K-beauty defies trade headwinds as exports to China, US lead sales growth

China rebound, US resilience and Middle East momentum bode well for South Korea’s beauty sector

By Apr 08, 2025 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s beauty industry is mounting a powerful global push, defying trade pressures and economic uncertainties with a surge in exports that has captured the attention of consumers from Beijing to New York, Paris and Abu Dhabi.

While exports to China, which had been sluggish for a while, are turning upward, Europe and the Middle East are emerging as new growth markets. Outbound shipments of not just cosmetics but also beauty medical devices are increasing, raising expectations of decent growth in the beauty industry despite the tariff war triggered by US President Donald Trump’s protectionist trade policy.

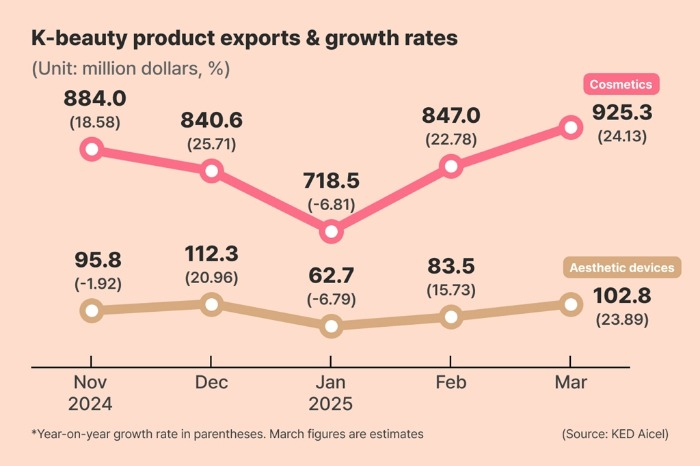

According to the Korean alternative data platform KED Aicel, the country’s cosmetics exports reached a preliminary $925.3 million in March, marking the second straight month of year-on-year growth exceeding 20%.

The figure is the highest monthly tally since last October, when exports stood at $993.9 million, and signals a broad rebound across major and emerging markets alike.

CHINA RETURNS TO THE FOLD

At the heart of the recovery is a turnaround in shipments to China, Korea’s largest beauty export destination.

After four months of decline, exports to Asia’s largest economy rose 10.4% year on year in March to $197.5 million, according to KED Aicel.

Analysts attributed the bounce to improving consumer sentiment spurred by Beijing’s stimulus measures, such as Yi Gu Huan Xin, which encourages discarding old products to buy new ones.

There is also growing market talk that the easing of unofficial Hallyu ban policies – restrictions on Korean pop culture imposed since 2016 – could further fuel demand for Korean brands such as Amorepacific Corp. and LG H&H Co., formerly LG Household & Health Care.

Sources said in February that China will likely lift its Hallyu ban in the country as early as May amid escalating Beijing-Washington trade conflict.

KED Aicel is the alternative data service brand of Hankyung Aicel, renamed from Aicel Technologies Inc. after The Korea Economic Daily acquired the data firm from US-based policy and global intelligence provider FiscalNote Holdings Inc. for $8.5 million last October.

RESILIENCE IN THE US DESPITE TARIFF THREATS

The US, now Korea’s second-largest cosmetics export market, also posted notable gains.

March exports to the US climbed 20.1% year-on-year to $152.5 million, underscoring the enduring appeal of Korean beauty, or K-beauty, products in the face of tariff uncertainty.

Even with the 25% tariffs on select imports, including cosmetics products, as proposed by Trump, analysts are confident about continued demand.

“While a 25% tariff is a considerable burden, a 10% increase in retail prices is unlikely to significantly dent consumer appetite for Korean cosmetics goods,” said Park Hyun-jin, an analyst at Shinhan Investment Corp.

Last year, South Korea overtook France as the largest cosmetics exporter to the US, buoyed by the growing wellness trend and preference for skincare-focused regimens in the US.

According to Euromonitor International, 86% of last year’s K-beauty sales on US e-commerce platforms were skincare-related.

BLUE OCEANS: EUROPE, MIDDLE EAST

Beyond traditional markets, Korean beauty firms are also targeting Europe and the Middle East – regions widely seen as untapped growth frontiers.

Exports to France, often considered the cradle of the global cosmetics industry, posted triple-digit growth for the second consecutive month in March.

February and March shipments to France reached $12.87 million and $12.24 million, up 159.5% and 195.7%, respectively, from the year-earlier periods.

The United Arab Emirates also emerged as a breakout market, with exports reaching $24.21 million in March, up 121% from the previous year. The March figure marks the first time that exports to the UAE have surpassed $20 million.

“The growth momentum in Europe and the Middle East is striking,” said Meritz Securities analyst Park Jong-dae.

Brands such as Amorepacific, Clio Cosmetics Co., VT Co. and APR Co. are finding new footholds in these regions, he said.

Samsung Securities Co. analyst Lee Ga-young said, “Cosmetic imports into Europe are three times those of the US. With sales of Korean products gaining traction in Europe and the Middle East, opportunities there could be even larger.”

AESTHETIC MEDICAL DEVICES

As K-beauty continues to evolve from a trend to a mainstay in global routines, Korea’s beauty ecosystem – from moisturizers to medical lasers – seems to be well-positioned to defy economic crosswinds and expand its global footprint.

Aesthetic medical devices, riding the coattails of the K-beauty wave, are also under the global spotlight.

Exports of cosmetic laser devices and related equipment reached $102.8 million in March, up 23.9% from a year earlier.

The US led the demand with a 28.7% rise, while shipments to Japan and Brazil rose 24.8% and 29.1%, respectively.

Medical skin treatments such as Rejuran made by PharmaResearch Products Co., Volnewmer by Classys Inc. and Oligio by Wontech Co. have shown sustained increases in global Google search interest over the past year, underscoring growing consumer awareness and market penetration.

The global aesthetic medical market is forecast to grow 12% annually to 62 trillion won by 2032 from 23 trillion won in 2023, according to Daishin Securities Co. analyst Han Song-hyup.

“The fusion of Korean innovation and K-beauty culture is becoming a strong export force,” he said.

Write to Jiyoon Yang and Tae-Ho Lee at yang@hankyung.com

In-Soo Nam edited this article.

-

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slump

Beauty & CosmeticsK-beauty exports to China rebound after 4-month slumpApr 04, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsSamsung, LG review strategies as Trump slaps Vietnam with steeper tariffs

Business & PoliticsSamsung, LG review strategies as Trump slaps Vietnam with steeper tariffsApr 03, 2025 (Gmt+09:00)

5 Min read -

K-popK-pop exports boom as end of Chinese K-wave ban looms large

K-popK-pop exports boom as end of Chinese K-wave ban looms largeMar 31, 2025 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declines

Beauty & CosmeticsK-beauty shake-up: APR, Shinsegae rise as Aekyung declinesMar 12, 2025 (Gmt+09:00)

3 Min read -

Business & PoliticsChina likely to lift ban on South Korea’s K-wave as early as May

Business & PoliticsChina likely to lift ban on South Korea’s K-wave as early as MayFeb 19, 2025 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reach

Beauty & CosmeticsAmazon to back K-Beauty’s broader global reachJun 26, 2024 (Gmt+09:00)

3 Min read -

Advertising & MarketingVietnamese MZers ensnared by K-beauty, K-fashion, K-everything

Advertising & MarketingVietnamese MZers ensnared by K-beauty, K-fashion, K-everythingOct 27, 2022 (Gmt+09:00)

2 Min read