Batteries

Korea EV battery makers lose market share against Chinese rivals

LG Energy regains No. 2 position, beating Chinese BYD, as its US joint venture with GM began mass production late last year

By Feb 08, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean electric vehicle cell makers lost a market share against Chinese competitors last year as they failed to fully benefit from a surge in the global battery sector on the rapid growth in the eco-friendly automobile industry, an industry research firm said.

The world’s EVs, plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs) used a combined 517.9 gigawatt-hours (GWh) of batteries in 2022, up 71.8% from the previous year, a South Korean market analysis firm SNE Research said on Wednesday.

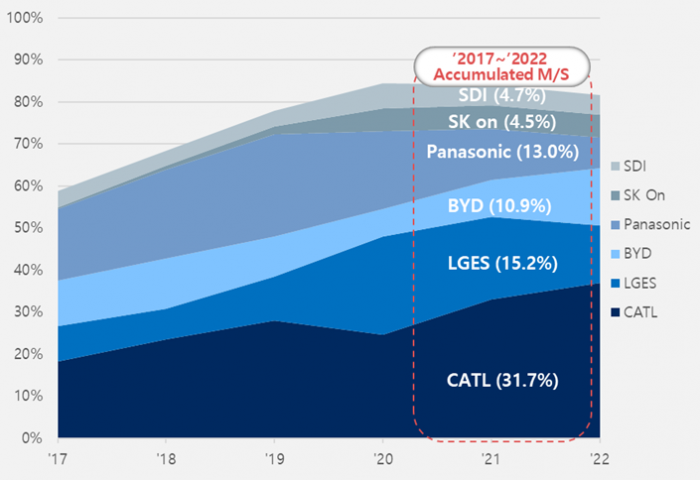

The total market share of South Korea’s secondary battery manufacturers – LG Energy Solution Ltd., SK On Co. and Samsung SDI Co. – fell to 23.7% last year from 30.2% in 2021. On the other hand, their Chinese rivals dominated the global market with a share of 60.4%, up from 48.2%, during the period.

The competition among cell producers in the two countries is expected to intensify as the world’s battery market is forecast to grow 44.6% to some 749 GWh this year, SNE Research said.

“Chinese cell makers have begun to leap out of the local market to global markets such as Asia and Europe,” the research firm said in a note. “Competition for market shares against the three Korean rivals is expected to heat up.”

CATL DOMINATES

China’s Contemporary Amperex Technology Co. Ltd. (CATL) maintained the throne in the global battery industry, raising its market share to 37% from 33% with the use of its cell nearly doubling to 191.6 GWh.

Such growth was led by higher sales of Tesla Inc.’s Model 3 and Model Y, as well as Guangzhou Automobile Corp.’s electric crossover sport utility vehicle Aion Y and Geely’s first EV Zeekr 001.

BYD’s market shares jumped to 13.6% from 8.7% as the installment of its batteries more than doubled to 70.4 GWh. Strong sales of battery EVs and PHEVs such as the BYD Yuan, a subcompact crossover electric SUV, in China, the world’s largest EV market, powered the growth.

LG Energy regained its second-place spot, beating BYD, with a similar market share, according to SNE Research.

The leading South Korean battery maker had been the No. 3 player in the first 11 months of 2022 but won back its No. 2 position from the Chinese producer as its US joint venture with General Motors Co. started mass production late last year, industry sources in Seoul said.

LG Energy’s growth was fueled by increasing sales of the Model 3, the Model Y, the Ford Mustang Mach-E and Volkswagen’s first electric SUV ID.4.

SK On and Samsung SDI’s market shares dipped to 5.4% and 4.7%, respectively, from 5.7% and 4.8%, although the sales of their batteries grew.

The use of SK On batteries jumped 61.1% to 27.8 GWh on strong sales of Hyundai Motor Co.’s IONIQ 5, Kia Corp.’s EV6 and Ford Motor Co.’s F-150. The installment of Samsung DI cells soared 68.5% to 24.3 GWh thanks to the popularity of the Audi e-tron the BMW i4 and the iX.

Write to Hyung-Kyu Kim at khk@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

BatteriesFord in talks with LG Energy for Turkey EV battery plant

BatteriesFord in talks with LG Energy for Turkey EV battery plantJan 10, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy posts largest-ever profit led by US JV with GM

BatteriesLG Energy posts largest-ever profit led by US JV with GMJan 09, 2023 (Gmt+09:00)

1 Min read -

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK On

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK OnSep 16, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN