Big Hit kicks off IPO as BTS single 'Dynamite' blows up Billboard

By Sep 02, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX in merger talks with Naver’s online reseller Kream

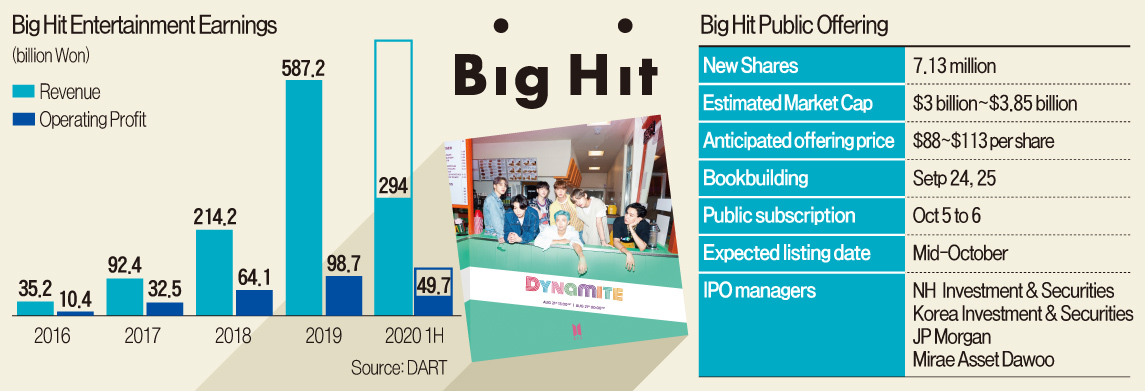

The company kicked off the IPO process submitting a statement of registration to the Financial Services Commission (FSC) on September 2. Big Hit's market cap is estimated to reach 3.7 to 4.8 trillion won ($3.1 to $4 billion) upon listing. If the offering price is fixed at the higher end of the price band then it will propel Big Hit to land between 50th and 60th place on the country's main bourse KOSPI.

Bookbuilding for institutional investors will be held in mid-September alongside a non-contact overseas deal roadshow. Public subscriptions will be held at the end of September. The company is aiming to make its trading debut on the KOSPI in October.

Big Hit is home to BTS, the global boy band sensation that yesterday (Sept. 1) became the first Korean artist or group to reach the No. 1 spot on the Billboard Hot 100 list with "Dynamite." Riding on BTS's success, Big Hit has become the leading player in the domestic entertainment industry.

Some predict that its enterprise valuation may eventually climb to 6 trillion won following the IPO. This is around fivefold the individual market caps of leading Korean entertainment companies, including SM Entertainment (870 billion won), JYP Entertainment (1.3 trillion won), and YG Entertainment (900 billion won).

Big Hit has positioned itself as a content company applying P/E ratios of 80 times in line with content platform giants such as Netflix and Korea-based production company Studio Dragon. The BTS label has increased the revenue portion of its content-related businesses, such as intellectual property and video streaming, following the success of in-house artists.

“Big Hit’s enterprise valuation would be around 3 trillion won if a P/E ratio of 30 to 40 times is applied, in line with other entertainment companies,” said a source from the investment banking industry. The company’s high P/E ratio is likely owing to BTS’s ascension as a global cultural icon.

There have been mixed views regarding the label’s high enterprise valuation, in particular concerns that the company relies too heavily on BTS and lacks diversification.

In 2019, the company posted a record-high turnover of 587.2 billion won ($491 million) and an operating profit of 98.7 billion won. Big Hit's operating profit was higher than the combined profits of SM, JYP, and YG, all listed on the country’s junior KOSDAQ market. BTS was credited with pulling in about 500 billion won in revenue for the year.

Big Hit addressed the concerns head-on by launching the IPO process in sync with BTS’s latest success in the US, which include topping the Billboard chart and taking home four trophies from the 2020 MTV Video Music Awards.

The company has shown efforts to diversify its portfolio by acquiring management rights for Pledis Entertainment, which manages boy bands such as Nu’Est and Seventeen. The company has also tapped into the gaming industry rolling out a mobile game using images and videos featuring BTS members.

The company posted 294 billion won in revenue with an operating profit of 49.7 billion won during the first half of 2020, according to Big Hit during an August 13 online briefing.

Big Hit's H1 earnings amount to nearly half of its 2019 earnings, indicating that the company's business remains solid despite the global coronavirus leading to cancellations in overseas tours and promotions.

Meanwhile, the company is projected to post record-high earnings in 2021 with an estimated revenue of at least 750 billion won and an operating profit of over 150 billion won, according to the securities industry.

Founded in 2005, the company’s founder and chief executive officer Bang Si-hyuk is the biggest shareholder with a 45.1% stake. Korean game company Netmarble is the second-biggest shareholder with a 25.22% stake. Other majority shareholders include local private equity firm STIC Investments with a 12.24% stake, and China-based VC Legend Capital.

Big Hit's investors are likely to pocket gains in the hundreds of billions of won given that Netmarble and STIC Investments got in when the company's enterprise valuation was around 800 billion won. The company's executives and employees have been granted 31,000 shares in stock options with an exercise price of 17,000 won per share.

NH Investment & Securities, Korea Investment & Securities, and JP Morgan are the lead IPO managers. Mirae Asset Daewoo has also participated as a joint manager.

Write to Ye-jin Jun at ace@hankyung.com

Danbee Lee edited this article

-

Woori Financial wins approval for Tongyang, ABL Life acquisition

Woori Financial wins approval for Tongyang, ABL Life acquisitionMay 02, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansion

Mergers & AcquisitionsCJ CheilJedang scraps $3.5 bn green bio sale, shifts gears to expansionApr 30, 2025 (Gmt+09:00)

-

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demand

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demandApr 30, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to Bunge

Mergers & AcquisitionsCJ CheilJedang scraps sale of Brazilian unit CJ Selecta to BungeApr 29, 2025 (Gmt+09:00)

-

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 million

Mergers & AcquisitionsLG Chem to sell water filter business to Glenwood PE for $692 millionApr 28, 2025 (Gmt+09:00)