Steel

POSCO raises ship steel prices as Korea's tariffs curb supply

Declining Chinese supply and the current shipbuilding boom bode well for Korean steelmakers

By Apr 28, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

POSCO Holdings Inc. has raised second-quarter prices of thick plates used in vessels amid concerns over tighter supply after South Korea levied anti-dumping duties on Chinese steel last week, according to steel industry sources on Sunday.

The largest steelmaker in South Korea recently concluded price negotiations with domestic shipbuilders such as HD Korea Shipbuilding & Offshore Engineering Co., Hanwha Ocean Co. and Samsung Heavy Industries Co.

It agreed to supply thick plates – steel plates 6 mm thick or more – at around 800,000 won ($556 ) per ton for the second quarter, said the sources.

Thick plates were supplied at the upper end of the 700,000 won range in the first quarter, a level many domestic steelmakers say fell below their manufacturing cost.

“Steel companies and shipbuilders have agreed to hold quarterly price negotiations starting this year,” said one of the sources. “The price was set at around 800,000 won, or slightly above, per ton.”

HYUNDAI STEEL

Hyundai Steel Co. has also agreed to hike steel prices for Korean shipbuilders for the first half of this year, with discussions ongoing over the final increase.

Industry watchers expect the price for Hyundai Steel’s thick plates to be set at a level similar to POSCO's, or around 800,000 won per ton.

“Data indicate a decline in Chinese steel supply. Raising domestic thick plate prices is unavoidable,” said a steel company official.

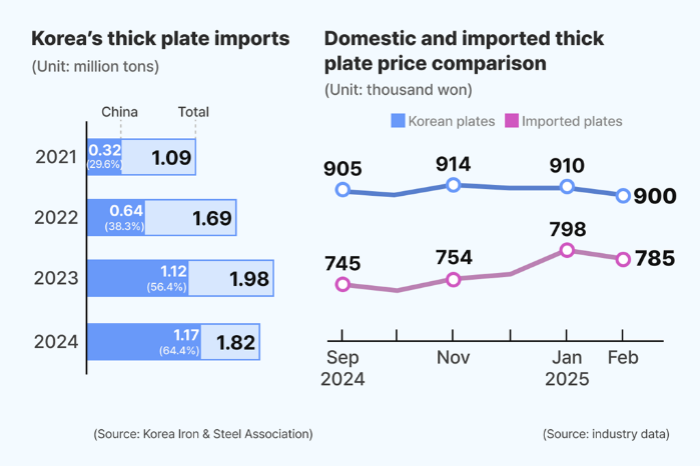

Even with the price increase, Korean steel products would be cheaper than Chinese imports following Seoul's imposition of tariffs.

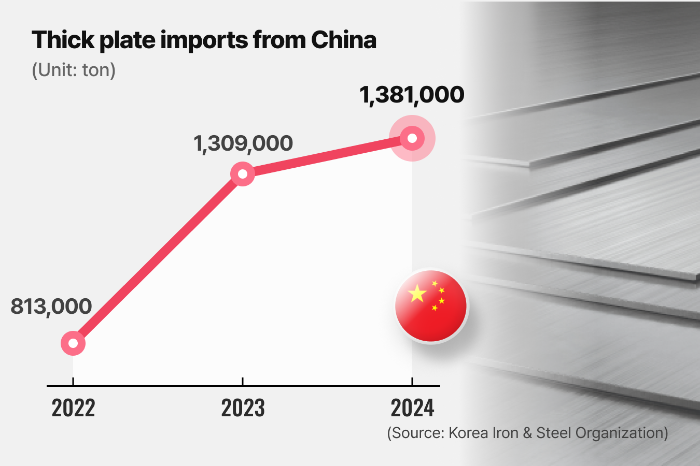

Starting on April 24, South Korea imposed anti-dumping duties of up to 38% on Chinese steel plates after steel imports from China surged to a seven-year high last year.

Higher-than-expected tariffs on Chinese steel have sent the prices of Chinese-made thick plates to 950,000 won per ton from the mid-700,000 range.

In South Korea, thick plate prices have been on a downward trend, falling from around 1 million in the first half of 2023 to the mid-to-high 700,000 won range by 2024.

The price increase is fueling expectations of a turnaround for Korean steelmakers.

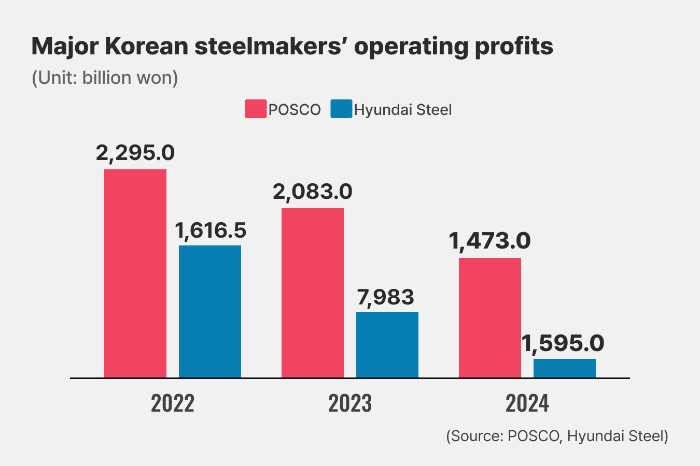

Thick plates have been a drag on their earnings. In 2024, POSCO posted losses of around 100 billion won from the thick plate business, pushing its operating profit down 29% to 1.47 trillion won from a year before.

Losses from thick plates also drove Hyundai Steel’s operating profit decline to 159.5 billion won in 2024.

For Korean shipbuilders, industry observers warn that higher steel plate prices may undermine their competitiveness against Chinese rivals, just as they are gaining momentum from the global shift toward low-emission vessels. Thick plates account for more than 20% of a vessel's cost.

Write to Sang Hoon Sung at uphoon@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

SteelHyundai Steel picks Donaldsonville as $5.8 bn US plant site, seeks investors

SteelHyundai Steel picks Donaldsonville as $5.8 bn US plant site, seeks investorsMar 28, 2025 (Gmt+09:00)

4 Min read -

SteelPOSCO to sell entire stake in Nippon Steel, ending equity ties

SteelPOSCO to sell entire stake in Nippon Steel, ending equity tiesMar 20, 2025 (Gmt+09:00)

1 Min read -

SteelDongkuk to file anti-dumping petition vs Chinese color steel imports

SteelDongkuk to file anti-dumping petition vs Chinese color steel importsFeb 27, 2025 (Gmt+09:00)

2 Min read -

SteelSouth Korea to levy 38% anti-dumping duties on Chinese steel products

SteelSouth Korea to levy 38% anti-dumping duties on Chinese steel productsFeb 20, 2025 (Gmt+09:00)

3 Min read -

SteelKorea to probe Chinese, Japanese steel imports over anti-dumping claims

SteelKorea to probe Chinese, Japanese steel imports over anti-dumping claimsFeb 19, 2025 (Gmt+09:00)

1 Min read -

-

SteelKorean steelmakers mull anti-dumping suit vs Chinese, Japanese firms

SteelKorean steelmakers mull anti-dumping suit vs Chinese, Japanese firmsJan 17, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN