Upcoming IPOs

Overhang concerns loom over HD Hyundai Marine IPO shares

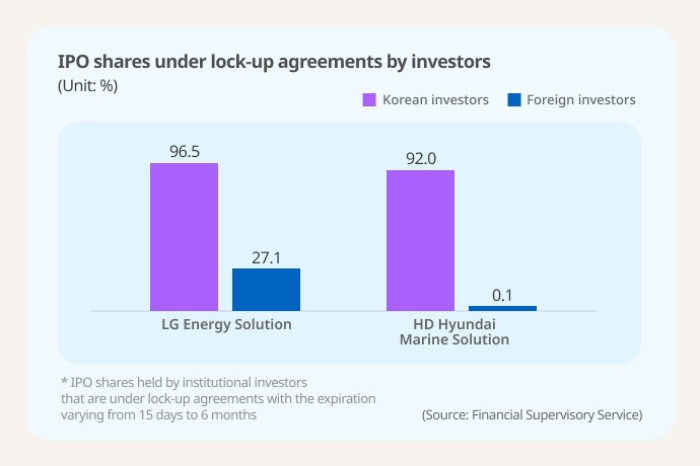

Of the total foreign institutional holdings of HD Hyundai Marine IPO shares, only 0.1% are under lock-up agreements

By May 03, 2024 (Gmt+09:00)

3

Min read

Most Read

Deutsche Bank's Korea IB head quits after country head resigns

Macquarie Korea Asset Management confirms two nominees

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Korea's Taeyoung to sell local hotel to speed up debt workout

Meritz leaves door open for an M&A, to stay shareholder friendly

Concerns are growing that South KoreaŌĆÖs main stock bourse could be inundated with a huge number of HD Hyundai Marine Solution Co. shares next week when the company goes public, as nearly all of its foreign holdings will be freed up for sale immediately after its debut.

According to the companyŌĆÖs initial public offering prospectus on Thursday, institutional investors took 4,895,052 IPO shares of HD Hyundai Marine Solution, of which 1,958,067 shares, or 40%, were sold to foreign institutions.

However, only 0.1% of such foreign holdings are under lock-up agreements, meaning the remaining 99.9% foreign holdings, or 1,957,267 shares, could flood into the market on Hyundai Marine Solution's May 8 debut, depressing its stock.

On the contrary, holders of some 92% of Korean institutional shares, the remaining 2,910,337, agreed to mandatory retention of the stock for at least 15 days.

A lock-up agreement is signed between a company seeking to go public and its investors to prevent the companyŌĆÖs early investors from offloading shares immediately after the stockŌĆÖs IPO, which often leads to a sharp drop in the stock price due to overhang issues.

The ŌĆ£cooling-offŌĆØ period mandated by the lock-up also helps to reduce the volatility of the new stock trading. This is a voluntary agreement.

TO PAVE THE WAY FOR KKRŌĆÖS EXIT

Speculations are circulating that HD Hyundai Marine Solution has freed most foreign institutions from mandatory holding agreements to allow its second-largest stakeholder KKR & Co. Inc. to cash out of its holdings upon the IPO without hassle.

The US investment giant owns a 38% stake in the vessel maintenance and aftermarket (AM) service unit of KoreaŌĆÖs No. 1 shipbuilding group HD Hyundai Co., which is also its largest stakeholder with 62%.

KKR invested in HD Hyundai Marine Solution on the condition that the Korean company will go public by 2026.

According to the two partiesŌĆÖ deal, the US investor is set to sell 1,057 shares following HD Hyundai Marine SolutionŌĆÖs advanced IPO, suggesting it may need a large institution from overseas that can digest its massive holdings up for grabs in a block-trade sale.

Following the sale, KKRŌĆÖs holdings in the Korean company are expected to fall to less than a quarter of the current level, according to HD Hyundai Marine Solution.

BLOCKBUSTER OR BUMMER

HD Hyundai Marine Solution is offering 8.90 million shares via listing on KoreaŌĆÖs main Kospi market to raise 742.6 billion won ($544 million). It will issue 4.45 million new shares while selling 4.45 million old shares, including KKR holdings.

This is the largest IPO in Korea since LG Energy Solution Ltd. more than two years ago.┬Ā

Reflecting the marketŌĆÖs high expectations for the newbie, its IPO stock price was determined at the top end of its guided IPO price range between 73,300 won and 83,400 won apiece.

It also attracted 1.04 million retail investors for 2.35 million shares, recording a 256 to 1 competition ratio in public subscriptions from April 25 to 26. ┬Ā

The highly anticipated blockbuster IPO for this year, however, may end up a disappointment due to such a huge number of unlocked shares, market analysts worried.

Last yearŌĆÖs big star IPO Doosan Robotics Inc. nearly doubled the IPO price on its debut day in October but this was seen as a letdown considering the hype during its institutional and public subscriptions.

Foreign investors were found to have offloaded 1,658,035 shares of Doosan Robotics on its public market debut day, taking 48 billion won in profit.

Market analysts fear this could happen to HD Hyundai Marine Solution on its market debut next Wednesday.┬Ā

The companyŌĆÖs market capitalization is estimated at 3.71 trillion won. Of its total listed shares, 9.9%, or 4,417,880 shares, will be floated for sale on its debut day, which will be worth 368.5 billion won based on the IPO price.

Write to Jeong-Cheol Bae at bjc@hankyung.com

Sookyung Seo edited this article.

More to Read

-

IPOsHD Hyundai Marine IPO sees strong demand from retail investors

IPOsHD Hyundai Marine IPO sees strong demand from retail investorsApr 26, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai Marine Solution aims for top spot in global ship repair market

Shipping & ShipbuildingHD Hyundai Marine Solution aims for top spot in global ship repair marketApr 03, 2024 (Gmt+09:00)

2 Min read -

Upcoming IPOsKoreaŌĆÖs IPO market heats up with HD Hyundai Marine, K Bank

Upcoming IPOsKoreaŌĆÖs IPO market heats up with HD Hyundai Marine, K BankMar 25, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai Marine bags order to upgrade Chevron LNG tankers

Shipping & ShipbuildingHD Hyundai Marine bags order to upgrade Chevron LNG tankersFeb 22, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHD Hyundai Marine Solution to enter ship cyber security

Shipping & ShipbuildingHD Hyundai Marine Solution to enter ship cyber securityJan 22, 2024 (Gmt+09:00)

1 Min read -

IPOsDoosan Robotics attracts $24.8 billion from retail investors in IPO deposits

IPOsDoosan Robotics attracts $24.8 billion from retail investors in IPO depositsSep 22, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN