Food & Beverage

Orion seeks M&As, facility expansion with dividends from China, Vietnam

Profits from overseas businesses will be reinvested in relevant countries first and extra money will be repatriated, Hur says

By Aug 26, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX in merger talks with Naver’s online reseller Kream

Orion Holdings Corp., a leading South Korean confectionery and snack maker, has been active in overseas markets for decades, particularly in China and Southeast Asia.

In 1995, it built its first Chinese affiliate, Pan Orion Corp. In Vietnam, Orion operates two factories — one in Hanoi and the other in Ho Chi Minh City.

The company’s efforts have led to business growth in target countries and decent dividends.

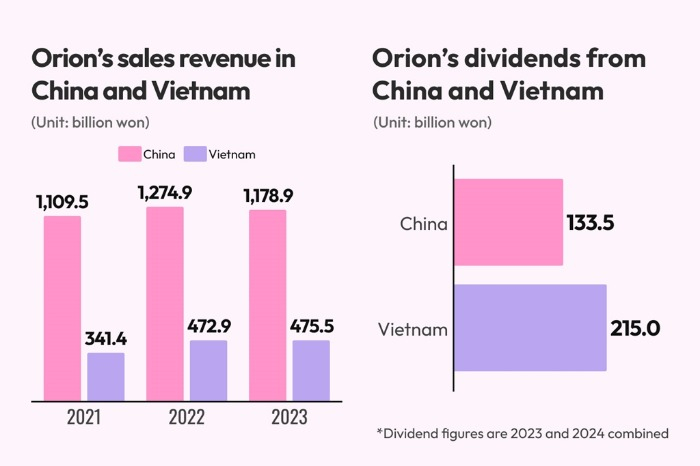

Last month, the snack maker’s flagship unit, Orion Corp., was paid out 133.5 billion won ($101 million) in its first dividend by Pan Orion since the launch of the Chinese affiliate.

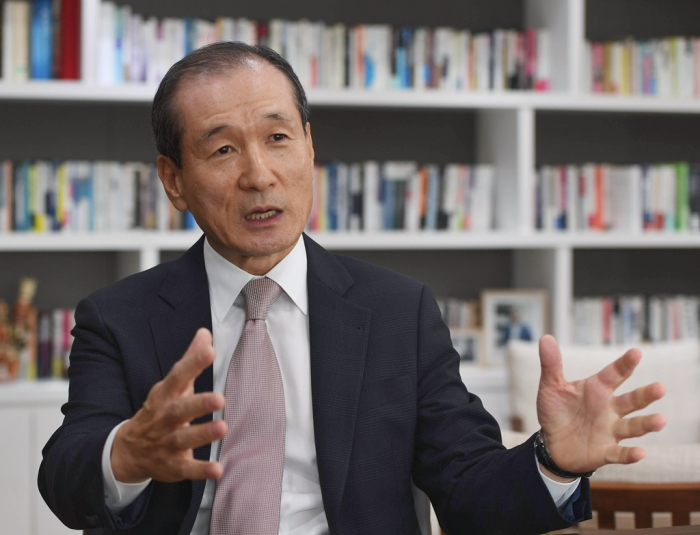

“We are now posting over 200 billion won in operating profit and 1.2 trillion won in sales annually from our Chinese business. Our facility investment in China has been completed, meaning we expect a steady stream of dividends from China,” Orion Holdings Vice Chairman and Chief Executive Hur In-cheol told The Korean Economic Daily in a phone interview.

Orion is already receiving dividends from its Vietnamese unit.

Orion Food Vina Co., the Korean snack maker's wholly owned subsidiary in Vietnam, paid 111.2 billion won in annual dividends to Orion Holdings in 2023. The Vietnamese unit is expected to pay 103.8 billion won in dividends this year, including 41.5 billion won in interim dividends already paid in April.

Orion Holdings expects 348.5 billion won in total dividends from China and Vietnam in 2023 and this year.

FACILITY EXPANSION IN KOREA

Hur said Orion plans to use dividends from overseas units to expand its main facility in Jincheon, Korea.

The company plans to build a new packaging plant and a logistics center in Jincheon, breaking ground on these facilities as early as this year.

“Our goal is to move the Gyeonggi Ansan packaging plant and Suji logistics center to Jincheon to integrate the production, packaging and logistics bases and increase efficiency,” said the vice chairman.

He said Orion Holdings also plans to steadily increase its dividend payment ratio. In February, the company said it is raising its dividend payout by 20% this year over last year.

M&A EFFORTS

The company is also vigorously pursuing mergers and acquisitions.

Earlier this year, it acquired a controlling stake in LegoChem Biosciences Inc., a Korean biotech startup, for 548.5 billion won in its foray into the biopharmaceuticals segment.

After the acquisition, Orion changed the biotech firm’s name to LigaChem Biosciences Inc.

“In our mainstay food, snack and confectionery businesses, we’re actively looking for M&A targets. If a good opportunity comes up, we will review a takeover,” he said.

Best known for its signature snack cake Choco-Pie, Orion has largely been active in Asian markets.

OVERSEAS FOCUS ON INDIA, US

The vice chairman said the company’s current overseas business focus is on India.

Orion built a production plant in Rajasthan, a state in northwest India, in 2021 and is ramping up its facilities there to meet growing Indian demand for Choco-Pie and other snacks.

“If we make money from our overseas branches, we will spend in the relevant country first and then invest extra profit from the country into Korea for facility expansions, shareholder returns and new businesses,” he said.

The vice chairman said he is also considering building a plant in the US, where Orion’s sales are growing rapidly.

Orion’s Turtle Chips, known as Kkobuk Chips in certain regions including in Korea, and Choco Songi are particularly popular among teens in the US, he said.

US sales of Turtle Chips are expected to surpass 20 billion won this year, up from 12 billion won in 2023.

“If a single product’s annual sales go above 40 billion, we’ll need a local factory to produce it there,” he said.

Write to Sul-Li Jun at sljun@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Food & BeverageKorea’s Orion to ship bottled water to China to challenge Evian

Food & BeverageKorea’s Orion to ship bottled water to China to challenge EvianApr 12, 2024 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsOrion to buy control of biotech startup LegoChem for $415 mn

Mergers & AcquisitionsOrion to buy control of biotech startup LegoChem for $415 mnJan 15, 2024 (Gmt+09:00)

3 Min read -

Food & BeverageSnack maker Orion earns dividends from Vietnam for 1st time

Food & BeverageSnack maker Orion earns dividends from Vietnam for 1st timeSep 07, 2023 (Gmt+09:00)

1 Min read -

-

Bio & PharmaOrion enters China’s vaccine market with tuberculosis plant in Jining

Bio & PharmaOrion enters China’s vaccine market with tuberculosis plant in JiningJul 13, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN