Hyundai Motor, Kia: S.Korea’s highest earners, Tesla’s biggest rival in US

Both of the automakers beat Samsung Electronics, the longest-reigning champion, to win the top two spots

By Jan 25, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Hyundai Motor Co. and Kia Corp., South Korea’s two largest automakers, became the country’s highest earners in 2023, buoyed by robust sales of pricey cars under the Genesis brand, sport utility vehicles and eco-friendly cars.

The two car-making units of Hyundai Motor Group on Thursday also gave ambitious sales and profit guidance for this year despite tough business conditions such as high inflation and slowing global economic growth.

Hyundai Motor said in a regulatory filing that its operating profit reached a record 15.1 trillion won ($11.3 billion) on a consolidated basis last year, up 54% from 9.82 trillion won the year prior.

With that figure, Hyundai took the top spot in terms of operating profit, pushing past the longest-reigning champion, Samsung Electronics Co.

Net profit jumped 54% to an all-time high of 12.27 trillion won from 8 trillion won. Sales increased 14.4% to a record 162.7 trillion won from 142.2 trillion won.

The company attributed its strong yearly performance to robust sales of its luxury Genesis models, pricey sport utility vehicles and favorable dollar-won exchange rates.

It posted a full-year operating profit margin of 9.3%.

KIA’S FIRST DOUBLE-DIGIT PROFIT MARGIN

On the same day, Kia, Korea’s second-largest automaker, said its 2023 net profit reached a record 8.78 trillion won, up 62.3% from 5.41 trillion won a year earlier, and also beating Samsung Electronics.

Operating profit climbed to an all-time high of 11.6 trillion won, a 60.5% on-year increase, while sales rose 15.3% to a record 99.8 trillion won.

The company’s full-year operating profit margin was 11.6%, its first double-digit margin.

“Our spectacular results last year were thanks to record global vehicle sales, increased sales of high-end models and favorable dollar-won exchange rates,” the company said in a statement.

Hyundai sold 4.22 million vehicles globally in 2023 and Kia sold 3.09 million units, bringing their total to more than 7.3 million units. With the combined sales figures, the Korean duo ranked third globally following Toyota and Volkswagen.

NEW SANTA FE BOOSTS HYUNDAI’S Q4 RESULTS

For the fourth quarter of last year, Hyundai’s net profit rose 29% to 2.2 trillion won from 1.71 trillion won in the year-earlier period.

Quarterly operating profit increased a mere 0.2% on-year to 3.41 trillion won while sales gained 8.3% to 41.67 trillion won. Fourth-quarter operating profit margin stood at 8.2%.

The company said its fourth-quarter sales were boosted by the all-new Santa Fe SUV launched in August.

Kia posted 1.6 trillion won in quarterly net profit, down 20.5% from 2.04 trillion won in the year-earlier period. Operating profit fell 6% on-year to 2.47 trillion won while sales rose 5% to 24.33 trillion won.

The company said a rise in sales incentives to dealers amid fierce competition and the won’s strength against the dollar hurt its fourth-quarter earnings.

Despite a weaker operating profit in the fourth quarter, the company posted a double-digit operating profit margin for the fifth straight quarter.

AMBITIOUS 2024 GUIDANCE

In a bid to build investor confidence, Hyundai Motor unveiled ambitious annual guidance that projects a revenue increase of 4-5% and an operating profit margin of 8-9% for 2024 despite growing concerns about a slowdown in the global EV uptake.

Hyundai Motor said it aims to sell 4.24 million cars globally this year, up 0.6% from 2023.

The company said it will spend 12.4 trillion won this year, including 4.9 trillion won in research and development projects and 5.6 trillion won in facility investment.

In a separate filing, Kia said it aims to achieve 12 trillion won in operating profit on sales of 101.1 trillion won this year, up 3.4% and 1.3% from last year, respectively, as it continues its EV push with a strengthened eco-friendly vehicle lineup.

The company targets a 2024 operating profit margin of 11.9% with a vehicle sales target of 3.2 million units, up 3.6% from last year.

Hyundai said it will pay 8,400 won per common share in dividends for 2023 shareholders. With quarterly interim dividends included, its full-year dividend payout will be 11,400 won.

Kia will pay 5,600 won a share in 2023 dividends.

Kia also said it would buy back 500 billion won worth of treasury shares this year and retire half of them by the end of June to boost shareholder value. If it successfully achieves the presented 2024 sales and profit targets, it will retire the remaining 50% of the repurchased treasury shares by year-end, it said.

Shares of Hyundai Motor finished 2% higher at 188,700 won while Kia closed up 5.8% at 93,000 won after the earnings announcement. The broader benchmark Kospi index ended flat.

EMERGING AS TESLA’S TOP RIVAL IN US EV MARKET

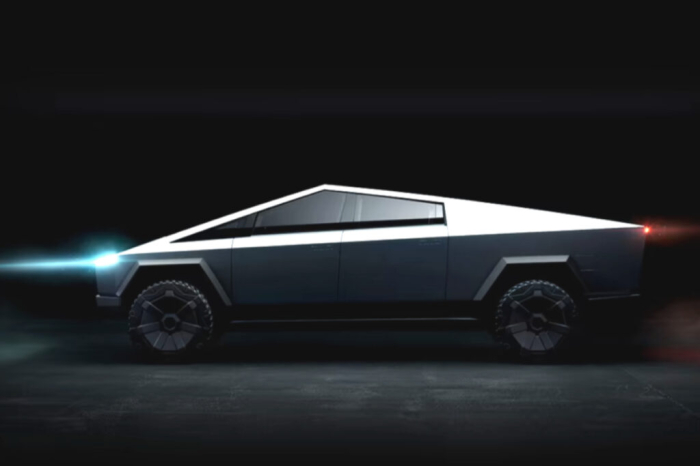

Hyundai and Kia’s strong results compare with their bigger EV rival Tesla Inc., which on Wednesday reported dismal 2023 operating profit.

Tesla, the world’s top EV maker, posted $8.9 billion in operating profit last year, down 16.8% from the previous year, although sales increased 19% to $97.7 billion.

Its 2023 operating profit margin stood at 9.2%, down from 16.8% in 2022.

Regarding this year’s outlook, Tesla warned of "notably lower" sales growth.

Tesla slashed prices repeatedly last year in a bid to keep up demand.

In the US market, Hyundai and Kia, armed with a broad lineup of EV models, are emerging as Tesla’s biggest rival.

The Korean duo jointly captured the No. 2 slot last year in US electric-vehicle sales, trailing only Tesla, which still holds a commanding lead.

The allied carmakers are poised to cement or advance their lead over non-Tesla rivals this year with fresh EV models and aggressive pricing, the Wall Street Journal reported on Wednesday.

Hyundai, its luxury brand Genesis, and Kia combined sell nine electric models and account for 8% of electric-car sales in the US, from the $32,000 Hyundai Kona to the Kia EV9, a large, seven-seater SUV that starts at $55,000 and favored by families.

Tesla, by comparison, sells five different models, with the cheapest one starting at about $39,000, according to the WSJ report.

(Combined with Kia’s results and updated with details of the duo’s 2024 earnings guidance and comparison with Tesla’s earnings)

Write to Jae-Fu Kim, Nan-Sae Bin and Jin-Won Kim at hu@hankyung.com

In-Soo Nam edited this article.

-

EarningsKia posts record 2023 sales, profit with bold 2024 business targets

EarningsKia posts record 2023 sales, profit with bold 2024 business targetsJan 25, 2024 (Gmt+09:00)

2 Min read -

AutomobilesHyundai Motor Group holds firm as world’s No. 3 carmaker

AutomobilesHyundai Motor Group holds firm as world’s No. 3 carmakerJan 21, 2024 (Gmt+09:00)

1 Min read -

AutomobilesHyundai Motor, Kia rank 4th in Europe with record 2023 sales

AutomobilesHyundai Motor, Kia rank 4th in Europe with record 2023 salesJan 18, 2024 (Gmt+09:00)

1 Min read -

Future mobilityHyundai Motor to launch advanced vehicle platform R&D division

Future mobilityHyundai Motor to launch advanced vehicle platform R&D divisionJan 16, 2024 (Gmt+09:00)

1 Min read -

AutomobilesKorea’s Kia to set up sales unit in Thailand; EV plant an option

AutomobilesKorea’s Kia to set up sales unit in Thailand; EV plant an optionJan 16, 2024 (Gmt+09:00)

3 Min read -

AutomobilesMojave Proving Ground: Backbone of Hyundai, Kia’s success in US

AutomobilesMojave Proving Ground: Backbone of Hyundai, Kia’s success in USJan 15, 2024 (Gmt+09:00)

3 Min read -

AutomobilesHyundai Motor to invest $845 million to expand India’s Talegaon plant

AutomobilesHyundai Motor to invest $845 million to expand India’s Talegaon plantJan 15, 2024 (Gmt+09:00)

3 Min read -

Korean innovators at CES 2024Kia, Uber to jointly develop custom-tailored electric ride-hailing PBV

Korean innovators at CES 2024Kia, Uber to jointly develop custom-tailored electric ride-hailing PBVJan 11, 2024 (Gmt+09:00)

2 Min read