Travel & Leisure

Korean convention sector enjoys increase in events post-pandemic

Major convention centers are expected to recover pre-COVID-19 profits this year after turnaround in 2022

By Mar 10, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

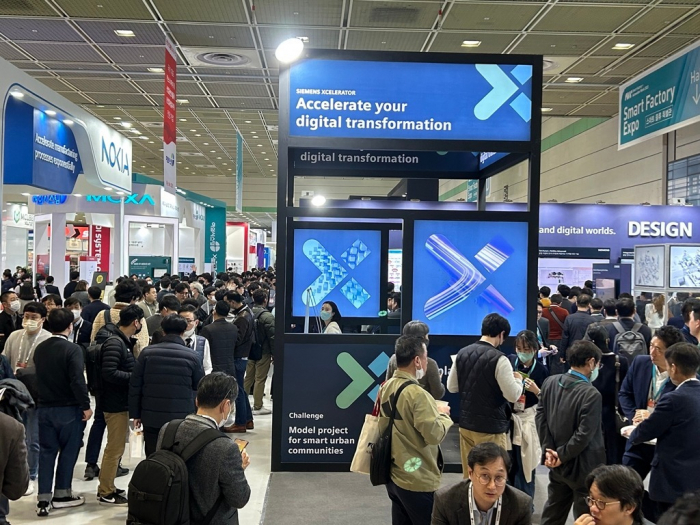

Coex Convention & Exhibition Center, the largest event complex in Seoul, was crowded on Friday for a smart factory and plant automation fair.

“We already met the visitor target yesterday,” said Choi Tae Neung, a business manager for the South Korean unit of Rockwell Automation Inc., a US industrial automation technology company that set up a booth there. “The mood is completely different from before.”

The trade show, which started March 8, has already attracted some 60,000 visitors, almost double some 34,000 spectators last year, according to Coex. A home furniture exhibition last month lured some 150,000 visitors, about triple some 50,000 last year, to the event complex in Seoul's upscale Gangnam district.

The South Korean convention industry is reviving as the local authorities lifted most restrictions against COVID-19 as the disease is expected to become an endemic.

TURNAROUND

Coex was estimated to have turned to the black with an operating profit of 3 billion won ($2.3 million) based on sales of 80 billion won last year, according to industry sources. It suffered operating losses of 8.1 billion won in 2020 and 2.7 billion won in 2021, respectively, compared with a profit of 3.8 billion won in 2019 before the outbreak of COVID-19.

Other major convention centers in the country – Korea International Exhibition Center (Kintex), Busan Exhibition and Convention Center (Bexco), Exco and Kim Dae Jung Convention Center (KDJ Center) – were also expected to have logged profits last year for the first time since 2019.

The convention industry suffered one of the worst downturns during the pandemic period when the government imposed social distancing measures.

“The travel industry found some support from demand for domestic trips, but we had no choice but to cancel exhibitions,” said a convention sector source. “Convention halls, as well as related companies such as agencies, equipment providers and event planners all had difficulty making a living.”

In 2020, 249 exhibitions, about half of the planned 537 shows, were canceled and the rest failed to attract the targeted number of visitors. The convention industry was estimated to have logged a loss of 1.7 trillion won that year, according to the Association of Korean Exhibition Industry.

“The estimate was based on a simple calculation by dividing the total sales of 4.5 trillion won in 2019 by the number of cancelations in 2020,” said an official at the association. “The actual damage would have been much greater than this.”

To help the entire industry, convention centers such as Coex refunded 60% of lease penalties and froze rents, suffering sharp drops in their sales in 2020 and 2021.

NETWORKING IS IMPOSSIBLE IN THE METAVERSE

The convention industry has been recovering since the government began easing COVID-19 restrictions in the second half of last year. Café Show Seoul, which opens every November, attracted some 120,000 visitors with about 600 companies participating last year. In 2020, only 397 exhibitors brought in some 70,000 spectators.

The recovery came as the industry gives customers a chance to see products in real life, as well as touch and experience items in person, which the rapidly growing metaverse cannot offer.

“Foreign buyers prefer to see products with their own eyes and directly order them,” said Yoon Seung-ji at the smart factory and plant automation fair, adding that more overseas companies took part in the event after COVID-19. Yoon has been participating in the trade show for three years.

The convention sector also creates chances for networking, which the metaverse hardly provides, industry sources said.

“Gatherings of people from an industry and related sectors often establish networks to exchange ideas,” said Coex CEO Lee Dong-Ki.

The industry, which recovered about 90% of its pre-COVID-19 earnings in 2022, is expected to recoup all of its pre-pandemic profits this year.

Coex was known to have set up a business plan for 2023 with an aim to raise sales to 90 billion won, which is higher than revenue of 86.5 billion won in 2019.

Write to Jae-Fu Kim at hu@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN