The KED View

Windfall tax on Korean banks to create quintuple burden

The country’s main opposition party has proposed taxes up to 40% on banks’ excess profits

By Nov 16, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

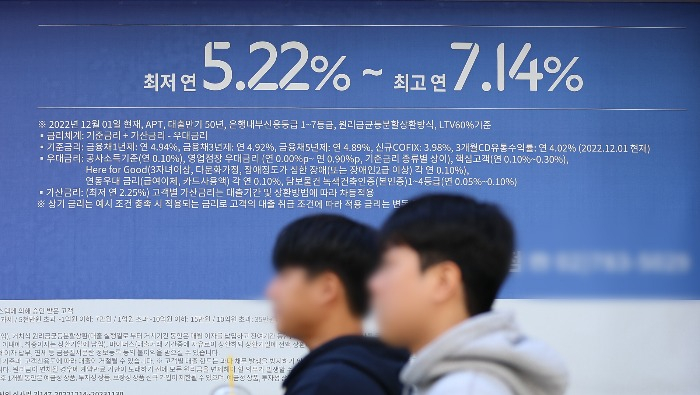

Koreans are piqued by banks raking in extraordinarily handsome profits and handing out generous bonuses amid the high-interest rate environment that has caused suffering to so many.

As big commercial lenders in South Korea are even guarded against free market competition by high entry barriers due to the government’s bank licensing system, and they can also tap public funds in emergencies, banks are under increasing criticism for greedily taking in profits by lending at high interest rates without sharing the spoils with the lesser off.

Such circumstances, however, do not justify the sudden windfall tax call by the country’s main opposition Democratic Party about six months before the country’s general election next year.

The party has proposed a bill to require banks to cough up maximum 40% of a bank’s net interest income exceeding 120% of the past five years’ average as part of their social contributions for the good of all.

But they can’t be disguised as social contributions. They are outright taxes, windfall taxes that will create a double, triple or even quintuple burden on banks’ shareholders.

KOREAN SHAREHOLDERS ALREADY TAXED TWICE

Corporate taxes are eventually paid out of shareholders’ pockets.

When a company is levied for income, it first pays the tax out of gains, which are also funds to pay dividends to its shareholders later.

But considering that dividend income is also subject to 15.4% tax in Korea, local corporate shareholders are taxed twice while the corporation pays income tax only once.

On top of that, the shareholders of large Korean conglomerates are also subject to heavier taxes due to the country’s surtax system in corporate income taxation.

Companies earning 300 billion won ($229.4 million) and more in operating profit are subject to 24% corporate tax each in Korea, three times higher than the lowest corporate tax rate of 9% for smaller companies.

Most countries have more simplified corporate tax rates like a flat rate or two tax rates. Only three out of 38 countries – including Korea – impose corporate taxes based on three or more tax rates.

Many countries have a simple corporate tax rate to bolster corporate investment by easing the tax burden.

The US in 2018 changed its federal corporate tax rate to a flat 21% from the previous surtax system tiered by eight rates from the highest 35% to the lowest 15%.

Since the change, the world’s biggest economy has recorded the highest growth rate among the Group of Five (G5) nations.

The global bestselling economics textbook “Principles of Economics” by N. Gregory Mankiw explains why this works, saying that corporate tax reduction has positive trickle-down effects on the broad economy from stock trading, investment, productivity and wages to consumer welfare.

Considering that corporate shareholders are already subject to different tax rates based on their income, the windfall tax would further increase their tax burden.

A TAX CUT TO BE BETTER OFF

Social contributions and taxes are two separate issues so they should not be treated the same.

If the government levies companies or industries for bumper profits from a one-off event or extraordinary economic conditions, nearly all companies and industries will be slapped with heavier taxes.

Even Samsung Electronics Co. could not be free from extra taxes for its windfall gains from the suspension of its foundry rival Taiwan Semiconductor Manufacturing Company Ltd.’s factory affected by natural disasters.

There is no doubt that the Democratic Party’s windfall tax idea has been derived from the Robin Hood Effect policy, which seeks to redistribute wealth from the rich to the poor for wealth equality.

The notion describes capital as the greedy villain and politicians as the apostles of justice that protect the less fortunate.

But Robin Hood's measures in the past failed to promote economic equality in our society.

Instead, history tells how such taxation had caused some nations and states to collapse, including the Roman Empire and the Islamic Empire.

Fast-forward to today: Argentina and Venezuela with effected hefty punitive taxation are teetering on the brink of bankruptcy.

The late US President John F. Kennedy said, “It is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise tax revenues in the long run is to cut tax rates now.”

It is a time for a tax cut now to be better off in the long run.

Write to Seong-Min Yoon at smyoon@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EarningsKB Financial beats profit forecast on higher interest rates

EarningsKB Financial beats profit forecast on higher interest ratesOct 24, 2023 (Gmt+09:00)

2 Min read -

EarningsS.Korea’s Woori Financial profit up on interest rate margins

EarningsS.Korea’s Woori Financial profit up on interest rate marginsApr 25, 2023 (Gmt+09:00)

1 Min read -

EarningsKorea refiners swing to Q4 loss amid windfall tax calls

EarningsKorea refiners swing to Q4 loss amid windfall tax callsFeb 07, 2023 (Gmt+09:00)

2 Min read -

Comment 0

LOG IN