Batteries

Sodium-ion batteries emerge as alternative to lithium, LFP batteries

China’s CATL, the world’s No. 1 battery maker, already uses SIBs in some EVs while BYD is building a $1.4 billion SIB plant

By Nov 27, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Sodium-ion batteries (SIBs) are emerging as an alternative to lithium-ion batteries, currently dominating the rechargeable battery market for electric vehicles and energy storage systems (ESS).

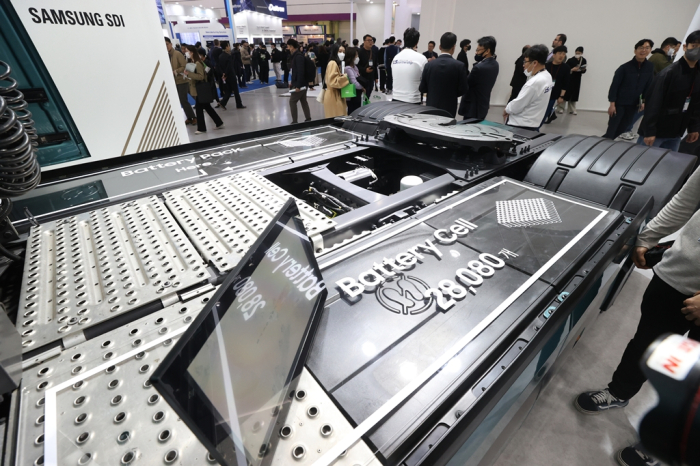

South Korea’s three battery makers – LG Energy Solution Ltd., SK On Co. and Samsung SDI Co. – have begun developing SIBs, also known as Na-ion batteries (NIBs), industry sources said on Monday.

According to a recent Bloomberg News report, battery giants have started putting their money on new sodium-based technology, a sign that there could be yet another shakeup in the industry so crucial for the global energy transition.

Sodium – found in rock salts and brines around the globe – has the potential to make inroads into energy storage and electric vehicles because it’s cheaper and far more abundant than lithium, which currently dominates batteries.

While chemically and structurally similar, sodium isn’t widely used yet partly due to the better range and performance of similarly sized lithium cells.

However, that could be about to change, according to Bloomberg.

Last week, Northvolt AB, a Swedish battery startup, announced its breakthrough in a new battery technology used for energy storage that it claims could help EV makers worldwide minimize dependence on China for the green transition.

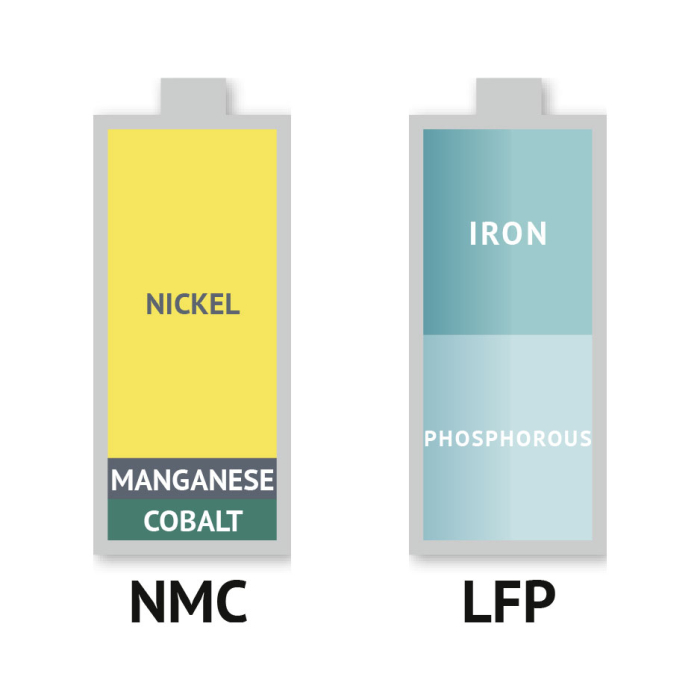

Northvolt said a sodium-ion battery it developed has no lithium, cobalt or nickel – critical metals that battery manufacturers scramble to obtain, leading to volatility in prices.

Analysts said SIBs are seen as a cheaper and safer alternative to lithium-based batteries, including cheaper lithium iron phosphate (LFP) batteries, used for energy storage because they work better at both very high and low temperatures.

But the amount of energy they can produce relative to their size has long lagged lithium batteries, making sodium cells currently impractical for most EVs.

Northvolt said it has validated its sodium-ion battery at the critical level of 160 watt-hours per kilogram, an energy density close to that of the type of lithium batteries typically used in energy storage, or 180 Wh/kg.

The Northvolt SIB is still well below the lithium batteries used in electric cars that have an energy density of up to 250-300 Wh/kg. Analysts said the Swedish firm’s batteries, if and when they are developed further, could be used in low-end EV models or for power-grid energy storage.

SIBs AT ADVANTAGE IN TERMS OF RESERVES, PRICES

Industry officials said the global sodium reserves are 440 times more than those of lithium, while its price is one-eightieth of lithium, making it easier and cheaper to mine and refine than lithium.

If China’s Contemporary Amperex Technology Co. Ltd. (CATL) – the world’s largest battery maker – uses SIBs, it will reduce the prices of EV battery cells to $5,500-$9,200 per vehicle, they said.

China’s BYD Co., a leading electric car maker, recently signed a 10 billion yuan ($1.4 billion) deal with Huaihai Holding Group to build a factory with an annual SIB production capacity of 30 GWh in Xuzhou, Jiangsu Province.

China’s CATL already said in April that its sodium-based batteries will be used in some vehicles from this year.

According to BloombergNEF, sodium should cut about 272,000 tons of lithium demand by 2035, or more than 1 million tons if lithium supplies can’t meet usage.

On the Guangzhou Commodity Exchange, the average price of lithium stood at 130,500 yuan on Nov. 24, down 78% from a year earlier, due to growing inventories amid a slowdown in demand for electric cars.

Lithium prices won’t likely stage a meaningful rebound if sodium-ion batteries move one step closer to commercialization, analysts said.

Write to In-Yeop Kim at inside@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesLG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slows

BatteriesLG Energy, Ford’s battery JV in Turkey scrapped as EV uptake slowsNov 12, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy, SK On to delay battery JVs with Ford as demand slows

BatteriesLG Energy, SK On to delay battery JVs with Ford as demand slowsNov 07, 2023 (Gmt+09:00)

4 Min read -

-

BatteriesKorean firms confident they can outpace China in LFP battery race

BatteriesKorean firms confident they can outpace China in LFP battery raceSep 11, 2023 (Gmt+09:00)

5 Min read -

BatteriesKorean firms fret over growing adoption of Chinese LFP batteries

BatteriesKorean firms fret over growing adoption of Chinese LFP batteriesAug 28, 2023 (Gmt+09:00)

4 Min read -

BatteriesSK Nexilis signs $1 billion deal to supply copper foil to Northvolt

BatteriesSK Nexilis signs $1 billion deal to supply copper foil to NorthvoltFeb 19, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN