Shipping & Shipbuilding

HD Hyundai, Hanwha to tap into $242 billion US Navy warship market

Korea and Japan are the only two US-allied Indo-Pacific nations capable of building the warships under the proposed two bills

By Feb 12, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s two warship builders – HD Hyundai Heavy Industries Co. and Hanwha Ocean Co., – are set to ride tailwinds in their bids to build US warships following two US senators' introduction of new bills aimed at strengthening the readiness of the US Navy and Coast Guard.

Once the bills are enacted, HD Hyundai and Hanwha will emerge as the top beneficiaries of US President Donald Trump’s push to forge deeper shipbuilding ties with allied nations, analysts said.

Last week, Mike Lee and John Curtis, Republican senators from Utah, introduced the Ensuring Naval Readiness Act and the Ensuring Coast Guard Readiness Act, designed to modernize and expedite the construction and procurement processes for US maritime forces by fostering increased collaboration with allied nations.

“By allowing the option to construct ships or components in shipyards of NATO member countries or Indo-Pacific nations with which the US has mutual defense agreements, this bill aims to reduce costs and speed up delivery times, helping to close the gap between current capabilities and strategic needs,” Lee said in a joint statement while introducing the Naval Readiness Act.

Curtis said in the statement, “This legislation (Coast Guard Readiness Act) permits the Coast Guard to partner with allied shipyards to procure vessels more quickly and cost-effectively, without compromising national security. It specifically allows for the construction of major vessel components in foreign shipyards not influenced by adversarial powers, particularly China.”

ONLY SOUTH KOREA, JAPAN ABLE TO FULFILL ROLE

In the Indo-Pacific region, only South Korea and Japan are capable of fulfilling this role, analysts said.

Last November, then-President-elect Trump said in a telephone conversation with the South Korean president that the two countries need close collaboration for shipbuilding as well as defense maintenance and repair work, commonly known as MRO.

If the bills pass, a significant portion of the US Navy’s new warship construction projects, under its annual budget of some 352 trillion won ($242 billion), will likely be undertaken by Korean shipbuilders.

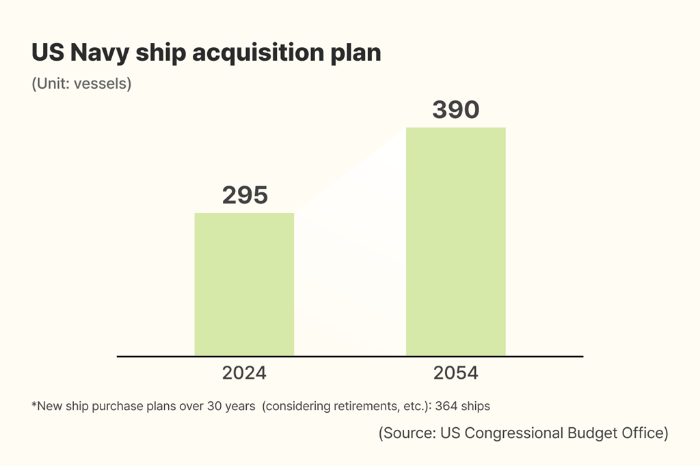

The US Navy is expected to raise its warship acquisition to 390 vessels by 2054 from 295 in 2024.

While Korean shipbuilders are unlikely to secure contracts for core assets such as aircraft carriers and nuclear submarines due to technical and security constraints, there is a high likelihood of winning contracts for Aegis-class destroyers and other warships, analysts said.

In the MRO business, HD Hyundai and Hanwha Ocean already obtained requirement approval.

In July 2024, the two Korean shipbuilders each signed a ship maintenance relations agreement (SMRA) with the US Navy, which qualifies them to bid for the US Navy’s MRO orders.

TECHNOLOGICAL EDGE

Korea has a technological edge in building Aegis-class destroyers.

While US shipbuilders can produce 1.6 to 1.8 Aegis destroyers on average per year, their Korean counterparts have the capacity and capabilities to build at least three warships annually, analysts said.

It is also less costly for Korean shipbuilders to make warships for the US Navy.

Industry officials said Korean firms can build an Aegis destroyer at half the cost of their US rivals.

HD Hyundai, which delivered Jeongjo the Great, one of the world's top-tier Aegis destroyers, to the Korean Navy, last November, won a deal to build another for Peru earlier this year.

Formerly Hyundai Heavy Industries Co., HD Hyundai Heavy is a unit of HD Korea Shipbuilding & Offshore Engineering Co.

HD KSOE, the intermediate holding company of HD Hyundai Co., a shipbuilding, oil refining and machinery conglomerate, has three shipbuilding affiliates under its wing – HD Hyundai Heavy, HD Hyundai Mipo Co. and HD Hyundai Samho Co.

Hanwha Ocean has been the only supplier of submarines for the Korean Navy since 1987.

DIFFERENT STRATEGIES

HD Hyundai and Hanwha have taken different strategies to respond to the US government’s protectionist policies.

HD Hyundai Heavy has refrained from investing in US shipyards in hopes that the US government may seek law revisions to allow allied nations to build US warships in their countries.

In contrast, Hanwha has been exploring ways to build ships on US soil regardless of legal changes, acquiring Philly Shipyard Inc. in June.

Hanwha executives said in January the company aims to secure up to six MRO contracts for US Navy ships this year.

Shares of HD Hyundai Heavy closed up 15.4% at 353,000 won on Wednesday, outperforming the broader Kospi index’s 0.4% rise.

Hanwha Ocean finished up 15.2% at 72,900 won.

Write to Woo-Sub Kim at duter@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EarningsHanwha Ocean swings to profit, seeks 6 US Navy MRO projects

EarningsHanwha Ocean swings to profit, seeks 6 US Navy MRO projectsJan 24, 2025 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHanwha Ocean, another Korean shipbuilder win $951 million WTIV deals

Shipping & ShipbuildingHanwha Ocean, another Korean shipbuilder win $951 million WTIV dealsDec 30, 2024 (Gmt+09:00)

2 Min read -

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bids

Shipping & ShipbuildingHanwha Ocean, HD Hyundai reconcile, look to joint overseas warship bidsNov 24, 2024 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHanwha acquires $100 million Philly Shipyard for US market debut

Shipping & ShipbuildingHanwha acquires $100 million Philly Shipyard for US market debutJun 21, 2024 (Gmt+09:00)

3 Min read -

Shipping & ShipbuildingHD Hyundai builds Aegis destroyer with anti-ballistic missiles

Shipping & ShipbuildingHD Hyundai builds Aegis destroyer with anti-ballistic missilesNov 22, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN