Central bank

BOK holds rates as it lowers growth, inflation forecasts

The Korean central bank cuts growth, inflation forecasts to 1.6% and 3.5%, respectively; but says tightening campaign is not over

By Feb 23, 2023 (Gmt+09:00)

2

Min read

Most Read

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

South Korea’s central bank held its policy interest rate unchanged on Thursday as it slashed forecasts for economic growth and inflation although the monetary authority left the door open for a further hike, given the sustained price pressure.

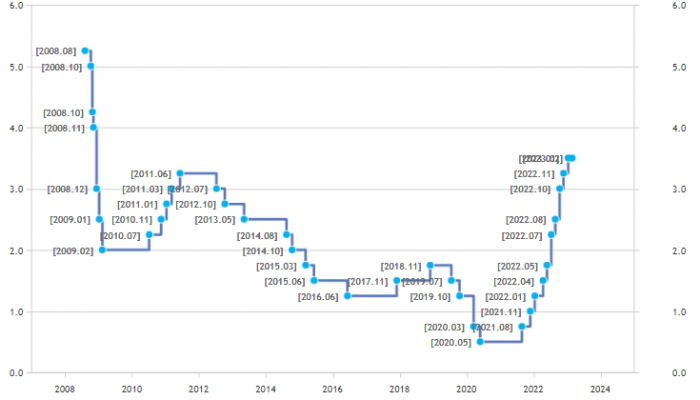

The Bank of Korea kept the base interest rate at 3.50% as expected, for the first time since February last year when it held the policy rate steady. The central bank has raised the rate by 3 percentage points through 10 hikes since August 2021 to curb rampant inflation in Asia’s fourth-largest economy.

“Domestic economic growth is expected to remain weak, affected by the global economic slowdown and the increase in interest rates,” the BOK said in a statement after the latest monetary policy decision.

Consumer inflation is also predicted to gradually decrease as global oil prices were lower than the elevated level last year and pressure from the demand side was weakening, it said.

Reflecting the assessment, the BOK lowered its gross domestic product growth forecast for this year to 1.6% from its previous expectation of 1.7% published in November 2022. Its inflation forecast was also cut to 3.5% from the prior 3.6%.

On Tuesday, the BOK said it has raised the policy rate to “a tightening level,” stoking expectations that the central bank may not raise the rate further.

NOT OVER YET

BOK Governor Rhee Chang-yong, however, said the latest monetary policy decision does not signal that the central bank has terminated its monetary policy tightening campaign.

Five BOK monetary policy board members out of seven suggested the central bank should leave the door open for raising the rate to up to 3.75%, the governor said.

“We decided to freeze the rate in consideration of greater uncertainties than ever before,” Rhee told reporters after announcing the decision. “Do not take this as an indication that a rate hike campaign is over.”

Inflation is expected to slow towards low-3% by the end of this year and if price pressure eases in line with the prediction, the BOK will check the impact of the rate hikes so far rather than tighten further, Rhee said.

But if inflation does not moderate, the central bank may raise the interest rate, he stressed.

The BOK said the pace of inflation slowdown is expected to be more modest that in other major countries due to the increase in utility fees. Inflation accelerated to 5.2% in January, reversing its course of the slowdown in the past two months on higher utility bills.

Rhee defied market expectations of a rate cut to support the economy, which is at risk of a recession on sluggish exports.

“It is premature to discuss the possibility of a cut unless we are confident that inflation is heading to our target of 2%,” he said.

The local bond market, however, bet on expectations that the central bank is unlikely to raise the policy rate as the economy stays sluggish, trading sources said.

Government bond yields skidded, failing to maintain their gains in the morning session, with the highly liquid three-year debt yield down 4.6 basis points to close the local market at 3.599%, according to the Korea Financial Investment Association.

(Updated with bond yields)

Write to Mi-Hyun Jo and Do-Won Lim at mwise@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Central bankBOK sees interest rate as tight amid continued drop in exports

Central bankBOK sees interest rate as tight amid continued drop in exportsFeb 21, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea confirms economic slowdown, recession concerns loom

EconomyS.Korea confirms economic slowdown, recession concerns loomFeb 17, 2023 (Gmt+09:00)

4 Min read -

EconomyKorea’s inflation picks up 5.2% in January on high utility prices

EconomyKorea’s inflation picks up 5.2% in January on high utility pricesFeb 02, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea likely to suffer recession as Jan exports tumble

EconomyS.Korea likely to suffer recession as Jan exports tumbleFeb 01, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK takes 25-bp rate hike as won rebounds against dollar

Central bankBOK takes 25-bp rate hike as won rebounds against dollarNov 24, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN