Markets

Korean retail investors’ US stockholdings at record high

US stock funds launched in Korea returned 17.21% on average this year, exceeding Korean equity funds' 2.98%

By Jun 10, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

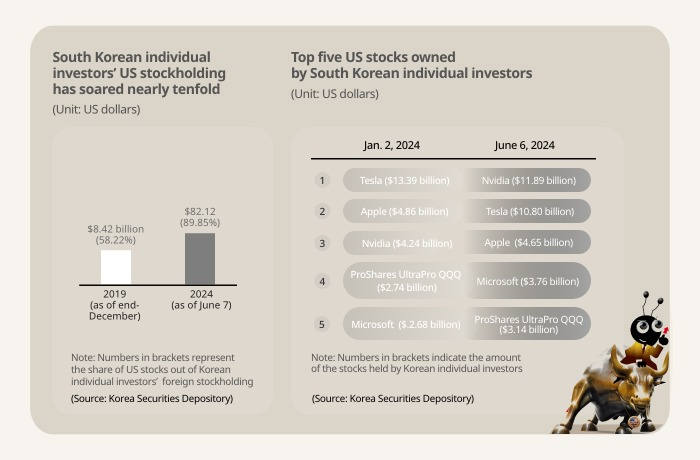

South Korean individual investors’ US stockholdings swelled to a record $82.19 billion as of early June amid the US stock market rally, while they dumped a net 11.5 trillion won ($8.4 trillion) worth of domestic stocks this year.

Their Nvidia Corp. holdings have nearly tripled to $11.9 billion since the start of the year until June 7, according to the Korea Securities Depository. The figure excluded their investments in US equity funds.

The world’s most famous AI chip producer surpassed Tesla Inc. late last month to become the most-owned stock by Korean retail investors. Its share price shot up by 150% to hit record highs this year, leading the US stock market rally.

Other leading AI companies topped the list of aggressively bought stocks by Korean individual investors.

Their Microsoft holdings have ballooned by 38.7% to $3.8 billion since the start of this year. Ownership in Alphabet Inc., the parent of Facebook Inc., increased by 19.4% to $2.4 billion over the same period.

As of June 7, Korean individual investors together own $82.19 billion worth of US stocks, up 22% year to date or a $15 billion gain. The figure represents a nearly tenfold jump since the end of 2019.

“AI-related stocks drove new inflows into the stocks,” said a stock brokerage company official.

The sluggish performance of the Korean stock market expedited their migration to US technology shares, which have powered the US stock market rally amid the AI boom.

"Korea is one step behind in the global AI race and rechargeable battery-related stocks, which are at the top of the market capitalization, faltered,” said a Korean stock market analyst.

“Amid the absence of domestic market-leading stocks, the flight of money to overseas stock markets will continue for a while," he added.

US stocks account for 89.85% of Korean individual investors’ foreign stockholdings as of June 7, up from 58.22% at the end of 2019.

The S&P 500, a major US stock index, has gained 12.74% year to date, while the Kospi index added a mere 2.54% over the same period.

INDIRECT INVESTMENTS VIA EQUITY FUNDS

By comparison, domestic equity funds have suffered net outflows of 1.3 trillion won so far this year, returning a meager 2.98% on average.

Hyundai Motor Co. has been the most-sold stock by Korean individual investors, who have unloaded a net 3.6 trillion won worth of shares in the automaker so far this year, cashing in on its bull run in the months prior.

“Individual investors have a tendency to realize profits quickly on domestic shares, even if they are on the rise,” said Kim Seung-hyun, research head at Yuanta Securities. "This tendency is getting stronger as they are increasing global stock investments."

Write to Tae-Ung Bae at Btu104@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rally

Pension fundsNPS logs 5.8% return in Q1 led by US tech stock rallyMay 30, 2024 (Gmt+09:00)

1 Min read -

Artificial intelligenceNvidia beats Tesla to emerge as top foreign stock held by Koreans

Artificial intelligenceNvidia beats Tesla to emerge as top foreign stock held by KoreansMay 30, 2024 (Gmt+09:00)

1 Min read -

-

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery shares

Pension fundsNPS loses $1.2 bn in local stocks in Q1 on weak battery sharesApr 21, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketForeign buying of Korean stocks hit record high in Q1

Korean stock marketForeign buying of Korean stocks hit record high in Q1Mar 31, 2024 (Gmt+09:00)

3 Min read

Comment 0

LOG IN