Korean duty-free shops post Q3 losses; no signs of recovery

They are forecast to widen losses due to rising rents and business licensing fees, alongside an increase in frugal travelers

By Nov 14, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korean duty-free shops, once golden geese for retailers, show no signs of recovery and are likely to widen losses in the coming quarters. They are struggling with a decline in spending by travelers, especially Chinese group tourists and climbing rents, said industry observers.

Business licensing fees owed to customs will add to their burden. The South Korean government brought the fees -- set in proportion to sales -- back to the original level after a reduction in 2020-2023. Money-losing duty-free stores need to pay the fees as well.

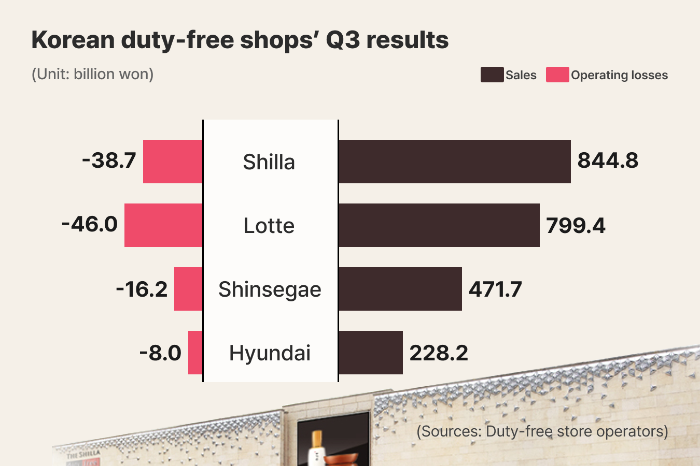

Lotte Duty-Free Shop, operated by Hotel Lotte Co., racked up losses for the fifth straight quarter, which widened to 46.0 billion won ($33 million) in the July-September period. That compared with a 36.2 billion won shortfall in the same period.

Shilla Duty-Free, under Hotel Shilla Co., chalked up a 38.7 billion operating loss during the same period. Duty-free stores operated by Shinseg Corp. and Hyundai Department Store Co. also suffered losses in the third quarter.

It was the first time that the four leading duty-free shop companies in the country all posted losses in a single quarter since the fourth quarter of 2022 in the aftermath of the COVID-19 outbreak.

Lotte Duty-Free has shifted into emergency management mode since June to fight the downturn and offered voluntary redundancies in August.

Shinsegae DF Co., the operator of Shinsegae Duty Free, recently set up an emergency management task force team directly under its top management. Hyundai Duty Free, formerly Hyundai Department Store Duty Free, replaced its chief executive in October.

Rents are rising at stores inside Incheon International Airport, their key location. The airport operator started charging rents in proportion to passenger numbers in 2022, doing away with the fixed rent system. Accordingly, the more people use the airport, the higher the rent.

The number of foreign shoppers at duty-free stores inside Incheon International Airport soared tenfold to 6.02 million in 2023 from 660,000 in 2021. But their combined sales contracted to 11 trillion won, versus 17 trillion won over the same period, according to the Korea Duty-Free Shop Association.

Lotte Duty-Free withdrew from the main air gateway to South Korea in 2023.

Returning Chinese travelers gave little boost to their sales.

There were fewer shuttle traders from China, those who come to Korea on group tours to buy items at duty-free shops en masse to resell in China, than before COVID-19. Most Chinese visitors are individual travelers looking for bang for their buck.

Due to declining sales, inventories have built up. Stockpiles at the four duty-free store operators increased 17.4% to 2.30 trillion won as of the end of June, compared with 1.96 trillion won at the end of last year.

Dutry-free operators have had to sell cosmetics at the cost of margins before their expiration dates. They buy the products in cash and need to clear the inventories themselves.

The ascent of Chinese duty-free stores in mainland China has also put a damper on Korean retailers. The neighboring country built the world’s largest duty-free shopping mall in Hainan, the nation’s top tourist destination, and has sharply increased shoppers’ purchase limits in the area.

Write to Ji-Yoon Yang at yang@hankyung.com

Yeonhee Kim edited this article.

-

RetailDuty-free underdog Kyung Bok Kung outshines Lotte, Shilla

RetailDuty-free underdog Kyung Bok Kung outshines Lotte, ShillaSep 18, 2024 (Gmt+09:00)

3 Min read -

-

RetailDuty-free shops at Incheon International Airport eager to lure boutiques

RetailDuty-free shops at Incheon International Airport eager to lure boutiquesMar 07, 2024 (Gmt+09:00)

2 Min read -

-

RetailS.Korea's duty-free sector expects boom from Chinese tourists' return

RetailS.Korea's duty-free sector expects boom from Chinese tourists' returnAug 28, 2023 (Gmt+09:00)

1 Min read -

RetailKorea’s duty-free sales skid despite China border reopening

RetailKorea’s duty-free sales skid despite China border reopeningAug 02, 2023 (Gmt+09:00)

2 Min read -

RetailHotel Shilla to challenge Lotte’s duty-free shop dominance in Korea

RetailHotel Shilla to challenge Lotte’s duty-free shop dominance in KoreaApr 28, 2023 (Gmt+09:00)

3 Min read -

RetailDomestic duty-free sales surpass 1 trillion won in February

RetailDomestic duty-free sales surpass 1 trillion won in FebruaryMar 28, 2023 (Gmt+09:00)

1 Min read -

RetailLotte Duty Free wins bid to operate Melborune Airport duty-free shop

RetailLotte Duty Free wins bid to operate Melborune Airport duty-free shopJan 25, 2023 (Gmt+09:00)

1 Min read -

RetailKorean duty-free shops hit by unfavorable exchange rate, limited inventory

RetailKorean duty-free shops hit by unfavorable exchange rate, limited inventoryJun 26, 2022 (Gmt+09:00)

2 Min read