Batteries

Korean battery makers fret over Tesla’s cost-cutting plans

Tesla said last week it would renegotiate with suppliers for better pricing to reduce costs amid softening EV demand

By Jan 28, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The South Korean battery industry is bracing for a grim market this year as Tesla Inc. is seeking every possible means to reduce costs to combat softening electric vehicle demand, while Contemporary Amperex Technology Co. (CATL) has decided to offer EV batteries at half price.

The world’s most valuable automaker on Thursday signaled renegotiations with its suppliers for better pricing to save costs during its earnings call on fourth-quarter results, which came in below market expectations due to weaker EV demand.

Projecting a “notably” slower growth this year, Tesla is “looking at every penny,” said Karn Budhiraj, vice president in charge of Tesla’s supply chain during the conference call.

“As we introduce new products, we have the opportunity to renegotiate with existing suppliers for better pricing,” said the VP.

An unidentified Tesla officer added the company is “getting into the tiers of the supply chain to see if there are opportunities, getting into the tier 2, tier 3, tier 4 levels and then negotiating those prices as well to get more efficiency out of the system.”

Considering that the company succeeded in saving 22% on-year in inbound logistics costs last year thanks to its rigorous cost-cutting efforts, it is expected to ask battery suppliers this year to renegotiate the prices of batteries, which account for about 40% of total EV raw material costs, according to industry experts.

DEVIL’S CONTRACTS

Early last year, Tesla gobbled up cylindrical batteries and cathodes from major suppliers, such as Korean contractors LG Energy Solution Ltd. and L&F Co. as well as Japan’s Panasonic Holdings, at high prices amid a battery shortage.

Taking advantage of their deals with the world’s most famous EV maker, EV battery and material suppliers had the upper hand in pricing negotiations with other EV makers.

But the tide suddenly changed later last year when the battery industry started suffering a battery oversupply due to a slump in global EV sales.

Taking a chance, Tesla has asked its existing suppliers to tweak the terms, making them less favorable to the suppliers, when it renews their supply deals.

Under the new terms, Tesla will be allowed to buy batteries that are just enough for its planned EV output without guaranteeing minimum battery supplies, adding to inventory risk at the suppliers.

Even though such agreements eat away at the suppliers’ profitability, they cannot resist Tesla’s offers given that their contracts with the most valuable EV brand on the planet are often the ticket to other deals.

This is why Tesla’s suppliers call their contracts deals with the devil.

CATL INTRODUCES HALF-PRICE BATTERIES

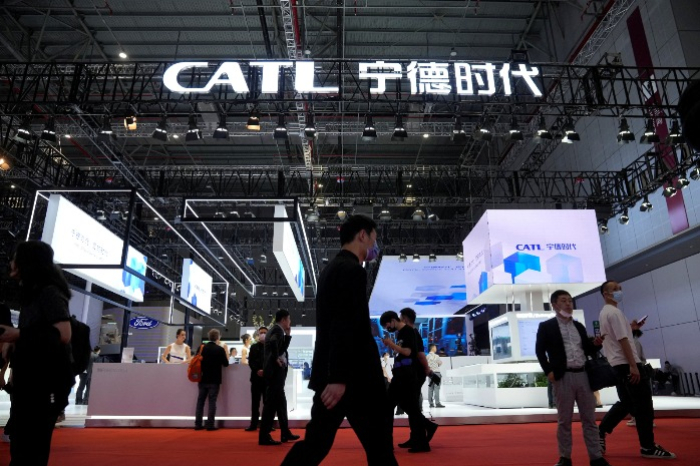

Meanwhile, an even darker cloud is looming over the global battery industry after China’s top EV battery supplier CATL recently agreed to sell its lithium iron phosphate (LFP) batteries to EV makers at home at 0.4 yuan ($0.06) per watt-hour (Wh), a price more than halved from a year ago.

If CATL, which is also the world’s No. 1 EV battery seller with a 37.4% market share, slashes battery supply prices, its global peers would have no choice but to follow suit.

If the CATL-led price war is prolonged, many global rivals at a disadvantage in the raw material supply chain could be forced to go bankrupt and close their businesses, warned analysts.

The Chinese player and its local peers backed by substantial government subsidies and the massive local market would be the only survivors of the latest price wars in the global battery market.

Write to Hyung-Kyu Kim at khk@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EarningsHyundai Motor, Kia: S.Korea’s highest earners, Tesla’s biggest rival in US

EarningsHyundai Motor, Kia: S.Korea’s highest earners, Tesla’s biggest rival in USJan 25, 2024 (Gmt+09:00)

5 Min read -

AutomobilesTesla Model Y reclaims spot as Koreans' favorite foreign car in September

AutomobilesTesla Model Y reclaims spot as Koreans' favorite foreign car in SeptemberOct 06, 2023 (Gmt+09:00)

1 Min read -

BatteriesBattery cell prices plummet amid supply glut in China, weak EV demand

BatteriesBattery cell prices plummet amid supply glut in China, weak EV demandSep 15, 2023 (Gmt+09:00)

2 Min read -

BatteriesKorean firms confident they can outpace China in LFP battery race

BatteriesKorean firms confident they can outpace China in LFP battery raceSep 11, 2023 (Gmt+09:00)

5 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN