Earnings

LG Energy Q3 profit at record high on gains from US battery tax credit

LG is a key IRA beneficiary as it runs the world’s largest battery manufacturing capacity in the US

By Oct 11, 2023 (Gmt+09:00)

3

Min read

Most Read

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

The South Korean company said it also benefited from US tax breaks under the Inflation Reduction Act (IRA), which took effect earlier this year.

Its preliminary operating profit in the July-September quarter reached an all-time quarterly high of 731.2 billion won ($545 million), up 40% from 521.9 billion won in the year-earlier period, LG said in a regulatory filing.

The result came above the market consensus of 690 billion won.

Third-quarter sales gained 7.5% to 8.22 trillion won from 7.65 trillion won.

Compared with the second quarter, LG Energy’s third-quarter operating profit rose 58.7% while sales declined 6.3%.

The company is due to release detailed third-quarter results, including divisional breakdown and net profit, on Oct. 25.

LG said its third-quarter operating profit included an estimated 215.5 billion won in tax credits it expects to receive from the US for its US battery manufacturing facilities and cells processed in Korea, under the Advanced Manufacturing Production Credit (AMPC) program.

Excluding the AMPC contribution, its third-quarter operating profit reached 515.7 billion won with an operating profit margin of 6.3%, the company said.

The IRA grants up to $7,500 per electric vehicle produced if it is assembled in the US and the battery's minerals are either mined or processed in the US or countries with free trade agreements with Washington.

With the implementation of the US tax credit rules, analysts said LG is expected to receive nearly 1 trillion won in such benefits for this year.

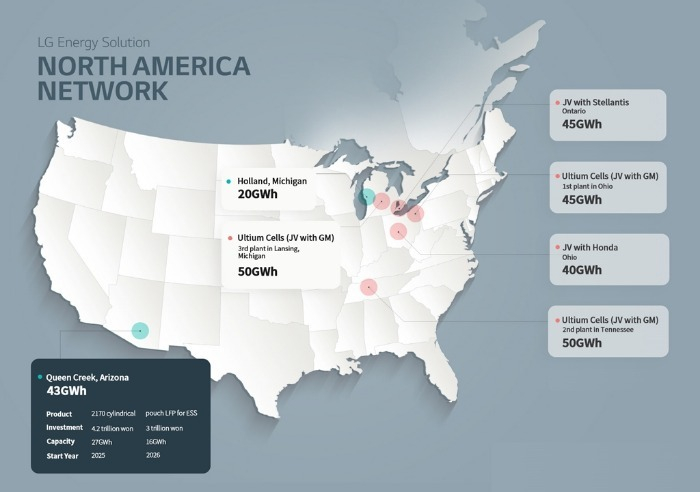

Industry watchers said LG is one of the major beneficiaries of the IRA because it has the largest battery manufacturing capacity among global battery players in the US.

The complex consists of two manufacturing facilities – one for cylindrical batteries used in electric vehicles and the other for lithium iron phosphate (LFP) pouch-type batteries used in energy storage systems (ESS).

The complex marks LG’s single largest investment in constructing its own battery manufacturing facility in the US.

In addition to another standalone battery plant in Holland, Michigan, LG also operates a battery joint venture, Ultium Cells LCC, with its US partner General Motors Co.

FULL-YEAR GUIDANCE REVISED UP

For the first nine months of this year, LG Energy likely posted 1.83 trillion won in operating profit on estimated sales of 25.74 trillion won, surpassing last year’s full-year operating profit and revenue.

LG said in July it is revising up its full-year sales growth target to an on-year increase of mid-30% from its earlier forecast of a 25-30% rise, reflecting its order backlog worth 440 trillion won.

“Demand from its major market, the US, is strong. We expect LG to continue to post decent sales growth based on its stable facility ramp-up and improving production yields,” said a local brokerage analyst.

Write to Nan-Sae Bin at binthere@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesLG Energy Solution to supply EV batteries to Toyota for 10 years

BatteriesLG Energy Solution to supply EV batteries to Toyota for 10 yearsOct 05, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Energy may partner with JSW to make EV batteries in India

BatteriesLG Energy may partner with JSW to make EV batteries in IndiaSep 22, 2023 (Gmt+09:00)

2 Min read -

BatteriesLG Energy to build $5.6 billion battery complex in Arizona

BatteriesLG Energy to build $5.6 billion battery complex in ArizonaMar 24, 2023 (Gmt+09:00)

3 Min read -

BatteriesLG Chem, GM in $30.6 billion EV battery materials supply deal

BatteriesLG Chem, GM in $30.6 billion EV battery materials supply dealJul 28, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN