Batteries

Sodium-ion batteries: Attractive option for EVs as costs, supply matter

When mass-produced, SIBs are expected to compete with LFP batteries, where Korean firms are setting their sights

By Jan 24, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

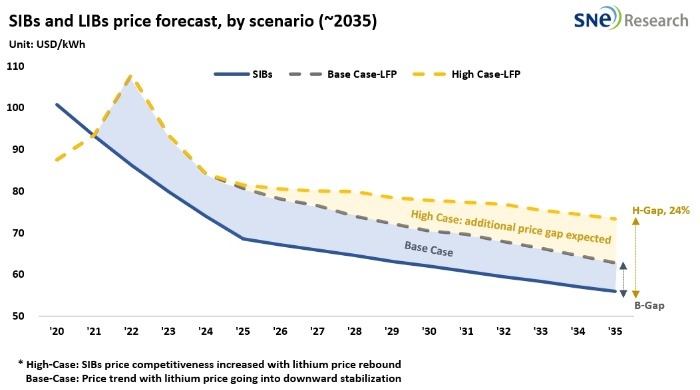

Sodium-ion batteries (SIBs), fast emerging as the next-generation battery cells, will be up to 24% cheaper than the most affordable lithium-based batteries by 2035, making SIBs an attractive option for budget electric vehicles, an industry study showed.

According to South Korea-based SNE Research on Wednesday, SIBs, also known as Na-ion batteries (NIBs), will enter the mass production phase worldwide by 2035 as automakers, particularly those in China, are increasingly rolling out low-end EVs equipped with such batteries.

If demand for sodium-based batteries continues at the current pace, the global SIB market is expected to grow to 254.5-gigawatt hours (GWh) in annual production worth $14.2 billion by 2035 for use mostly in two-wheelers, small-sized EVs and energy story system (ESS) devices, SNE Research said in a research note.

Sodium – found in rock salt and brine around the globe – has the potential to make inroads into energy storage and EVs because it’s cheaper and far more abundant than lithium, which currently dominates batteries.

Industry officials said the global sodium reserves are 440 times more abundant than those of lithium, while its price is one-eightieth of lithium, making it easier and cheaper to mine and refine.

While chemically and structurally similar, sodium isn’t widely used yet partly due to the better range and performance of similarly sized lithium cells.

However, things are changing as battery giants put their money on new sodium-based technology, achieving breakthroughs in battery performance and life span.

CHINESE EV MAKERS TAKE THE LEAD

Sodium-ion batteries are increasing as Chinese automakers start producing SIB-installed electric vehicles.

JMEV, a joint venture between France’s Renault and China's Jiangling Motors Corp. Group, launched an SIB-powered EV late last year – the industry’s first.

JAC Motors, another Chinese auto brand, recently began selling EVs with sodium batteries.

SNE Research said that battery industry leader CATL’s announcement in 2021 that it would nurture SIBs as its next-generation battery triggered a worldwide rush for the new type of battery.

Battery makers in other countries, including the UK’s Faradion, Sweden’s Altris, France’s Tiamet and Natron Energy in the US, have also rolled out SIB production plans.

Analysts said SIBs are seen as a cheaper and safer alternative to lithium-based batteries including cheaper lithium iron phosphate (LFP) batteries because they work better at both very high and low temperatures.

The price gap between SIBs and LFP batteries is forecast to be as wide as 24% by 2035 and if compared with more expensive nickel-cobalt-manganese (NCM) batteries, SIBs will be much cheaper, SNE Research said.

LFP: KOREAN BATTERY MAKERS’ CHOICE

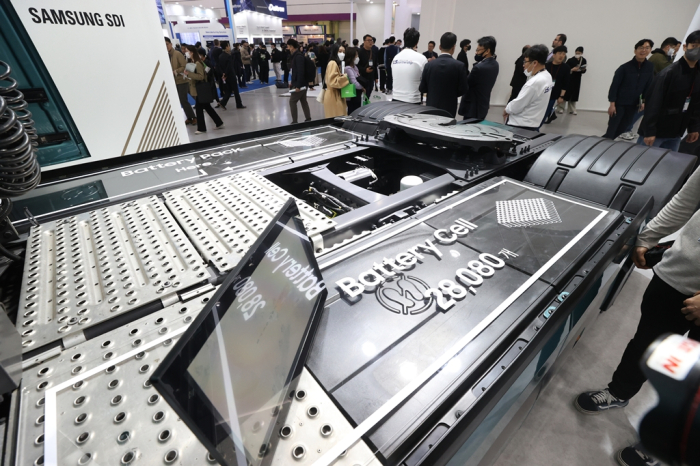

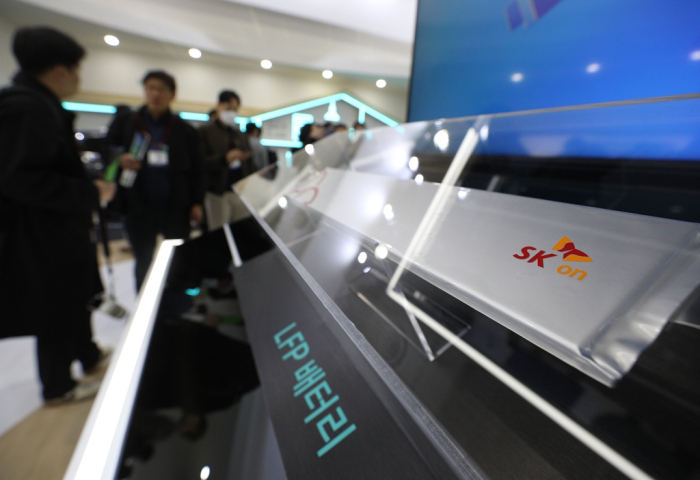

Korea’s three battery makers – LG Energy Solution Ltd., SK On Co. and Samsung SDI CO. – have so far focused on NCM batteries, which have higher energy density and thus are more profitable.

The trio has recently begun developing LFP batteries to capture the mid to low-end battery market, although mass production is unlikely until 2026, industry officials said.

Officials at LG Energy and Samsung SDI said they have had technical reviews of sodium batteries but have not yet embarked on development.

As a result of heavy investment and R&D efforts by the likes of China’s CATL and Swedish battery startup Northvolt AB, sodium batteries’ energy density has increased to between 120 and 200 watt-hours per kilogram, compared with NCM batteries’ density of 200 to 350 Wh.

Critics say, however, that it may take time before sodium batteries catch up to lithium batteries given the LIB price downtrend and technological barriers.

“At the mass production stage, the energy density of sodium batteries is still seen as lower than that of LFP batteries. It may take longer than expected for SIBs to become the mainstream,” said an industry official.

Write to Hyung-Kyu Kim at khk@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesSodium-ion batteries emerge as alternative to lithium, LFP batteries

BatteriesSodium-ion batteries emerge as alternative to lithium, LFP batteriesNov 27, 2023 (Gmt+09:00)

3 Min read -

BatteriesSK On to develop large-size cylindrical battery with 4680 form factor

BatteriesSK On to develop large-size cylindrical battery with 4680 form factorJan 07, 2024 (Gmt+09:00)

3 Min read -

BatteriesHyundai-invested SES to provide Li-Metal battery B samples, eyes UAM

BatteriesHyundai-invested SES to provide Li-Metal battery B samples, eyes UAMDec 13, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG, Poland’s ICPT in mega-million-dollar battery module supply deal

BatteriesLG, Poland’s ICPT in mega-million-dollar battery module supply dealDec 08, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy, KAIST develop Li-Metal battery tech for improved EV range

BatteriesLG Energy, KAIST develop Li-Metal battery tech for improved EV rangeDec 07, 2023 (Gmt+09:00)

3 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN