Earnings

Shinhan Financial’s overseas business blooms, on track for record earnings

Shinhan’s Vietnamese unit, in particular, continued to deliver robust lending growth despite headwinds from US tariffs

By Apr 28, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Shinhan Financial Group Co., South Korea’s leading financial holding company, is poised to surpass 1 trillion won ($692 million) in annual net profit from its global operations as the banking giant continues its aggressive expansion beyond its home market.

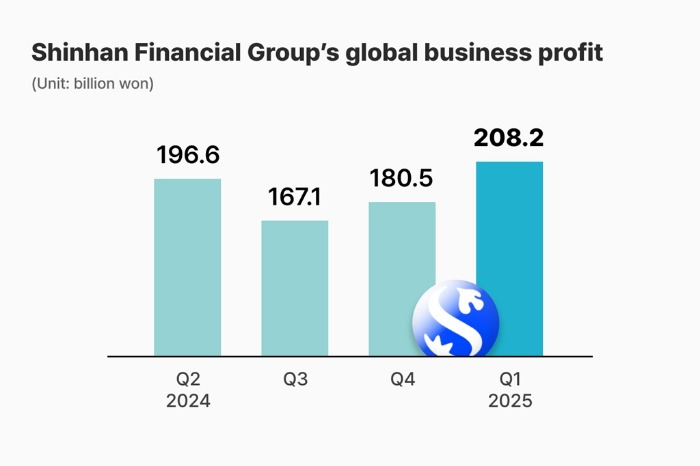

Industry data showed on Monday that the group posted 208.2 billion won in net profit from overseas businesses in the first quarter – its second-highest quarterly result after a 214.7 billion won profit in the first quarter of 2024.

Adjusted for a 20 billion won reversal of loan loss provisions booked last year, the latest figure marks Shinhan’s strongest quarterly performance from pure operations at its overseas businesses.

Shinhan Financial Group offers various financial services ranging from banking to life insurance, non-life insurance, securities, credit card services and asset management.

VIETNAM’S STRONG SHOWING

Solid results from key markets, including Japan, Vietnam and Kazakhstan underpinned the group’s decent performance.

Shinhan’s Vietnamese unit, in particular, continued to deliver robust lending growth despite headwinds from US tariffs that have weighed on the local economy.

Net profit from Vietnam rose 12.9% on-year to about 70 billion won in the first quarter.

This performance strengthens Shinhan’s ambition to generate more than 1 trillion won in overseas net profit this year – a target set by Group Chairman Jin Ok-dong earlier this year.

The group plans to deepen its overseas footprint through business activities at new subsidiaries and strategic equity investments to diversify its source of earnings from Korea’s saturated interest income market.

Jin’s recent trip to Uzbekistan, where Shinhan is laying the groundwork for expanded local operations, reflects the group’s proactive global strategy.

IMPROVING DOMESTIC SERVICES FOR FOREIGN RESIDENTS

Shinhan is also ramping up its domestic efforts to serve Korea’s growing foreign resident population, viewing it as a launchpad for future global customer loyalty.

In September 2024, Shinhan unveiled a non-face-to-face check card issuance service for foreigners.

Earlier this month, Korea’s financial regulator, the Financial Services Commission, designated Shinhan’s accounts and cards dedicated to foreign workers’ overseas remittances as innovative financial services.

Shinhan plans to open a second foreign-specific branch in Doksan-dong, Seoul, next month.

It will also launch a credit loan service exclusively for foreigners as early as the third quarter of this year.

In addition, Shinhan is working hard to attract foreign customers by operating a digital lounge where foreign language video consultations are available, creating a marketing organization dedicated to foreigners, and offering an on-site account opening service.

Write to Jin-Seong Kim at jskim1028@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Banking & FinanceShinhan Bank partners with Hyundai Mobis for loan services to suppliers

Banking & FinanceShinhan Bank partners with Hyundai Mobis for loan services to suppliersMar 16, 2025 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomMicrosoft CEO Nadella seeks AI alliance with Hyundai, POSCO, Shinhan, KT

Tech, Media & TelecomMicrosoft CEO Nadella seeks AI alliance with Hyundai, POSCO, Shinhan, KTFeb 11, 2025 (Gmt+09:00)

2 Min read -

EarningsShinhan Bank reclaims top spot as S.Korea’s leading lender

EarningsShinhan Bank reclaims top spot as S.Korea’s leading lenderFeb 07, 2025 (Gmt+09:00)

2 Min read -

Corporate investmentShinhan, POSCO invest $20 mn in Australian hydrogen startup Hysata

Corporate investmentShinhan, POSCO invest $20 mn in Australian hydrogen startup HysataMay 10, 2024 (Gmt+09:00)

2 Min read -

Banking & FinanceShinhan Financial chief in Europe to meet with BNP Paribas, investors

Banking & FinanceShinhan Financial chief in Europe to meet with BNP Paribas, investorsJun 08, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN