Batteries

Samsung SDI’s Q2 profit drops on sluggish European EV sales

The battery maker won't make a major change in its investment plans on expectations of gradual EV demand recovery this year

By Jul 30, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung SDI Co., the world’s sixth-largest electric vehicle battery maker, saw its second-quarter operating profit plunge from the year-earlier period due to sluggish EV sales of its European clients, such as BMW, Volkswagen and Audi, and low demand for cylindrical batteries.

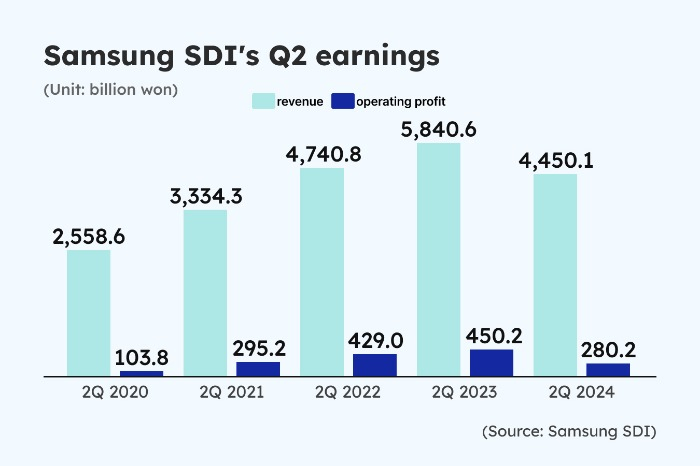

On Tuesday, the battery unit of Samsung Group posted 280.2 billion won ($202.4 million) in operating profit and 4.45 trillion won in revenue for the April-June period. Quarterly sales and profit dropped 24% and 38% from a year ago, respectively.

“Global demand for our products, particularly batteries, slowed significantly more than initial forecasts in the first half of this year and failed to meet market expectations. Global demand may continue to fall short of projections in the second half and recovery momentum could also be later than anticipated,” Samsung SDI’s Executive Vice President Kim Jong Sung said during the earnings conference call on Tuesday.

“We believe the falling demand is short term due to chasm (slower-than-expected uptake of a product), inventory adjustments and uncertainties in the macro environment, thus our mid- to long-term growth forecasts will remain unchanged,” Kim added.

NO MAJOR CHANGE IN INVESTMENT

Market insiders said sluggish EV sales of Samsung SDI’s European clients, such as BMW, Volkswagen and Audi, and the decline in sales of cylindrical batteries for electric cars and electronic devices have impacted the Korean battery maker’s earnings.

The sales and operating profit of batteries for energy storage systems (ESS) rose in the second quarter from a year-earlier period, thanks to the growing demand for data centers. Samsung SDI is slated to supply batteries for ESS to US clean energy company NextEra Energy Inc. in a 1 trillion won deal.

“We don’t have a major change in investment plans, including our capital injection in the Hungary-based battery facilities expansion and the construction of the first US EV battery plant of Samsung SDI-Stellantis N.V. joint venture for secured orders, as well as in all-solid-state and 46-phi batteries for our mid-to-long-term growth,” said Samsung SDI’s business management office finance team head Kim Yoon-tae.

The company made new investments of 3 trillion won in the first half of this year, more than double what it did a year ago, he added.

EARLY PRODUCTION

The first joint plant between Samsung SDI and Stellantis will start operations in the fourth quarter of this year, earlier than the initial schedule for the first quarter of 2025, as the companies expect EV battery demand to gradually recover from later this year.

Samsung SDI has also moved up mass production of 46-phi cylindrical batteries by a year to early next year. The battery cells are heralded as a “game changer” as they have greater power and lower production costs compared with 2170-type cylindrical batteries.

The company will supply the batteries to micromobility vehicles such as electric scooters for commercial viability assessment and then launch the battery cells for EVs.

OUTPERFORMANCE

Despite the decline in second-quarter earnings, Samsung SDI posted better performance than its crosstown rivals LG Energy Solution Ltd. and SK On Co.

The world's third-largest battery maker LG Energy logged a 195.3 billion won operating profit for the second quarter. However, the earnings could be calculated as a 252.5 billion won loss if excluding benefits from the Advanced Energy Project Credit (AMPC), a subsidy of the US Inflation Reduction Act (IRA).

SK On, the global No. 4 EV battery producer, is estimated to see more than 400 billion won in operating losses for the second quarter.

Samsung SDI has been more cautious in investments compared with its peers since the battery market started expanding two years ago. The investment strategy focused on profitability shines with less burden for fixed costs, market insiders said.

Write to Hyung-Kyu Kim at khk@hankyung.com

Jihyun Kim edited this article.

More to Read

-

BatteriesSamsung SDI to ink $726 mn ESS deal with NextEra Energy

BatteriesSamsung SDI to ink $726 mn ESS deal with NextEra EnergyJul 05, 2024 (Gmt+09:00)

3 Min read -

BatteriesGM chair to visit Korea, meet LG Energy, Samsung SDI CEOs

BatteriesGM chair to visit Korea, meet LG Energy, Samsung SDI CEOsFeb 06, 2024 (Gmt+09:00)

2 Min read -

BatteriesSamsung SDI to invest in Canada Nickel, new mine in Canada

BatteriesSamsung SDI to invest in Canada Nickel, new mine in CanadaJan 15, 2024 (Gmt+09:00)

1 Min read -

BatteriesEcoPro BM hits $34 billion jackpot to supply cathodes to Samsung SDI

BatteriesEcoPro BM hits $34 billion jackpot to supply cathodes to Samsung SDIDec 03, 2023 (Gmt+09:00)

2 Min read -

BatteriesSamsung SDI inks first battery supply deal with Hyundai

BatteriesSamsung SDI inks first battery supply deal with HyundaiOct 23, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN