Batteries

Once a videotape maker, Cosmo reborn as battery materials firm

Its 2023 operating profit is forecast to soar 70.4% on-year to a new record high

By Mar 15, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

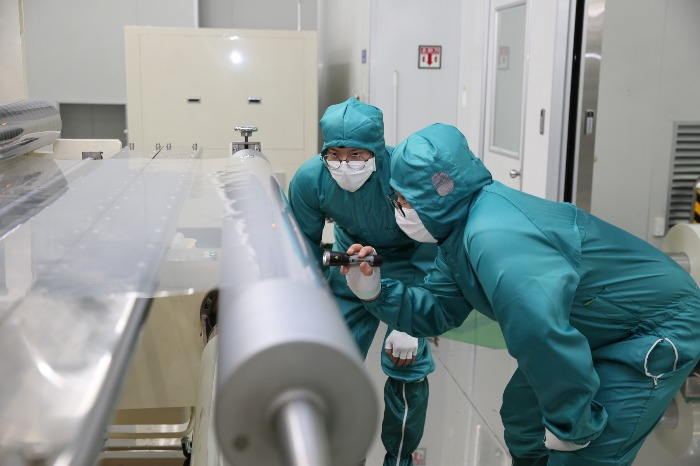

Cosmo Advanced Materials & Technology Co., once the world’s largest video and cassette tape maker, has transformed into a money-making manufacturer of cathode materials used for rechargeable batteries.

After several years of losses, it posted record-breaking earnings both in 2021 and 2022, lifting its enterprise value by market capitalization about twentyfold in three years.

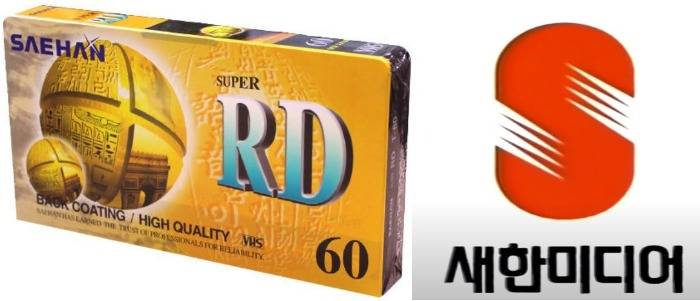

Cosmo, formerly known as Saehan Media Co., reported a 49% surge on-year to a record 32.5 billion won ($25 million) in operating profit in 2022. Sales jumped 59% to a record 485.6 billion won.

This year, its operating profit is projected to shoot up 70.4% on-year to 55.4 billion won, according to a consensus forecast.

Based on its current share price, the company is valued at 3 trillion won, sharply higher than 145 billion won in 2020, at the height of a liquidity crunch for the company.

Cosmo was established in 1967 by Lee Chang-hee, the deceased second son of the late Samsung Group Founder Lee Byung-chul.

Hit by the shrinking magnetic tape market, the company faced a severe liquidity shortage and applied for a debt workout program in May 2005.

Five years later, it was acquired by South Korea’s Cosmo Group, spun off from GS Group.

Renamed Cosmo Advanced Materials & Technology, it has successfully transformed into a rechargeable battery materials supplier.

Cosmo Group is led by Chairman Huh Kyung-soo, grandson of the late GS Group Founder Huh Man-jung and the eldest son of GS Retail Co.’s Honorary Chairman Huh Shin-koo.

Between 2012 and 2015, Cosmo Advanced again fell into a liquidity crunch, on the back of heavy borrowings for facility investments, leading to straight operating losses.

But it managed to stay afloat after a private equity firm took it over and sharpened its competitiveness in cathode materials, a key ingredient of rechargeable batteries.

Thanks to the rapid growth in the electric vehicle market, it swung to the black in 2016 and was sold back to its parent Cosmo Group in 2019.

Cosmo Advanced’s cathode materials are used primarily for NCM batteries embedded into energy storage systems.

NCM batteries are composed of lithium, nickel, cobalt and manganese. They feature higher energy density, or longer battery run time, compared with lithium iron phosphate (LFT) batteries.

Cosmo is currently developing cathode materials for EV batteries to diversify its product portfolio.

Its share price has almost doubled year-to-date and hit a record high of 107,200 won on March 10.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Yeonhee Kim edited this article

More to Read

-

AutomobilesBMW surpasses Mercedes in Korean sales for 1st time in 10 years

AutomobilesBMW surpasses Mercedes in Korean sales for 1st time in 10 yearsMay 02, 2025 (Gmt+09:00)

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

Comment 0

LOG IN