Webtoons

Naver, Kakao to hold off M&As to pursue profits

South Korea's two top online portals put their priorities on making overseas businesses profitable

By Jan 03, 2023 (Gmt+09:00)

3

Min read

Most Read

Naver Corp. and Kakao Corp., South KoreaŌĆÖs two leading online platforms, will put on hold acquisition-oriented growth strategies and instead pursue the profitability of their global services.

This year, both companies will focus on shoring up the bottom line of their money-losing overseas webtoon and webnovel platforms amid fears of an economic recession, company officials said on Jan. 2

In recent years, Naver and Kakao have aggressively expanded their global footholds through acquisitions and partnerships with leading companies. But their overseas services have not yet paid off.

Despite a 20% profit margin of its webtoon service at home, NaverŌĆÖs web-based content services reported a 292.1 billion won ($230 million) loss in the first nine months of 2022 as a whole. The division posted sales of 1 trillion won during the period.

Naver CEO Choi Soo-yeon said at a second-quarter earnings call of last year that its web-based publications abroad would be able to achieve similar levels of operating profit margins within the next couple of years.

In particular, Naver stressed a steady growth in its paying subscriber number both in Japan and the US, where users have spent more to read a diverse library of its fiction than Korea subscribers.

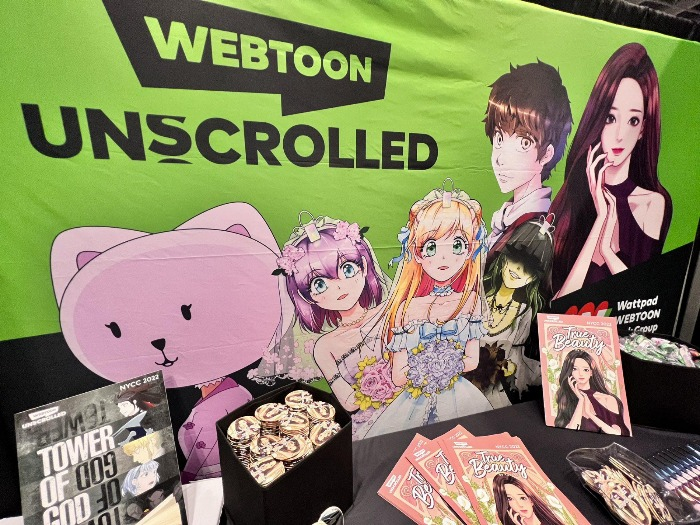

Naver Webtoon Ltd., a digital comics and novel platform, ranks first in North AmericaŌĆÖs web manga scene. In the US, its monthly user number reached 12.5 million as of end-April, 2022, according to Naver on Jan. 2.

| Naver accelerates overseas expansion through M&As |

| Launch of a serialized fiction paid app Yonder in October 2022 |

| Purchase of the worldŌĆÖs largest web novel platform Wattpad Corp. in 2020 |

| Line Digital Frontier Co., NaverŌĆÖs Japanese subsidiary for instant communications service, purchased eBOOK Initiative Japan in 2022 |

| Launch of webtoon producer studio Studio TooN in partnership with Japanese broadcaster TBS in 2022 |

| Launch of a drama production joint venture with CJ ENM's Studio Dragon in 2022 |

Kakao, South KoreaŌĆÖs top mobile platform, is scrambling to turn its overseas services into a profitable one as well.

Kakao had spent a combined 1.1 trillion won to buy Tapas Media Inc. and Radish Fiction Inc. in 2021. It merged with the two webtoon and mobile novel platforms based in North America to launch Tapas Entertainment last year.

The merged entity boasts plenty of intellectual property rights ranging from digital comics to web novels and dramas

In addition, Kakao expects growing interest in Korean content such as drama series would help the entertainment arm make a profit.

Korean webtoons take up less than 1% of Tapas' content offerings. But the Korean publications account for as much as 70% of its transaction value.┬Ā

To further boost its global presence, Tapas updated the ŌĆ£Wait Until FreeŌĆØ feature in the fourth quarter of 2022. The updated service allows its users to enjoy TapasŌĆÖ top episodes every three hours for free.

Previously, Kakao introduced a similar free service, in which its users were able to access KakaoŌĆÖs hit titles after 12 hours or three days of their publication.

Kakao Entertainment now bets on some 10,000 intellectual property rights of top series it had secured for about 2 trillion won in its early business years, a company official said.

About one-third of them have been offered to global readers so far.

Going forward, Kakao Entertainment plans to expand its presence in Europe, taking advantage of its original contents and the management know-how of the Japanese unit Piccoma.

Piccoma is JapanŌĆÖs No. 1 webtoon subscription service. Kakao established PiccomaŌĆÖs Europe office in France in 2021.

Write to Sang-eun Lucia Lee at selee@hankyung.com

Yeonhee Kim edited this article

More to Read

-

WebtoonsNaver Webtoon, digital comics case for global MBA study

WebtoonsNaver Webtoon, digital comics case for global MBA studyDec 13, 2022 (Gmt+09:00)

2 Min read -

WebtoonsNaver Webtoon to pursue profits with Yonder app launch in US

WebtoonsNaver Webtoon to pursue profits with Yonder app launch in USOct 31, 2022 (Gmt+09:00)

3 Min read -

WebtoonsNaver Webtoon to pursue profitability with more paying subscribers

WebtoonsNaver Webtoon to pursue profitability with more paying subscribersAug 30, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsBehind the scenes of NaverŌĆÖs $600 mn Wattpad purchase

Mergers & AcquisitionsBehind the scenes of NaverŌĆÖs $600 mn Wattpad purchaseFeb 01, 2021 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsNaver to acquire web novel platform Wattpad for $593 mn

Mergers & AcquisitionsNaver to acquire web novel platform Wattpad for $593 mnJan 20, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN