Mergers & Acquisitions

MBK-led consortium to take over Japan’s FICT for $656 mn

North Asia’s largest private equity firm will own an 80% stake and US chip test firm FormFactor 20%

By Feb 06, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

MBK Partners, the largest private equity firm in North Asia, will acquire a controlling stake in FICT Ltd., a semiconductor printed circuit board (PCB) and substrate-producing firm in Japan, for 100 billion yen ($656.3 million), betting big on cloud computing and artificial intelligence.

FormFactor Inc., a Livermore, California-based semiconductor qualification and production test company, announced on Thursday that it will acquire FICT together with MBK from Advantage Partners Inc.

Under the agreement, MBK will hold an 80% stake in the Japanese semiconductor PCB and substrate maker, and FormFactor will own a minority, non-controlling stake of 20% with a seat on FICT’s board of directors.

The US company said it will invest about $60 million in the MBK-led consortium, and the 100 billion yen deal is expected to close within the first quarter of this year.

MBK will use its sixth buyout fund, which completed the second closing of fundraising at $5 billion late last year, to buy FICT’s controlling stake.

MBK said it has decided to invest in FICT to meet the growing demand for high-performing semiconductor components from global chip makers amid rapid growth in the cloud computing and AI sectors.

It will team up with FormFactor to accelerate the development of innovative technology in semiconductor tests and packaging while fostering FICT’s mid- to long-term growth.

“The semiconductor industry’s rapidly accelerating adoption of advanced packaging requires increased investment and stronger collaboration across the test and assembly supply chain,” said Mike Slessor, FormFactor’s CEO.

“We’ve built a partnership with MBK, North Asia’s leading private equity firm, with a shared vision to enhance FICT’s long-term value by fully serving all FICT’s existing and potential customers,” he added.

MAJOR PCB AND SUBSTRATE MAKER IN JAPAN

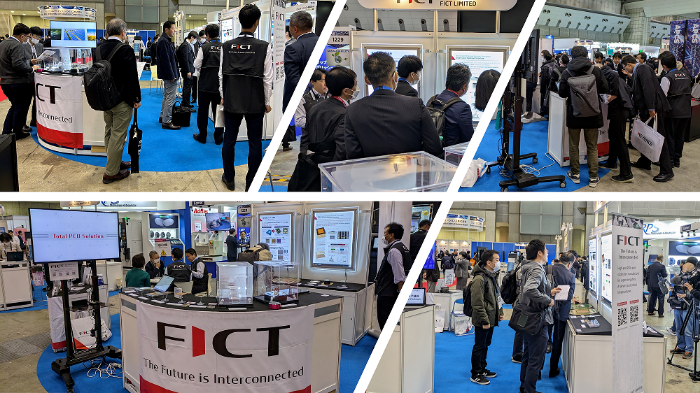

Headquartered in Nagano, FICT develops and manufactures high-performance PCBs and substrates for semiconductor test equipment and information and communications technology (ICT) infrastructure, including supercomputers and data centers.

In particular, its high-performing multilayer PCBs and glass substrates are highly sought after. Its proprietary PCB technology called F-ALCS is also in the limelight.

Founded in 1967 as Fujitsu’s PCB business unit, it raked in 30 billion yen in sales for the fiscal year ending in March 2024.

Its sales are expected to grow rapidly driven by the booming construction of data centers for generative AI and high-speed base transceiver stations across Japan.

It supplied substrates for Fugaku, which is considered Japan’s fastest supercomputer.

It has also been a long-time supplier of high-performance components to FormFactor.

This is the second investment of MBK’s sixth fund after the completion of its tender offer for the world’s largest lead and zinc smelter Korea Zinc Inc. late last year.

The North Asia-focused buyout fund plans to complete the third closing of its sixth fund in the first quarter of this year with a target of $7 billion at the final closing.

Write to Jun-Ho Cha at chacha@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Investment bankingMBK’s ByungJu Kim, UBS’ Kyungin Lee: Most influential in capital market

Investment bankingMBK’s ByungJu Kim, UBS’ Kyungin Lee: Most influential in capital marketJan 20, 2025 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsMBK, Young Poong close in on majority of Korea Zinc

Mergers & AcquisitionsMBK, Young Poong close in on majority of Korea ZincDec 19, 2024 (Gmt+09:00)

2 Min read -

Private equityMBK Partners’ 6th buyout fund raises $5 bn at 2nd close

Private equityMBK Partners’ 6th buyout fund raises $5 bn at 2nd closeNov 19, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsMBK Partners tipped to win battle for control of Korea Zinc

Mergers & AcquisitionsMBK Partners tipped to win battle for control of Korea ZincNov 12, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN