Korean chipmakers

Samsung shifts gears to focus on HBM, server memory chips

Advanced AI chips will continue to provide a tailwind for its sales and profit for the rest of the year, executives say

By Apr 30, 2024 (Gmt+09:00)

3

Min read

Most Read

Macquarie Korea Asset Management confirms two nominees

Deutsche Bank's Korea IB head quits after country head resigns

Hanwha buys SŌĆÖpore Dyna-MacŌĆÖs stake for $73.8 mn from Keppel

Korea's Taeyoung to sell local hotel to speed up debt workout

Meritz leaves door open for an M&A, to stay shareholder friendly

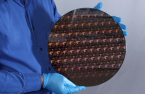

South Korean tech giant Samsung Electronics Co. said on Tuesday it will adjust its memory chip product mix to increase the output of advanced memory chips for servers and storage systems to meet the growing demand for artificial intelligence (AI) devices.

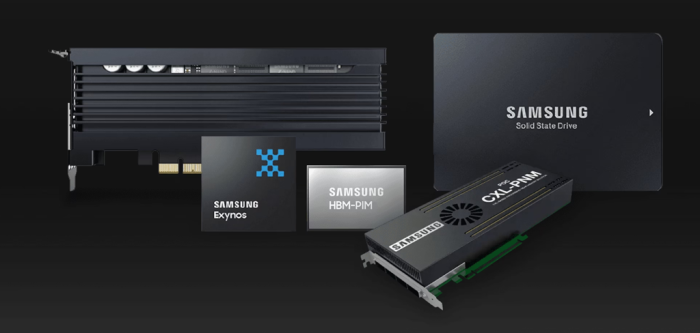

During a conference call with analysts after announcing its first-quarter results, company executives said the companyŌĆÖs memory chip production will focus on high-bandwidth memory (HBM), double data rate 5 (DDR5) and high-capacity solid-state drive (SSD) chips instead of PC and mobile chips.

In the second quarter, its server DRAM production will increase by 50% from the first quarter while server SSD output will double in terms of bit growth, executives said.

"We plan to increase supply of HBM chips in 2024 by more than threefold versus last year," Kim Jae-june, SamsungŌĆÖs memory business vice president, said on the call.

ŌĆ£We have already completed talks with our clients on this year's supply of HBM chips. In 2025, our HBM chip production will double from this year. Our talks on the 2025 volume with our customers are also going well.ŌĆØ

Last month, a senior Samsung executive said at Memcon 2024, a gathering of global chipmakers, held in San Jose, California that its HBM chip production will likely triple this year as it aims to take the lead in the artificial intelligence chip segment.

Samsung, the worldŌĆÖs top memory chipmaker, said on Tuesday it expects AI chip demand to continue to be strong, leading to a tight supply of some high-end chips throughout this year.

MASS PRODUCTION OF 8-LAYER HBM3E CHIPS

Kim said Samsung has begun mass production this month of its HBM chips for use in generative AI chipsets, called 8-layer HBM3E, and sales revenue from the chips will start from the end of the second quarter.

Samsung plans to start making the fifth-generation 12-layer version in the second quarter. The latest HBM3E products will account for two-thirds of its HBM output by year-end, he said.

A laggard in the HBM chip segment, Samsung has heavily invested in HBM to rival SK Hynix Inc., the dominant supplier of HBM ŌĆō essential to the AI boom as it provides faster processing speed than traditional memory chips.

Kim said Samsung will also step up efforts to increase high-end SSD product volumes to meet AI server demand as high-end memory chip supply is forecast to become tighter toward year-end with the chip industryŌĆÖs capacity focused on HBM.

ŌĆ£From the supply side, this yearŌĆÖs industry production bit growth will be limited. For DRAM, high-end chip production capacity will be mostly used for HBM. For NAND, bit growth will also be limited in the wake of chipmakersŌĆÖ output cuts and conversion of existing facilities for advanced processes,ŌĆØ Kim said.

Q1 SALES BEAT ITS OWN FORECAST

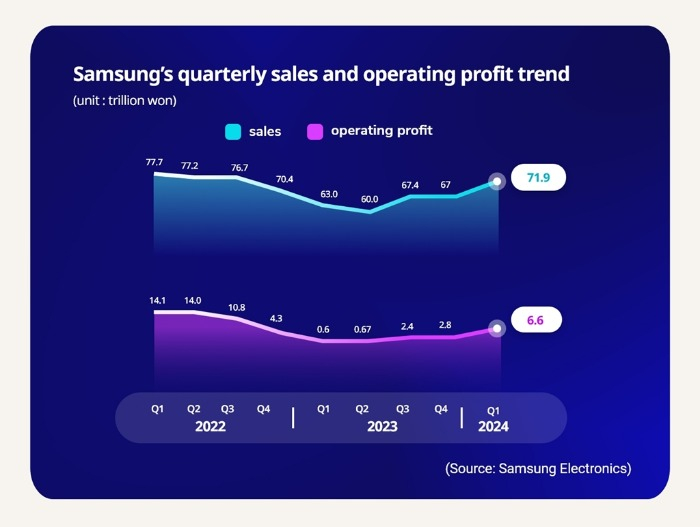

Earlier on Tuesday, Samsung said in a regulatory filing that its first-quarter operating profit on a consolidated basis rose more than tenfold to 6.6 trillion won ($4.8 billion) from 640.2 billion won in the year-earlier period, boosted by a rebound in chip demand. ItŌĆÖs the company's highest operating profit since the third quarter of 2022.

Its sales jumped 12.8% on-year to 71.9 trillion won and net profit soared 329% to 6.75 trillion won.

While the quarterly operating profit came in line with its forecast earlier this month, sales came above its own projection of 71 trillion won.

Its chip division swung to a profit of 1.91 trillion won in the January-March quarter from a 4.58 trillion won loss a year earlier ŌĆō posting its first profit since the third quarter of 2022.

SamsungŌĆÖs first-quarter capital expenditure stood at 11.3 trillion won, including 9.7 trillion won for chips and 1.1 trillion won for affiliate Samsung Display Co.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK HynixŌĆÖs HBM leadership

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK HynixŌĆÖs HBM leadershipMar 20, 2024 (Gmt+09:00)

3 Min read -

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demand

EarningsSamsung Q1 profit soars, set to benefit from Taiwan quake, AI chip demandApr 05, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung set to supply HBM3 to Nvidia, develops 32 Gb DDR5 chip

Korean chipmakersSamsung set to supply HBM3 to Nvidia, develops 32 Gb DDR5 chipSep 01, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN