Artificial intelligence

Samsung, LG go head-to-head in AI components market

The two companies trail Taiwan's Unimicron Technology and Ibiden in the FC-BGA substrate market

By Jan 16, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

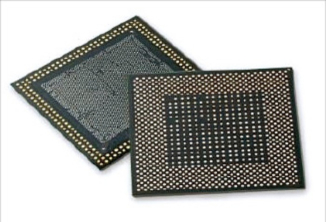

Samsung Electro-Mechanics Co. and LG Innotek Co., two major South Korean suppliers for Apple iPhones, are going head-to-head in the artificial intelligence components market, particularly for flip chip ball grid array (FC-BGA) substrates.

FC-BGA substrates are high-density printed circuit boards used for high-performance memory chips such as AI chips, including graphic processing units. They are also embedded into communication networks and digital TVs.

Samsung and LG are latecomers to the FC-BGA substrate market, where Taiwanese companies such as Unimicron Technology and Ibiden hold dominant positions.

Samsung began the mass production of FC-BGA substrates in 2022. LG Innotek launched its mass production in June last year after it expanded its production facilities in Gumi, about 200 kilometers southeast of Seoul. It will increase its production next year.

The company will boost FC-BGA substrate production once its plant in Vietnam comes online later this year. Its sales from FC-BGAs are expected to top 1 trillion won ($750 million) in 2024.

According to Fuji Chimera Research Institute, the global market for FC-BGA substrates is forecast to double to $16.4 billion by 2030 from $8 billion in 2022.

Samsung and LG are pivoting toward high-performance substrates to make up for declining smartphone component sales in the saturated smartphone market amid an economic slowdown.

The two companies produce camera modules installed on iPhones.

Operating profit at Samsung Electro-Mechanics is estimated at 656.2 billion won in 2023, about half the 1.5 trillion won it reported in 2021, according to brokerage companies.

Over the same period, LG Innotek’s operating profit is estimated to narrow to 838.9 billion won, compared to 1.3 trillion won.

Samsung Electro-Mechanics' FC-BGA for servers can reduce power consumption by 50%, using passive component embedding technology (EPS), which embeds passive elements into a thin board of 1 millimeter or less.

In 2022, Samsung Electronics Co. Chairman Jay Y. Lee said the semiconductor market will continue to grow centered on high-end products such as server central processing units and AI accelerators in line with the growing AI and cloud server markets.

He made the remarks at a ceremony to commemorate the first production of Samsung Electro-Mechanics’ FC-BGA substrates in Busan, South Korea’s second-largest city.

Samsung Electro-Mechanics has spent a total of 1.9 trillion won to beef up its FC-BGA business at home and abroad since 2021.

Write to Eui-Myung Park at uimyung@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

ElectronicsSamsung Electro-Mechanics eyes turnaround with Galaxy AI

ElectronicsSamsung Electro-Mechanics eyes turnaround with Galaxy AIJan 10, 2024 (Gmt+09:00)

1 Min read -

-

Samsung GroupSamsung Electro-Mechanics suffers cut in Q3 earnings estimate

Samsung GroupSamsung Electro-Mechanics suffers cut in Q3 earnings estimateAug 30, 2023 (Gmt+09:00)

1 Min read -

Tech, Media & TelecomLG Innotek gears up for FC-BGA substrate mass production

Tech, Media & TelecomLG Innotek gears up for FC-BGA substrate mass productionJan 30, 2023 (Gmt+09:00)

2 Min read -

EarningsLG Innotek, Samsung Electro-Mechanics Q4 profit disappoint

EarningsLG Innotek, Samsung Electro-Mechanics Q4 profit disappointJan 25, 2023 (Gmt+09:00)

1 Min read -

Tech, Media & TelecomLG Innotek eyes top spot in FC-BGA substrate market

Tech, Media & TelecomLG Innotek eyes top spot in FC-BGA substrate marketJan 12, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN