Korea Zinc likely to supply copper foil to LG Energy for EV batteries

The company is entering a market where competition is already fierce among Korean and Chinese rivals

By Jul 17, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korea Zinc Co., the world’s largest zinc and lead smelter, will likely start supplying copper foil, a key battery component, to LG Energy Solution Ltd. from October.

Korea Zinc is already providing samples to LG Energy, the world’s second-largest battery maker, after test approval on LG batteries, industry sources said on Monday.

Eventually, Korea Zinc aims to supply the battery material to Ultium Cells LLC in the US – LG’s battery manufacturing joint venture with General Motors Co.

LG Energy has been receiving copper foil from SK Nexilis Co., a unit of chemical materials maker SKC Ltd.

A copper foil is a thin foil that surrounds the anode, the negative end of a lithium-ion battery. High-strength copper foils are essential to making safer, high-density rechargeable batteries.

PARTNERSHIP WITH LG GROUP

Korea Zinc produces copper foil through its affiliate KZAM Corp., which began commercial operations in the first quarter.

When KZAM improves its manufacturing yields to the level for mass production, it expects to have an annual production capacity of 13,000 tons by this year’s end – an amount that could result in as much as 280 billion won ($221 million) in annual revenue.

Copper foil, which accounts for 5-6% of battery cell manufacturing costs, is priced at $14-$17 per ton, industry officials said.

If all goes to plan, Korea Zinc will also seek to supply its product to other battery makers, including Samsung SDI Co. and SK On Co., sources said.

Korea Zinc has for years been a key partner of LG Group affiliates.

In 2018, the company joined hands with LG Energy’s parent LG Chem Ltd. to establish Korea Energy Materials Co. (KEMCO), a JV that produces nickel sulfate, a raw material for lithium-ion batteries.

Last year, Korean Zinc and LG Chem signed a comprehensive battery material business contract, under which the two companies are building a precursor JV, tentatively named Korea Precursor Co.

A precursor is a material created by mixing nickel, cobalt and manganese. It is added to lithium to make cathodes, which make up the positive end of a lithium-ion battery. Precursors make up 70% of the cathode expense, while nickel accounts for more than half of precursor ingredients.

To strengthen its battery material business, Korean Zinc has also hired Jang Sa-bum, a former SKC senior executive, and Kim Young-joong, a former Samsung SDI marketing official, as its New Materials Business Division executives.

GROWING COMPETITION

Korea Zinc is entering a market increasingly suffering from a supply glut.

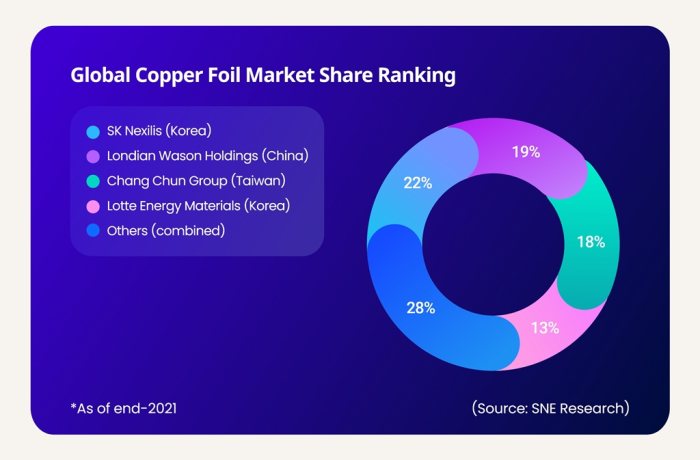

SK Nexilis is the world’s largest copper foil maker with a market share of 22% as of the end of 2021, according to research firm SNE Research. China’s Londian Wason Holdings Co. is the No. 2 player with a 19% market share, followed by Taiwan’s Chang Chun Group (CCP) with an 18% share.

Lotte Energy Materials Corp., formerly Iljin Materials Co., ranks fourth with a 13% share. Solus Advanced Materials is also a major Korean copper maker.

“Battery makers around the world are not yet fully running their plants, which is also hurting copper foil makers,” said Kim Yeon-seop, Lotte’s chief executive, during a press conference earlier this month.

He said Lotte aims to become the world’s top copper foil maker with a 30% market share by 2028 by posting annual sales growth of 20% until then.

SK Nexilis saw its first-quarter operating profit margin fall to 0.2% from last year’s full-year profit margin of 12.1%. Lotte Energy Materials reported its first-quarter profit margin was 3.7%, down from 11.6% for all of 2022.

“To better compete with their Chinese rivals, Korean companies need to focus on high-end, wide-size products,” said an industry expert.

Lotte Energy said last September it has developed a new ultra-high tensile elecfoil, which can significantly improve the mileage, power and stability of EVs.

Lotte’s clients include China’s BYD as well as Samsung SDI and LG Energy of Korea.

Write to Mi-Sun Kang at misunny@hankyung.com

In-Soo Nam edited this article.

-

BatteriesLotte Energy Materials aspires to become copper foil leader: CEO

BatteriesLotte Energy Materials aspires to become copper foil leader: CEOJul 04, 2023 (Gmt+09:00)

3 Min read -

BatteriesSK Nexilis signs $1 billion deal to supply copper foil to Northvolt

BatteriesSK Nexilis signs $1 billion deal to supply copper foil to NorthvoltFeb 19, 2023 (Gmt+09:00)

1 Min read -

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materials

Corporate investmentKorea Zinc to invest $7.5 billion in green hydrogen, battery materialsAug 09, 2022 (Gmt+09:00)

2 Min read -

BatteriesSK Nexilis to unveil ultra-high strength EV battery copper foil

BatteriesSK Nexilis to unveil ultra-high strength EV battery copper foilAug 03, 2022 (Gmt+09:00)

2 Min read -

BatteriesSKC breaks ground on Europe’s largest copper foil plant in Poland

BatteriesSKC breaks ground on Europe’s largest copper foil plant in PolandJul 08, 2022 (Gmt+09:00)

2 Min read -

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JV

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JVJun 02, 2022 (Gmt+09:00)

1 Min read -

Hydrogen economyKorea Zinc expands from smelter to hydrogen, battery materials maker

Hydrogen economyKorea Zinc expands from smelter to hydrogen, battery materials makerSep 27, 2021 (Gmt+09:00)

3 Min read