POSCO, GM JV inks battery materials supply deal worth $16 bn

POSCO and GM agree to establish 85:15 JV for EV battery materials in Canada and look to expand partnership to precursors

By May 27, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

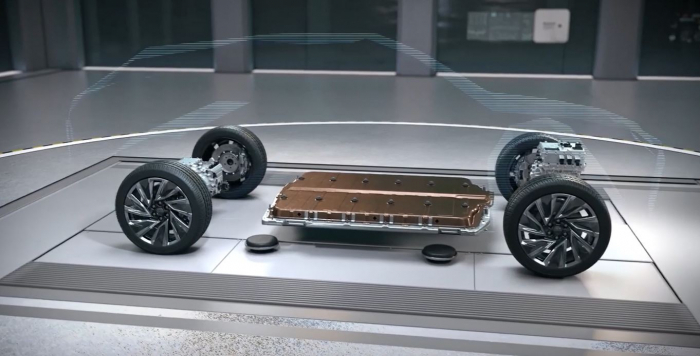

South Korea’s POSCO Chemical Co. and General Motors Co. on Friday agreed to set up a joint venture that will supply about 20 trillion won ($16 billion) worth of cathode materials for eight years to GM’s electric vehicle battery venture with LG Energy Solution Co.

In a regulatory filing, POSCO put the contract value at 8 trillion won ($6 billion), based on the 2021 prices of lithium, nickel, cobalt, manganese and aluminum -- before the mineral and metal prices skyrocketed.

Reflecting the surge in their prices, the eight-year supply deal is estimated at 20 trillion won, equivalent to 10 years of POSCO Chemical sales, based on its 2021 revenue.

The POSCO-GM venture, with a capital of $327 million, is slated to be established in Quebec, Canada by the end of September of this year.

It will produce cathode materials for a nickel, cobalt, manganese and aluminum (NCMA) mixture with high nickel content.

Depending on GM's EV ouput, the venture's production capacity could gradually increase from the initially planned 30,000 tons, enough to power 220,000 EVs, according to POSCO.

The battery materials will be supplied to the US-based Ultium Cells, a JV between GM and LG Energy, from 2025 through 2033.

POSCO CHEMICAL'S FIRST US PLANT

Ultium Cells is building battery cell plants in Ohio and Tennessee, each with an annual capacity of 35-gigawatt hours. Cathode materials account for 40% of the EV battery production cost.

POSCO had already announced the plan to build an EV materials plant in Bécancour, Quebec jointly with GM back in March of this year and December 2021. It revealed more details about the venture in Friday's filings.

The battery material JV, dubbed Ultium CAM LP, will become POSCO’s first EV materials plant in North America.

It will inject $278 million into the venture by end-September to secure an 85% stake. GM will hold the remaining 15%.

Building the Quebec-based plant is expected to cost a total of $633 million, including borrowings and government subsidies, according to POSCO.

POSCO has a call option to buy the remaining 15% stake in the JV from GM.

PARTNERSHIP ACROSS EV BATTERY VALUE CHAIN

POSCO Chemical is seeking to expand its partnership with GM into other components of EV batteries beyond cathode materials.

"We are looking to cooperate (with GM) in the manufacture of precursors as well," a POSCO Chemical official said. "We will strengthen cooperation across the rechargeable battery value chain."

The precursor is a material created by mixing nickel, cobalt, manganese and aluminum and represents more than 60% of the cathode material cost.

Designated as a cathode and anode material supplier for Ultium Cells in December 2020, POSCO Chemical also plans to build a plant with an annual capacity of 60,000 tons in Gwangyang, southwest of Seoul, by the end of this July.

The new domestic facility will increase the company's cathode materials output by about six times to 610,000 tons per year by 2030 from this year's 105,000 tons.

Meanwhile, a senior executive of POSCO Holdings’ secondary battery business told The Korea Economic Daily early this month that the group will pump 25 billion won by 2030 into EV battery materials through 2030 to cope with the global trend of resource nationalism.

Write to Jeong-Min Nam at peux@hankyung.com

Yeonhee Kim edited this article.

-

BatteriesPOSCO to invest $20 billion in battery materials to rival Chinese firms

BatteriesPOSCO to invest $20 billion in battery materials to rival Chinese firmsMay 11, 2022 (Gmt+09:00)

3 Min read -

BatteriesPOSCO Chem, GM to build $400 mn battery material plant in Canada

BatteriesPOSCO Chem, GM to build $400 mn battery material plant in CanadaMar 08, 2022 (Gmt+09:00)

2 Min read -

BatteriesPOSCO Chemical, GM to launch new battery material JV in US

BatteriesPOSCO Chemical, GM to launch new battery material JV in USDec 02, 2021 (Gmt+09:00)

4 Min read