LG Innotek eyes top spot in FC-BGA substrate market

Supply shortages of the high-density semiconductor substrates are expected to continue through 2027

By Jan 12, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s LG Innotek Co. will boost the production of its flip chip ball grid array (FC-BGA) packages, or high-density package substrates, "to a meaningfully high level” from the second half of this year, its Chief Executive Jeong Cheol-dong said.

“We will increase our share in the FC-BGA market to 30% or more within the next few years and become No. 1 player in the sector,” he told The Korea Economic Daily last Saturday on the sidelines of CES 2023 in Las Vegas.

To that end, the camera module maker will make aggressive investments to mass produce sophisticated semiconductor substrates so as to crack the market dominated by Japanese rivals.

Jeong is upbeat about its FC-BGA business, saying it would take less than 10 years for the company to take the lead in the sector.

“Despite being a latecomer, we will upend the market, where Japanese companies control 60%,” he said. "The FC-BGA market has huge growth potential. We’ll make it our key revenue source.”

An FC-BGA is used to produce semiconductor modules, on which memory chips, a central processing unit and a graphic processing unit are assembled. They employ state-of-the-art technologies for smaller circuits and layer build-ups.

The high-performance substrate is called the Hermes of the semiconductor sector because of its high price tag.

The market is now controlled by a handful of companies such as Japan’s Ibiden Co. and Shinko Denki Co. and Taiwan’s Unimicron.

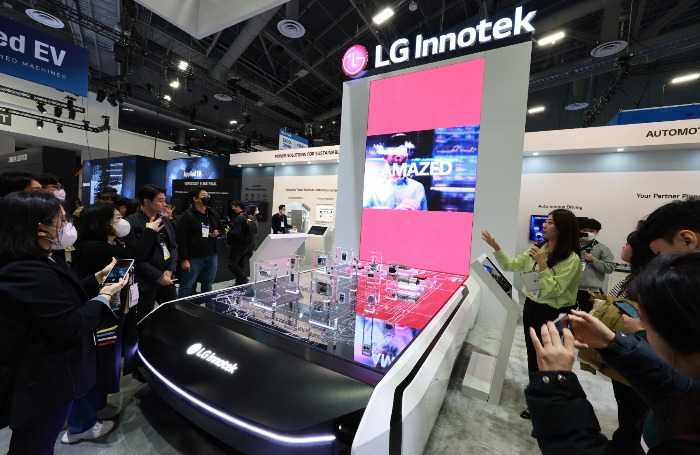

LG Innotek has been spending 413 billion won ($331 million) to build FC-BGA facilities since last year. During CES 2023, it displayed its FC-BGA prototypes.

LG Innotek is not alone in pushing into the FC-BGA market. Its domestic rival Samsung Electro-Mechanics Co., and Taiwanese and Chinese competitors are also rushing to secure their footholds in the segment.

An industry official said that CPU manufacturers such as Intel Corp. and AMD Inc. recommended substrate makers to boost FC-BGA output.

Chip designing companies are now seeking to buy FC-BGAs even before they hit the market, he added.

Supply shortages of FC-BGAs are expected to continue through 2027, driven by the growth in artificial intelligence and cloud server markets.

Apple Car, an electric vehicle under development, is expected to adopt the FC-BGA.

Write to Ji-Eun Jeong at jeong@hankyung.com

Yeonhee Kim edited this article.

-

Korean Innovators at CES 2023LG unveils self-driving auto parts, brighter OLED panels

Korean Innovators at CES 2023LG unveils self-driving auto parts, brighter OLED panelsJan 06, 2023 (Gmt+09:00)

1 Min read -

ElectronicsLG Innotek to unveil precision smartphone camera module

ElectronicsLG Innotek to unveil precision smartphone camera moduleDec 23, 2022 (Gmt+09:00)

1 Min read -

ElectronicsLG Innotek to unveil parts for EVs, self-driving cars at CES 2023

ElectronicsLG Innotek to unveil parts for EVs, self-driving cars at CES 2023Dec 15, 2022 (Gmt+09:00)

1 Min read -

Future mobilityLG Innotek unveils plastic-glass lenses for self-driving car camera modules

Future mobilityLG Innotek unveils plastic-glass lenses for self-driving car camera modulesDec 07, 2022 (Gmt+09:00)

1 Min read -

Corporate investmentLG Innotek dwarfs Korean rivals with hefty investment plan

Corporate investmentLG Innotek dwarfs Korean rivals with hefty investment planJul 13, 2022 (Gmt+09:00)

3 Min read