Upcoming IPOs

LB Investment draws record demand in IPO bookbuild

The conservative valuation and low free float are creating strong interest in the VC company's IPO

By Mar 16, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

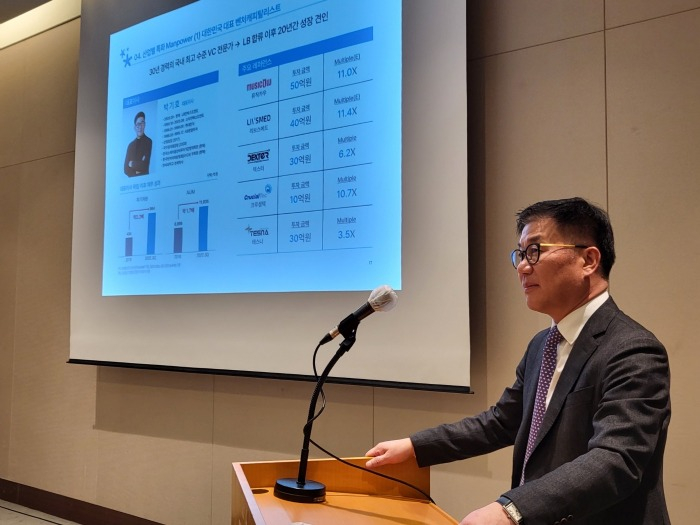

LB Investment Inc., formerly known as LG Group’s venture capital arm, has attracted the most orders ever for an initial public offering of a South Korean VC firm, pricing its final offer price at the top of its indicative range.

The 23.6 billion won ($18 million) IPO was oversubscribed 1,298.4 times during the March 13-14 bookbuilding process, the company said on Thursday.

It marked the highest ever level of oversubscription for a domestic VC firm in history. It also became the first VC company to be oversubscribed more than 1,000 times in South Korea.

Among the 1,321 institutions participating in the bookbuilding, 94% have placed bids at the top end of the 4,400-5,100 won range or above, according to people with knowledge of the matter.

Based on the final offer price, its market capitalization is estimated at 118.4 billion won after its debut on the junior Kosdaq market.

CONSERVATIVE VALUATION

The venture capital industry has been out of favor in the domestic stock market of late due to its high vulnerability to economic cycles.

But LB Investment’s lower-than-expected valuation and free float have drawn strong demand from investors keen on small-to-mid-cap stocks.

Its IPO size is small relative to its assets under management in excess of 1 trillion won. The free float ratio of just 19.9% has eased investor concerns of possible heavy sell-offs following its stock market listing.

LB Investment used its book value as a valuation yardstick, unlike its domestic peers that sought to price their shares based on earnings at the height of the stock market boom.

It will pour the proceeds into new investments.

Its stable ownership structure was another appealing factor, an investment banking source told Market Insight, the capital market news outlet of The Korea Economic Daily.

Founded in 1996, it is wholly owned by LB Corp., spun off from LG Group.

LB Investment will receive retail subscriptions between March 20 and 21 before making its stock market debut on March 29. Mirae Asset Securities Co. is underwriting the IPO.

Two other Kosdaq-listed VC firms -- Daol Investment Co. and Stonebridge Ventures Inc. -- saw their IPO shares oversubscribed just 50 times and 20 times, respectively.

Write to Seok-Cheol Choi at dolsoi@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Korean startupsKorea's StoneBridge Ventures invests $91 mn in semiconductor, AI

Korean startupsKorea's StoneBridge Ventures invests $91 mn in semiconductor, AIMar 09, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsWoori Financial to acquire VC firm Daol Investment

Mergers & AcquisitionsWoori Financial to acquire VC firm Daol InvestmentJan 18, 2023 (Gmt+09:00)

2 Min read -

Corporate restructuringKorea’s Daol to sell another unit to secure liquidity

Corporate restructuringKorea’s Daol to sell another unit to secure liquidityJan 06, 2023 (Gmt+09:00)

2 Min read -

Venture capitalDaol Financial Group to let go of VC affiliate, hit by liquidity crunch

Venture capitalDaol Financial Group to let go of VC affiliate, hit by liquidity crunchDec 06, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN