MBK Partners tipped to win battle for control of Korea Zinc

The buyout firm is expected to call a Korea Zinc shareholder meeting no later than January next year to take majority of the board

By Nov 12, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

A consortium led by North Asia-focused buyout firm MBK Partners edged closer to winning the battle for control of Korea Zinc Inc. against the smelting company’s top management after further widening its shareholding gap, which industry watchers said would be difficult to overturn.

After completing its tender offer for the world’s largest lead and zinc smelter in October, MBK and Young Poong Corp. together bought an additional 1.36% stake in the company for 292.0 billion won ($208 million) in the market, according to a regulatory filing on Monday by their special purpose company set up for the tender offer.

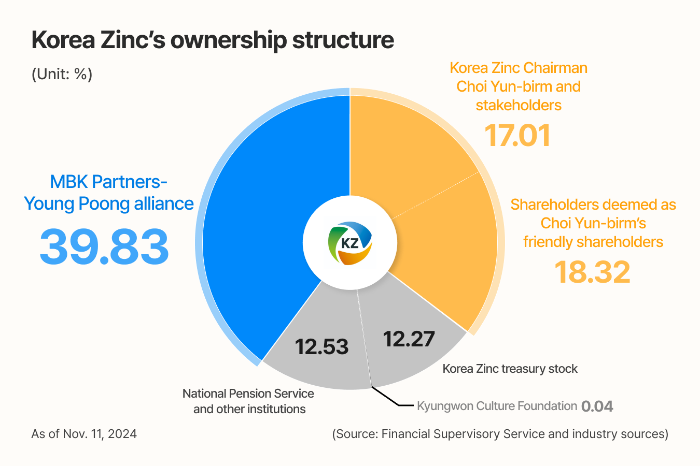

The MBK-Young Poong coalition has consequently increased its stake in Korea Zinc to 39.83% from 38.47% in October.

In terms of shares with voting rights, they control 45.42% of Korea Zinc after the latter’s share buybacks in October for retirement. Young Poong is the single largest shareholder in Korea Zinc.

The MBK-led group has continuously purchased Korea Zinc shares via NH Investment & Securities Co. since late last month. It bought them at 1,034,400 won per share on average, higher than its tender offer of 830,000 won.

By comparison, Korea Zinc Chairman Choi Yun-birm holds a 17.01% stake in Korea Zinc, together with stakeholders and the US private equity firm Bain Capital after its buybacks last month.

That falls short of MBK-Young Poong alliance’s 45.42% stake by about five percentage points as of Nov. 11, widening the gap from about three percentage points as of late last month.

Both of them failed to secure a majority of Korea Zinc in their separate tender offers last month, though.

Industry watchers said the battle for control of Korea Zinc will likely end up in a victory for MBK.

Even if the National Pension Service, believed to hold about a 4% stake in Korea Zinc, joins the smelter’s white knights, their combined stake will still be below that of the MBK-Young Poong consortium.

Other institutional and individual investors holding the remaining 8% of Korea Zinc shares could call the shots on the fight.

But they are unlikely to vote in favor of the company’s current management, who angered investors with the abrupt announcement of a 2.5-trillion-won rights issue on Oct. 30.

It planned to use the proceeds to repay debts used for its share buybacks. But regulators put the brakes on the rights offering, finding fault with the process.

MBK is expected to call an extraordinary shareholder meeting of Korea Zinc no later than January next year to take majority of the board.

If the MBK-led group ultimately seizes control of Korea Zinc, it would mark its first success in a hostile takeover of a domestic company.

The takeover attempt is aimed at improving its governance and shareholder value, MBK founder and Chairman Michael ByungJu Kim told The Korea Economic Daily last week.

Korea Zinc's share price was little changed at 1,134,000 won in morning trade.

Write to Jong-Kwan Park and Ji-Eun Ha at pjk@hankyung.com

Yeonhee Kim edited this article.

-

Mergers & AcquisitionsRegulator puts brakes on Korea Zinc’s $1.8 bn rights issue

Mergers & AcquisitionsRegulator puts brakes on Korea Zinc’s $1.8 bn rights issueNov 06, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK’s Korea Zinc bid aimed at corporate governance, shareholder value

Mergers & AcquisitionsMBK’s Korea Zinc bid aimed at corporate governance, shareholder valueNov 05, 2024 (Gmt+09:00)

2 Min read -

Rights offeringsKorea Zinc to raise $1.8 bn in rights issues amid face-off with MBK

Rights offeringsKorea Zinc to raise $1.8 bn in rights issues amid face-off with MBKOct 30, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea Zinc, MBK face proxy war for zinc smelter

Mergers & AcquisitionsKorea Zinc, MBK face proxy war for zinc smelterOct 28, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsMBK’s Korea Zinc takeover attempt to spur search for white knights

Mergers & AcquisitionsMBK’s Korea Zinc takeover attempt to spur search for white knightsOct 27, 2024 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsKorea Zinc shares skyrocket after buybacks in tender offer

Mergers & AcquisitionsKorea Zinc shares skyrocket after buybacks in tender offerOct 24, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKorea Zinc takes control of key shareholder in management feud with MBK

Mergers & AcquisitionsKorea Zinc takes control of key shareholder in management feud with MBKOct 22, 2024 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea Zinc

Mergers & AcquisitionsMBK wins enough stake in tender offer to control Korea ZincOct 14, 2024 (Gmt+09:00)

4 Min read -

Mergers & AcquisitionsKorea Zinc ups share buyback price, volume to counter MBK

Mergers & AcquisitionsKorea Zinc ups share buyback price, volume to counter MBKOct 11, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK not to raise Korea Zinc tender offer price after regulator warning

Mergers & AcquisitionsMBK not to raise Korea Zinc tender offer price after regulator warningOct 10, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea Zinc, MBK face-off for control of zinc smelter takes new twist

Mergers & AcquisitionsKorea Zinc, MBK face-off for control of zinc smelter takes new twistOct 04, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsMBK ups stakes for Korea Zinc to match buyback offer

Mergers & AcquisitionsMBK ups stakes for Korea Zinc to match buyback offerOct 04, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsKorea Zinc, Bain Capital offer $2.4 bn share buyback vs MBK

Mergers & AcquisitionsKorea Zinc, Bain Capital offer $2.4 bn share buyback vs MBKOct 02, 2024 (Gmt+09:00)

3 Min read