IPOs

Doosan Robotics attracts $24.8 billion from retail investors in IPO deposits

With Doosan’s successful public subscription, expectations are running high that other IPO hopefuls will follow suit

By Sep 22, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Doosan Robotics Inc., a unit of South Korea’s Doosan Group, has attracted billions of dollars from retail investors in subscription deposits for the robot maker’s planned initial public offering (IPO) next month.

The collaborative robot maker received 33.1 trillion won ($24.8 billion) from individual investors during the two-day public subscription, which ended on Friday.

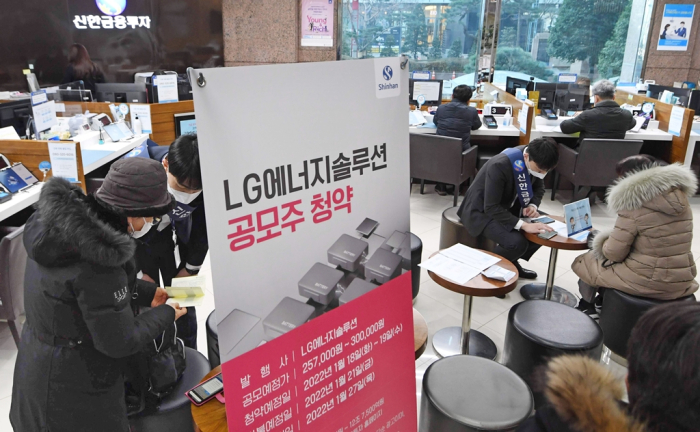

That represents the highest amount since battery maker LG Energy Solution Ltd. went public in January 2022. At that time, LG Energy attracted a whopping 114.1 trillion won in subscription deposits from retail investors – the highest ever amount in Korea’s IPO history.

With 33.1 trillion won, Doosan ranks ninth in terms of retail subscription value for a Korean IPO.

Two leading underwriters – Mirae Asset Securities Co. and Korea Investment & Securities Co. – and five other domestic brokerages, including NH Investment & Securities, KB Securities, Hana Securities, Kiwoom Securities and Shinyoung Securities, are handling the share sale.

About 1.5 million people have bid for 4.86 million Doosan Robotics shares allotted for retail investors.

Of the total, 2.43 million shares will be evenly sold to those subscribed individuals. For the other half 2.43 million shares, subscribers will receive one share for every 12.5 million won in subscription deposits.

The average competition ratio for the public subscription was 511 to 1. For the two lead managers – Mirae Asset and Korea Investment, the ratio was 538 to 1 and 539 to 1, respectively.

STRONG DEMAND FROM INSTITUTIONAL INVESTORS

During the five-day bookbuilding process, which closed on Sept. 15, the robot maker attracted 1,920 institutional investors, setting the IPO price at 26,000 won a share – the top end of the previously set indicative price range.

The order bookbuilding with large investors is designed to gauge their interest in the share sale, allot stocks in proportion to their bids and set the final IPO price.

Lead IPO managers said 51.6% of the investors who participated in the institutional subscription have already agreed to a lock-up clause, promising not to sell the stock post-IPO for a certain period of time.

Doosan will issue 16.2 million shares through the IPO. The company expects to raise 421 billion won with its market capitalization estimated at 1.69 trillion won based on the IPO price.

The company is due to make its Kospi market debut on Oct. 5. On the first day of trading, the stock is allowed to move in a price range of 15,600 won-104,000 won.

Following the IPO, conglomerate Doosan Corp.’s stake in the robotics firm will shrink to 68.2% from 91%.

NEXT IN LINE

Funds raised from the offering will be used to expand production facilities and its product portfolio.

Doosan Robotics is a leading maker of collaborative robots such as robot arms that work side by side with humans to perform assembling, loading and welding tasks.

Following Doosan’s successful bookbuilding and public subscription, expectations are running high that other IPO hopefuls will follow suit.

Seoul Guarantee Insurance Co. is next in line.

With its bookbuilding and general subscription slated for next month, the company plans to list its shares on the main bourse in November. Analysts expect the company to become the largest IPO this year with its market cap estimated at 2.76 trillion-3.62 trillion won.

EcoPro Materials, a battery materials maker, filed an IPO review request with the Korea Exchange in April. Its market cap is forecast to be about 3 trillion won.

Unicorn startups such as cosmetics company APR and software firm IGAWorks are also expected to go public by the end of this year. While seeking pre-IPO investments, the enterprise value of the two firms was set at about 1 trillion won each.

Companies affiliated with big conglomerates such as LG CNS, SK Ecoplant and CJ Olive Young are expected to go public in the first half of next year.

Write to Seok-Cheol Choi and Jeong-Cheol Bae at dolsoi@hankyung.com

In-Soo Nam edited this article.

More to Read

-

RoboticsDoosan Robotics aims to draw $256 mn in IPO subscriptions

RoboticsDoosan Robotics aims to draw $256 mn in IPO subscriptionsSep 11, 2023 (Gmt+09:00)

2 Min read -

RoboticsSamsung raises Rainbow Robotics stake, eyes management control

RoboticsSamsung raises Rainbow Robotics stake, eyes management controlMar 16, 2023 (Gmt+09:00)

2 Min read -

-

IPOsOne in 10 Koreans rushes for LG Energy shares ahead of $8.6 billion IPO

IPOsOne in 10 Koreans rushes for LG Energy shares ahead of $8.6 billion IPOJan 19, 2022 (Gmt+09:00)

4 Min read -

Hyundai Robotics, KFC team up to make chicken-frying robot chefs

Hyundai Robotics, KFC team up to make chicken-frying robot chefsOct 23, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN