Batteries

Lotte Energy Materials aspires to become copper foil leader: CEO

With Spain as Lotte’s European base, it is now looking to build a factory in the US to benefit from the IRA, he says

By Jul 04, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s Lotte Energy Materials Corp. said on Tuesday that growing demand for reasonably priced electric vehicles will expand the market for high-end copper foil, a key battery component, in which it aims to become the world leader by 2028.

Lotte Energy, formerly Iljin Materials Co., said it aims to grab 30% of the global copper foil market within the next five years by posting annual sales growth of 20% until then.

“Battery makers will ramp up output in the coming years as EV demand grows, helping ease the oversupply now seen in the copper foil market,” said Kim Yeon-seop, Lotte’s chief executive, at a media conference.

“Growth in the elecfoil market will be led by high-end foils, which have ultra-thinness, higher strength and higher elongation.”

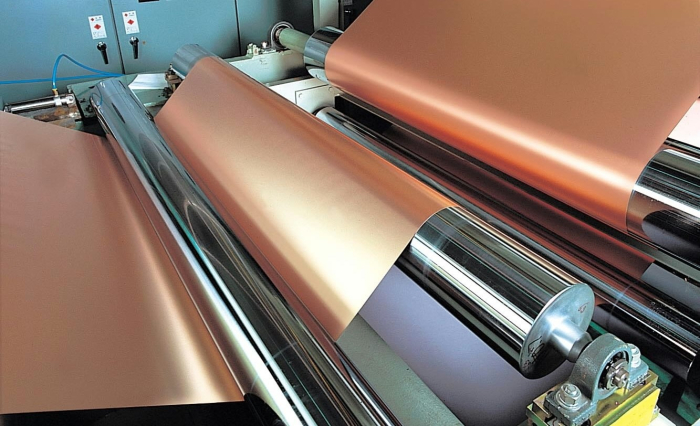

A thin copper foil less than 10 micrometers thick made through electrolysis of a copper sulfate solution, elecfoil is used to make the cathode collectors in rechargeable lithium batteries.

It is used widely in EVs and energy storage systems. The growth of the EV market is generating robust growth in the elecfoil market, he said.

The company said last September it has developed a new ultra-high tensile elecfoil, which can significantly improve the mileage, power and stability of EVs.

TARGETS

CEO Kim said he expects the global copper foil market to grow to 2.23 million tons by 2030, a fourfold increase from the current 500,000 tons.

He said automakers are increasingly adopting high-end foil to boost the performance of lithium iron phosphate (LFP) batteries, which are cheaper than their nickel-cobalt-manganese (NCM) counterparts.

To lead the market, Lotte Energy Materials plans to boost its annual high-end copper foil production from 60,000 tons this year to 240,000 tons by 2028, of which 130,000 tons would come from its plants under consideration in North America and Europe.

Lotte currently operates production bases in Korea and Malaysia.

Lotte is targeting an order backlog of 20 trillion won ($15.4 billion) by 2025, up from an estimated 15 trillion won by the end of this year, the chief executive said.

To achieve this goal, he said the company aims to expand its facility in Europe, build a new one in North America and develop next-generation battery materials such as LFP cathodes and silicon anodes.

US FACTORY

Last year, Lotte Chemical Corp. bought a controlling stake in Iljin Materials for 2.7 trillion won and renamed it Lotte Energy Materials.

Lotte Energy’s clients include China’s BYD and Korea’s Samsung SDI Co. and LG Energy Solution Ltd.

CEO Kim reaffirmed that Spain is the company’s main European base in response to the European Union’s Critical Raw Materials Act.

In May 2022, the company unveiled a plan to build a 500 billion won copper foil plant in Spain — its first production base in Europe.

He said Lotte is also considering a production base in the US to benefit from tax breaks under the US Inflation Reduction Act.

“Two to three sites are being considered. We will be able to announce the right place by the end of this year,” he said.

To finance the US factory construction, he said the company has 850 billion won in cash reserves and would borrow if needed, to the extent that it doesn't hurt Lotte’s financial stability.

Write to Mi-Sun Kang at misunny@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsIljin Materials to change its name to Lotte Energy Materials

Mergers & AcquisitionsIljin Materials to change its name to Lotte Energy MaterialsFeb 28, 2023 (Gmt+09:00)

1 Min read -

BatteriesLotte Chem to buy Iljin at $1.9 bn for battery material biz

BatteriesLotte Chem to buy Iljin at $1.9 bn for battery material bizSep 27, 2022 (Gmt+09:00)

3 Min read -

BatteriesIljin Materials unveils elecfoil with ultra-high tensile strength

BatteriesIljin Materials unveils elecfoil with ultra-high tensile strengthSep 16, 2022 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsLotte Chemical, Bain Capital among bidders for Korea’s Iljin Materials

Mergers & AcquisitionsLotte Chemical, Bain Capital among bidders for Korea’s Iljin MaterialsJul 01, 2022 (Gmt+09:00)

3 Min read -

BatteriesKorea’s Iljin to build $391 mn battery materials plant in Spain

BatteriesKorea’s Iljin to build $391 mn battery materials plant in SpainMay 17, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN