso challenges behemoth CJ Olive Young’s longstanding dominance

By Mar 12, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s beauty industry is undergoing a major reshuffle, with new players rising to prominence while established giants face growing competition.

For years, Amorepacific Corp., LG H&H Co. and Aekyung Industrial Co. have dominated the K-beauty sector.

Now their iron-clad dominance is starting to crack.

Fast-growing brands such as APR Co. and Shinsegae International Co.’s cosmetics division are rapidly reshaping the industry’s landscape, posing a serious threat to the leading trio.

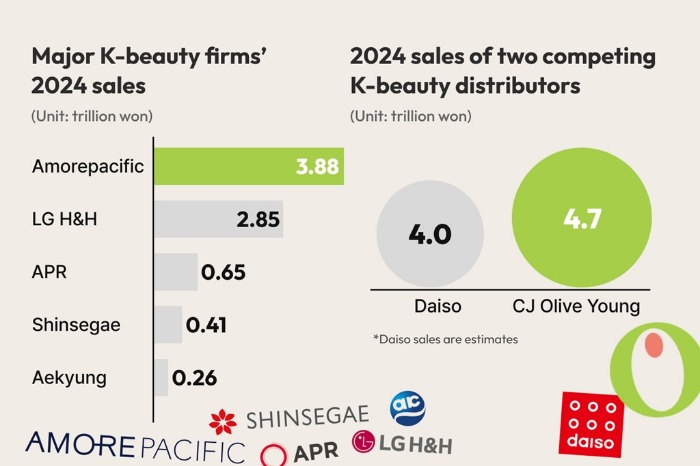

According to government and industry data, Amorepacific was the largest Korean beauty firm in 2024 with 3.89 trillion won ($2.68 billion) in beauty business sales. LG H&H, formerly LG Household & Health Care, came in second with 2.85 trillion won.

However, APR emerged as a serious contender, posting 651.2 billion won in beauty sales – excluding its fashion business – marking an impressive 51.3% on-year increase.

Shinsegae International’s cosmetics division crossed the 400 billion won milestone, reporting 414.9 billion won in 2024 sales.

Meanwhile, Aekyung’s sales fell to 261.5 billion won, continuing its downward trend from a high of 300 billion won.

FAST-EMERGING CHALLENGERS

APR’s rise is largely driven by its best-selling Medicube skincare line and the AGE-R beauty device range, both having gained strong traction in overseas markets.

The company is targeting 1 trillion won in sales this year – a goal analysts say is within reach given its current growth trajectory.

Shinsegae International’s cosmetics business has steadily grown and is expected to post over 400 billion won in sales this year.

Shinsegae’s steady expansion in the beauty segment comes after it acquired the Vidivici brand in 2012 to enter the beauty market.

Shinsegae’s cosmetics division now accounts for nearly one-third of its entire revenue, fueled by the success of in-house brands like Vidivici and Yunjac, as well as imported niche fragrances such as Diptyque and Santa Maria Novella.

As K-beauty undergoes a slow but steady shake-up, industry watchers are keeping a close eye on established giants’ response to the rise of new challengers.

RETAIL BATTLE: CJ OLIVE YOUNG VS DAISO

The changing K-beauty landscape is extending beyond manufacturing to retail, with CJ Olive Young Corp. and Daiso vying for dominance.

CJ Olive Young, the country’s top beauty store chain, posted a staggering 4.79 trillion won in sales last year – an increase of over 900 billion won from the previous year.

Analysts had expected the franchise operator, a unit of food-to-entertainment conglomerate CJ Group, to post about 4 trillion won in 2024 sales.

Korea’s top dollar store chain Daiso, owned by Asungdaiso Corp., is fast emerging as a formidable rival.

With its ultra-low pricing strategy and Daiso-only products, it is drawing attention from budget-conscious consumers, prompting Olive Young to closely monitor its expansion.

Analysts estimate Daiso’s 2024 revenue in the 4 trillion won range.

Encouraged by its rapid growth, Daiso is gradually expanding its product line to more expensive offerings.

In December 2023, Asung HMP Co., the parent of Asungdaiso, said it will wholly own the discount store by purchasing a significant stake from its Japanese partner.

Write to Sun A Lee at suna@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Beauty & CosmeticsKorea’s beauty retailer CJ Olive Young to open first US offline outlet

Beauty & CosmeticsKorea’s beauty retailer CJ Olive Young to open first US offline outletFeb 04, 2025 (Gmt+09:00)

2 Min read -

Korean startupsAllsale, K-beauty's leading ambassador to the US

Korean startupsAllsale, K-beauty's leading ambassador to the USJan 21, 2025 (Gmt+09:00)

5 Min read -

-

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reach

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reachJun 26, 2024 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsCJ Olive Young beats Amorepacific to become K-beauty king

Beauty & CosmeticsCJ Olive Young beats Amorepacific to become K-beauty kingMar 22, 2024 (Gmt+09:00)

2 Min read -

RetailKorea’s top dollar store chain Daiso buys out Japanese shareholder

RetailKorea’s top dollar store chain Daiso buys out Japanese shareholderDec 13, 2023 (Gmt+09:00)

1 Min read -

Advertising & MarketingVietnamese MZers ensnared by K-beauty, K-fashion, K-everything

Advertising & MarketingVietnamese MZers ensnared by K-beauty, K-fashion, K-everythingOct 27, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN