Mergers & Acquisitions

Macquarie kicks off sale of DIG Airgas estimated at over $3.4 billion

POSCO and major global PE firms are being floated as strong candidates for South Korea’s No. 3 industrial gas producer

By Jan 13, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Macquarie Asset Management has embarked on a process to sell off its 100% stake in South Korea’s third-largest industrial gas producer DIG Airgas Co. in what would be the country’s largest buyout deal so far this year.

According to investment banking industry sources on Sunday, the asset management division of Australia’s Macquarie Group is expected to send out a letter this week inviting global investment banks (IB) to join a bid to lead a deal to sell its full stake in DIG Airgas.

DIG Airgas supplies its gases to Samsung Electronics Co., SK Hynix Inc. and many others in the country.

Its sales for 2024 were estimated at 750 billion won ($510 million), while its earnings before interest, taxes, depreciation and amortization (EBITDA) was estimated at 250 billion won.

Based on last year’s earnings, its enterprise value is estimated at more than 5 trillion won, and Korea’s largest steelmaking group POSCO Holdings Inc. and multinational private equity firms such as KKR & Co. and Carlyle Group Inc. are expected to vie for the gas producer.

If Macquarie succeeds in selling its full stake in DIG Airgas in the first half of this year as planned, the deal would mark the country’s largest M&A deal so far this year, industry analysts said.

STABLE CASH-GENERATING BUSINESS

An industrial gas producer is considered a lucrative business in Korea thanks to its long-term contracts to supply special gases to the country’s large manufacturing conglomerates like Samsung and SK Hynix. As such, its sale often invites many bidders.

DIG Airgas produces industrial gas from refined oxygen, nitrogen and argon gases.

Formerly known as Daesung Industrial Gases, founded in 1979, it was taken over in 2017 by PE firm MBK Partners for 1.8 trillion won when it was in financial distress.

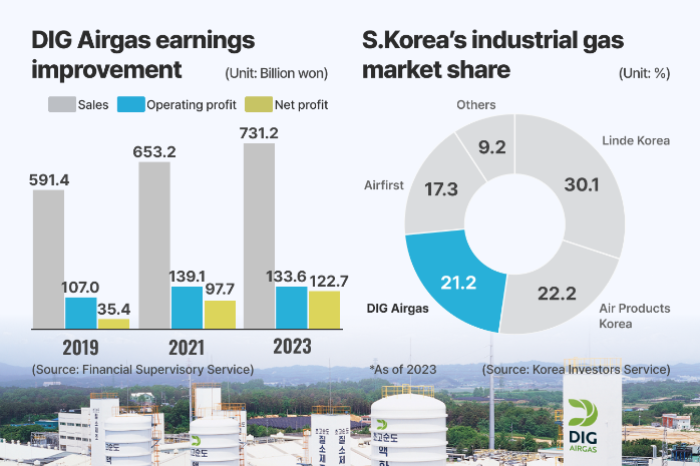

Two years later, it was sold to Macquarie for 2.5 trillion won. Under the Australian asset manager’s control, its operating profit improved 24.9% from 2019 to 2023 on sales of 731.2 billion won, which increased 23.7% over the same period. Its net profitd jumped 3.5 times to 122.7 billion won during that period.

Considering its order backlog and anticipated orders this year, DIG Airgas is projected to continue posting better earnings for the next few years.

Given that an industrial gas producer’s enterprise value is generally determined at an EBITDA multiple of around 20 times, the DIG Airgas sale is expected to fetch more than 5 trillion won.

In 2023, Seoul-based IMM Private Equity sold a 30% stake in AirFirst Co., DIG Airgas’ smaller cross-town rival, to BlackRock for 1.1 trillion won at an EBITDA multiple of 25 times.

When US industrial gas maker Air Products and Chemicals Inc. put its Korean unit, Air Products Korea, up for sale last year, its value was estimated at 5 trillion won at an EBITDA multiple of 20 times.

POSCO AND GLOBAL PE FIRMS AS STRONG CANDIDATES

Korean steel giant POSCO, which added industrial gas to its business portfolio in 2021, is being floated as a strong candidate to bid for DIG Airgas.

In 2023, POSCO set up an industrial business unit, which supplies special gases mainly to POSCO affiliates.

If it acquires Korea's DIG Airgas, it could become a major player in the country’s industrial gas market.

Multinational PE firms, renowned for their lucrative infrastructure investments in Korea, are also seen as formidable contenders.

KKR, MBK Partners, Carlyle and Stonepeak joined the bid for Air Products Korea last year. All but MBK Partners are expected to tender for DIG Airgas this time.

INDUSTRY SLUMP MAY DAMPEN DEMAND

Air Products Korea’s deal was called off last year due to the big gap in sale price between seller and buyer after its earnings outlook was sharply downgraded following the suspension of Samsung Electronics’ new semiconductor plant.

Air Products Korea was set to supply its gases to the chip giant’s Pyeongtaek Campus plant 5.

The Korean semiconductor industry outlook may affect the DIG Airgas deal, said an official from the IB industry, citing the collapsed sale of Air Products Korea.

Write to Jong-Kwan Park and Jun-Ho Cha at pjk@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Chemical IndustryGas maker Air Products Korea put on sale for around $3.6 bn

Chemical IndustryGas maker Air Products Korea put on sale for around $3.6 bnAug 07, 2024 (Gmt+09:00)

2 Min read -

-

Mergers & AcquisitionsBlackRock buys $860 mn stake in S.Korean gas supplier

Mergers & AcquisitionsBlackRock buys $860 mn stake in S.Korean gas supplierJun 09, 2023 (Gmt+09:00)

1 Min read -

Macquarie seeks co-investors for over $2 bn Korean gas firm purchase

Macquarie seeks co-investors for over $2 bn Korean gas firm purchaseDec 17, 2019 (Gmt+09:00)

2 Min read

Comment 0

LOG IN