The KED View

Four chip alliance: S.Korea's courage to overcome Chinaphobia

Seoul has been walking a tightrope between the US and China, but it's time to take a stern stance against China's threats

By Aug 09, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

“I'm gonna make him an offer he can’t refuse.”

Ahn Cheol-soo, a senior lawmaker of South Korea’s ruling People Power Party, cited the line from The Godfather to describe the US' proposal to form a four-country chip alliance with South Korea, Japan and Taiwan.

In referencing the iconic quote, the founder of the country’s first antivirus software company cut straight to the heart of the matter. The offer from Don Corleone, the leader of the Corleone crime family in the 1972 film, must be accepted on two accounts: to prove loyalty to the family and to avoid being killed.

The US-led four-country chip supply chain alliance is touted as a global semiconductor ecosystem to strengthen the country's collaboration in the semiconductor industry.

Their alliance will connect the original chip design technology from the US with Japan’s semiconductor materials and equipment, alongside the manufacturing capabilities of South Korea and Taiwan.

Decoupling from such an alliance might mean abandoning the semiconductor business.

The four countries are still in their early stages of discussion. But Washington seems determined to leverage the alliance to fill the void in the US semiconductor manufacturing sector laid bare by the COVID-19 pandemic while isolating China.

The US Senate’s passage last week of a $280 billion bill to revive the US manufacturing and technological prowess underscored the US policy efforts in that respect.

The vast semiconductor and science bill, dubbed the CHIPs and Science Act, includes strict new guardrails for firms considering expanding into China.

Chip manufacturers that want to take US subsidies and tax credits cannot make new investments in “countries of concern” for at least a decade to produce chips with 28-nanometer circuits or smaller.

The measures take aim at China. The 28 nano or smaller processing nodes encompass almost all chip production lines.

The launch of the four-country chip alliance would be a game changer in the battle for technological supremacy with China.

Chip manufacturing remains the Achilles’ heel for China, the world’s largest manufacturing country.

Keeping China shifting to the advanced fabrication process for 10 nano chips or below will likely put a significant dent in its ambitions of nurturing high-tech industries such as communications and robotics.

In its efforts to upgrade its chip technology, China may scramble to poach chip talent from other countries. Further, it may exert pressure on South Korea, the only country that has yet to confirm its participation in the chip alliance.

While Seoul is walking on a tightrope between Washington and Beijing, China has been pushing South Korea harder not to join the US-led group, dubbed Chip 4.

Last month, China’s state-run English newspaper Global Times said in an editorial that South Korea should have the courage to say “no” to the US-led chip alliance.

The daily also warned that decoupling from China, South Korea’s largest market for semiconductor chips, is akin to commercial suicide.

Such threats can not be played down, since China accounts for 60% of South Korea’s semiconductor exports, including those shipped via Hong Kong.

China’s import restrictions on South Korea in retaliation for the deployment of Terminal High Altitude Area Defense (THAAD) remain in place. The urea supply crisis in 2021 caused by China’s delay in its exports is a reminder of China’s influence over the South Korean economy.

The relationship between South Korea and China is entering a new chapter as they mark the 30th anniversary of establishing diplomatic ties on Aug. 24. But the so-called Season 2 of their relations faces a bumpy road ahead.

Escalating tensions between the US and China signal increasing friction between China and South Korea.

Once Seoul normalizes the THAAD missile system operation, China could exercise more influence over South Korea, reminiscent of their vertical relationship sustained for the better part of thousands of years.

However, South Korea must overcome its fears of any possible retaliation from China.

Last week, President Yoon Suk-yeol skipped a meeting with US House Speaker Nancy Pelosi in Seoul due to him taking a one-week vacation, a decision seemingly made to reflect concerns of triggering a backlash from Beijing.

Unless such fears are overcome, Seoul’s policy efforts to reduce its economic dependence on China appears an empty promise.

Now all eyes are on Foreign Minister Park Jin’s meeting with Chinese counterpart Wang Yi today and Seoul’s follow-up measures.

But in the end, it is the nation's citizens who hold the key to the government policy direction.

Ushering in a new chapter of South Korea-China ties, we need to stop being indecisive and take a stern stance on future conflicts with China.

Write to Seong-Min Yoon at smyoon@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Korean chipmakersS.Korea edges closer to joining US-led chip alliance

Korean chipmakersS.Korea edges closer to joining US-led chip allianceAug 02, 2022 (Gmt+09:00)

long read -

Business & PoliticsBiden and leaders of Japan and South Korea pledge greater cooperation

Business & PoliticsBiden and leaders of Japan and South Korea pledge greater cooperationJul 06, 2022 (Gmt+09:00)

4 Min read -

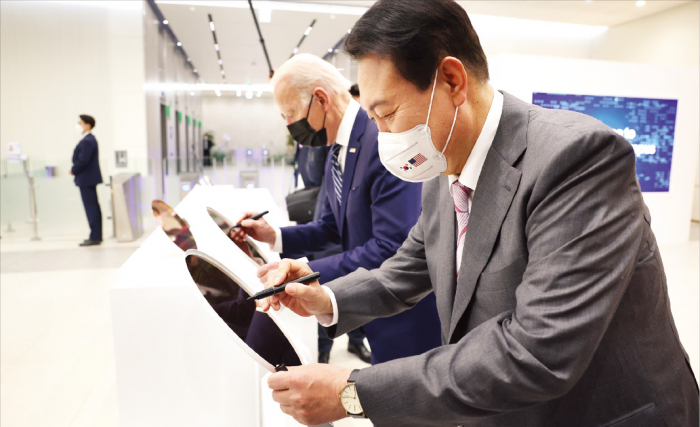

Business & PoliticsYoon, Biden highlight 'economic security alliance' following Samsung tour

Business & PoliticsYoon, Biden highlight 'economic security alliance' following Samsung tourMay 20, 2022 (Gmt+09:00)

5 Min read

Comment 0

LOG IN