Batteries

EcoPro BM, SK On, Ford to invest $886 mn to build cathode plant in Canada

It is EcoPro BM’s first battery material plant in North America with an annual cathode production capacity of 45,000 tons

By Aug 18, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

EcoPro BM Co., South Korea’s leading battery material producer, will invest $886 million jointly with SK On Co. and Ford Motor Co. to build a battery material plant in Canada, a move expected to complete the three allies’ EV value chain in North America and ensure bigger benefits from the US' EV tax credit act.

EcoPro BM, SK On and Ford will build cathode materials manufacturing facilities on a 280,000 square-meter (more than 3 million square-feet) site in Becancour, Quebec that will supply EV battery materials for Ford’s EVs, the US auto giant announced on Thursday when the three signed a binding contract.

This is a follow-up to their memorandum of understanding agreement signed in July last year to form a joint venture to build the plant.

The manufacturing JV, dubbed EcoPro CAM Canada LP, is expected to produce up to 45,000 tons of cathode active materials, mainly high-quality nickel-cobalt-manganese (NCM) materials, annually, enough to power 225,000 EVs, once it commences production in the first half of 2026.

The three companies will jointly invest 1.2 billion Canadian dollars ($886 million) in the plant, of which CA$644 million will be financed by Canada’s federal government and the Government of Quebec.

EcoPro BM will operate the plant, in which SK On and Ford will hold equity stakes.

The new cathode materials plant is expected to complete the partners' EV value chain -- materials (cathodes), parts (battery cells) and finished cars (EVs) -- in North America, a move that will ensure them a stable supply of core battery materials in the region and give them an upper hand in competitive pricing.

TO LOWER RELIANCE ON CHINA

Their latest cooperation is also expected to help them enjoy bigger benefits from the US EV tax credit act that favors battery cells with parts made in the US or its free trade partners including Canada.

The US government gives up to a $7,500 tax credit to an EV fitted with batteries using a certain percentage of critical minerals from those countries and assembled in the US under the Inflation Reduction Act, passed last year to bolster the world’s No. 2 economy’s EV ecosystem against China’s dominance.

EcoPro BM has been seeking to reduce its hefty reliance on China for battery minerals and materials in response to the law.

Canada has the world’s second and fifth biggest reserves for essential battery minerals nickel and tungsten, respectively, while the country’s cobalt production is the world’s eighth largest.

EcoPro BM’s cathode plant in Canada would be its first plant in North America and the second overseas battery material manufacturing site after the one in Hungary currently under construction.

The leading Korean cathode supplier plans to spend 2.8 trillion won ($2.1 billion) in North America and Europe by 2026 to produce a combined 480,000 tons of cathode materials a year, enough to power 6 million EVs.

It controlled the second-largest 27.6% of the global high-nickel cathode market in 2020, trailing behind global top player Japan’s Sumitomo Metal Mining Co. with 48.8%.

“By expanding here in North America, EcoProBM looks forward to globalizing our growth in cathode materials, which has been a unique strength of our company,” said Joo Jae-hwan, EcoProBM chief executive officer.

BOON TO SK ON

The latest partnership should be another boon to SK On, which has been aggressively expanding its presence in North America set to become a major EV market following the enactment of the US IRA. The US is the world’s third-largest EV market.

The world’s fifth-largest EV battery cell maker earlier this year signed separate agreements with US mineral resource companies Urbix Inc. and Westwater Resources Inc. to jointly develop battery anode materials as part of its efforts to enhance its battery material supply chain in North America.

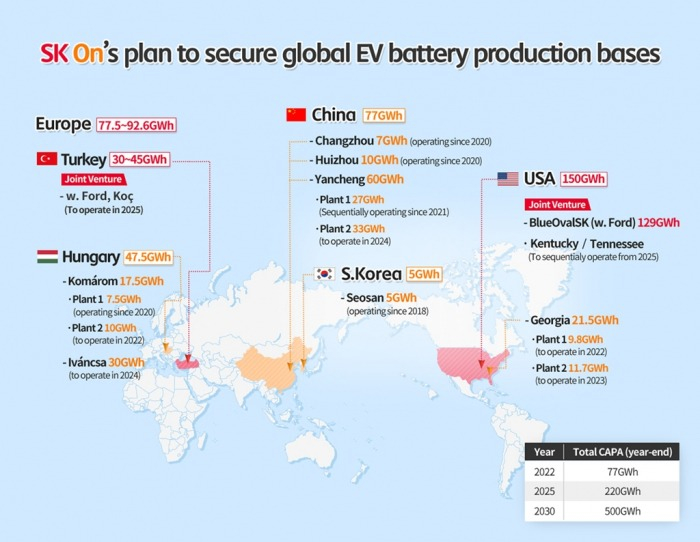

The Korean battery maker currently operates two battery plants in the region and plans to add four more plants with its partners.

Once they are completed, SK On would be able to churn out battery cells worth more than 180 gigawatt-hours (GWh) per year, enough to run more than 1.7 million EVs.

It in July last year officially launched BlueOval SK, a 50-50 joint venture for the North American EV market with US auto giant Ford, after injecting 5.1 trillion won, each. The JV plans to build a battery plant in Tennessee and two more facilities in Kentucky to be completed in 2025.

“Through the cathode JV, the three companies will have a stable supply of battery raw materials in North America,” SK On CEO Sung Min-suk said after SK On signed the final contract with EcoPro BM and Ford on Thursday.

Ford and Canada also welcomed the latest partnership with the Korean companies.

This is the American automaker’s “first-ever investment in Quebec,” and the company will strive to help shape the EV ecosystem in Canada, said Bev Goodman, president and CEO, Ford of Canada.

“Today, we are helping to further position Quebec as a key hub in the electric vehicle supply chain, as we continue to build our battery ecosystem,” said the Honourable François-Philippe Champagne, Minister of Innovation, Science and Industry.

Another US auto major General Motors Co. also plans to build a cathode material manufacturing plant in Becancour, Quebec with POSCO Future M Co., formerly POSCO Chemical.

Write to Hyung-Kyu Kim at khk@hankyung.com

Sookyung Seo edited this article.

More to Read

-

BatteriesSK On to develop anode materials with Westwater Resources of US

BatteriesSK On to develop anode materials with Westwater Resources of USMay 04, 2023 (Gmt+09:00)

1 Min read -

BatteriesSK On resumes Ford F-150 Lightning battery production line

BatteriesSK On resumes Ford F-150 Lightning battery production lineFeb 21, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On, graphite processor Urbix to jointly produce anode materials

BatteriesSK On, graphite processor Urbix to jointly produce anode materialsJan 19, 2023 (Gmt+09:00)

2 Min read -

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in Kentucky

BatteriesSK On-Ford Motor EV battery joint venture breaks ground in KentuckyDec 06, 2022 (Gmt+09:00)

3 Min read -

-

BatteriesKorea's EcoPro BM to build first overseas plant in Hungary

BatteriesKorea's EcoPro BM to build first overseas plant in HungaryDec 10, 2021 (Gmt+09:00)

1 Min read -

Battery materialsEcoPro BM to build battery materials plants in US, Europe

Battery materialsEcoPro BM to build battery materials plants in US, EuropeOct 21, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN