Batteries

LG Chem, China’s Huayou Cobalt to build $923 million precursor plant

The latest JV is aimed at reducing LG’s reliance on China for raw materials and in response to the US IRA

By Apr 14, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s top chemicals company LG Chem Ltd. and its Chinese partner Zhejiang Huayou Cobalt Co. will launch a 1.2 trillion won ($923 million) joint venture to manufacture precursors, a key battery component used in electric vehicles.

The move is designed to strengthen LG’s battery supply chain from raw battery minerals to components such as cathodes and battery cells and is also a response to the US Inflation Reduction Act, which favors batteries made in America or its trading partners.

LG Chem and Zhejiang Huayou, the world’s largest producer of refined cobalt, will build the precursor plant at the Saemangeum Industrial Complex in Gunsan, southwest of Seoul, people familiar with the matter said on Friday.

The two companies will sign an initial investment agreement with the Saemangeum Development and Investment Agency on Wednesday, sources said.

The signing ceremony will be attended by LG Chem Vice Chairman Shin Hak-cheol, a Zhejiang Huayou executive and Kim Gyu-hyeon, administrator of the Saemangeum agency.

Saemangeum, a reclaimed area on Korea’s southwest coast, houses the country’s major industrial complexes. The agency, an organization under the Ministry of Land, Infrastructure and Transport, is responsible for planning, management and investment for Saemangeum.

With the 1.2 trillion won investment, LG Chem and Zhejiang Huayou plan to build the precursor plant on a 330,000 square-meter plot of land.

Construction work will begin around the end of this year with an aim to complete it by the end of 2028.

Once completed, the factory will start commercial operation in early 2029 with an annual production capacity of 50,000 tons, enough to manufacture cathodes for about 600,000 EVs, sources said.

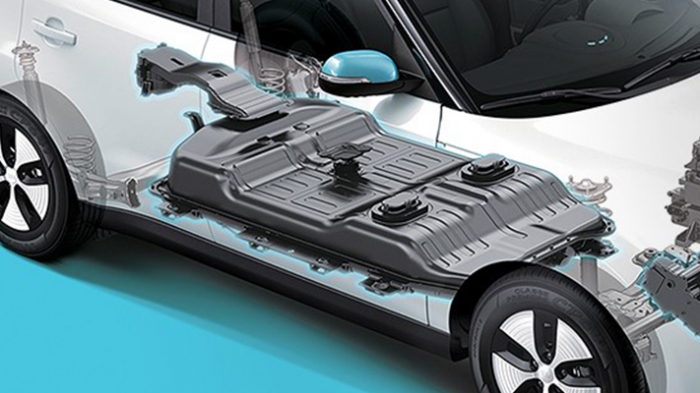

A precursor, one of four key battery components, is a material created by mixing nickel, cobalt and manganese, and is added to lithium to make cathodes, the positive end of a lithium-ion battery.

Precursors make up 70% of the expenses of cathode materials, while nickel accounts for more than half of precursor ingredients.

Precursors made from Saemangeum will be shipped to LG Chem’s cathode plants worldwide. Those cathodes will be supplied to its affiliate LG Energy Solution Ltd., the world’s second-largest battery maker, and made into battery cells at its US plant.

CUT CHINA RELIANCE TO MEET IRA REQUIREMENT

LG Chem and Zhejiang Huayou are already running two JV factories in China.

The two companies, which entered into a partnership with the launch in 2018 of their JV, Huajin New Energy Materials, built a precursor plant in Zhejiang Province in 2019, and a cathode plant in Wuxi, Jiangsu Province in 2020.

The two plants have an annual production capacity of 40,000 tons, respectively.

Last year, LG and Zhejiang Huayou also agreed to build a cathode factory in Korea.

The two partners’ latest precursor joint venture comes in response to the US IRA, which gives tax incentives for making EV batteries with minerals and components produced in the US or in countries with which the US has a free trade agreement.

“If the JV is judged ineligible for US EV subsidies because of Huayou Cobalt, we can send precursors produced at the plant to other regions such as Europe,” said an LG official.

The JV will also help reduce Korean battery makers’ heavy reliance on China for raw materials.

While China is not the primary producer of battery materials such as cobalt, nickel and lithium, it is the primary processor of them.

Currently, Korean battery players import more than 90% of the precursors they need from China.

OTHER KOREAN FIRMS IN THE WORKS

Last June, LG Chem began constructing another precursor JV with its Korean partner, Korea Zinc Co., with an annual production capacity of 20,000 tons.

The 200 billion won JV between LG Chem and Korea Energy Materials Co., Korea Zinc’s affiliate that produces nickel sulfate, is slated to begin mass production in the second quarter of 2024.

Other Korean battery makers are also working on building or expanding their precursor factories in Korea.

In March, SK On Co. said it is joining forces with EcoPro Co. and China’s GEM Co. to build a precursor plant in Saemangeum with an annual production capacity of 50,000 tons.

The 1.2 trillion won JV is scheduled for completion by the end of 2024.

POSCO Future M Co., formerly POSCO Chemical, operates two precursor plants in Korea – one in Gumi and the other in Gwangyang with an annual capacity of 5,000 tons each.

EcoPro Materials Co., which runs a precursor plant with an annual capacity of 50,000 tons in Pohang, plans to raise its output capacity to 80,000 tons by the end of 2024.

L&F Co. said it is considering building one in Korea.

Write to Mi-Sun Kang and Hyung-Kyu Kim at misunny@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesSK On, EcoPro, China’s GEM to jointly build precursor factory

BatteriesSK On, EcoPro, China’s GEM to jointly build precursor factoryMar 23, 2023 (Gmt+09:00)

1 Min read -

BatteriesLG Energy, China’s Huayou Cobalt to build battery recycling joint venture

BatteriesLG Energy, China’s Huayou Cobalt to build battery recycling joint ventureJul 26, 2022 (Gmt+09:00)

4 Min read -

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JV

BatteriesLG Chem, Korea Zinc affiliate KEMCO to launch battery precursor JVJun 02, 2022 (Gmt+09:00)

1 Min read -

BatteriesChina’s tighter grip on minerals boosts costs for Korean battery makers

BatteriesChina’s tighter grip on minerals boosts costs for Korean battery makersApr 12, 2022 (Gmt+09:00)

4 Min read -

Battery materialsLG Chem, China’s Huayou Cobalt to build battery metal JV in Korea

Battery materialsLG Chem, China’s Huayou Cobalt to build battery metal JV in KoreaJan 05, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN