S.Korea’s love of luxury ushers in 3rd wave of bling boom

South Korea’s luxury market grew 24% on-year to $16.8 billion in 2022, in contrast to a 10% slump in China

By Feb 09, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Global luxury brands from Louis Vuitton to Chanel and Thom Browne are readying themselves for a third wave of the luxury boom in South Korea, where their sales proved even more resilient during the pandemic than China.

South Korea's craze for luxury handbags, clothes and jewelry has heated up since COVID-19 struck, undeterred by global brands’ frequent and drastic price hikes.

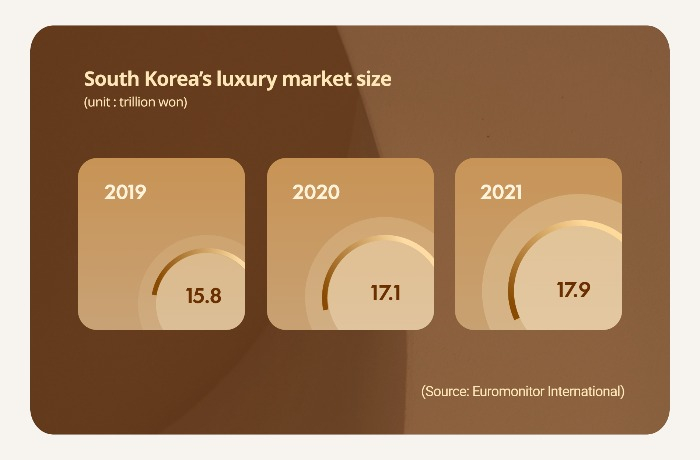

In 2022, the luxury market in the world’s 10th-largest economy expanded 24% on-year to $16.8 billion, ranking seventh in terms of sales.

That contrasted with a 10% decline in China’s high-end goods market last year, which marked its first year-on-year contraction in five years.

Riding on the sales growth, high-end brands are returning to Korea, about five years after they flooded into China. Since 2021, nine fashion designer brands have opened branches in Korea.

This year, Italy’s Only The Brave, or OTB Group, and American fashion designer house Thom Browne are ending contracts with domestic retailers to directly manage Korean outlets.

OTB -- better known for Maison Margiela and Jil Sander brands -- as well as Thom Browne, are now recruiting Korean employees to open boutiques.

Such trends signal a new phase of growth in the country’s luxury goods market, after it opened the doors to luxury imports in the late 1980s.

Louis Vuitton, Chanel and Hermes were among the first-generation luxury brands introduced in the country. They opened shops in Seoul in the 1990s.

The second wave of the luxury boom in Korea occurred in the mid-2000s, when designer bags, clothes and watches began attracting middle-class consumers.

ASIA HUB

Now South Korea has replaced Hong Kong and Japan as the Asian hub of global fashion houses.

Burberry and Bottega Veneta have authorized their Korean heads to take charge of Asian operations as a whole.

Burberry saw a 23% decline in sales in China last year. By contrast, its sales in South Korea and Japan were up 10% and 28%, respectively.

The Korean offices of jewelry houses Tiffany and Boucheron are now directly reporting to their headquarters, highlighting the growing importance of the South Korean market.

In 2021, Tiffany opened a pop-up store in a Seoul department store for 5 billion won ($4 million). In its first month of business, it garnered sales of 25 billion won.

South Koreans’ luxury spending has already exceeded that of Americans and Chinese shoppers.

They spent an average of $325 on luxury items last year, compared to $280 by Americans and $50 by Chinese, according to Morgan Stanley.

Italian brands saw their exports to South Korea up 4.4% on-year in 2022, according to Il Sole 24 Ore, an Italian media outlet. Leather products, shoes, clothes and jewelry topped the list of their export items.

LEVERAGE OF K-POP

The luxury fever during the pandemic was led by those in their 20s and 30s, who opened their wallets toward high-end items amid travel restrictions.

To appeal to those younger consumers and create trendy images, fashion brands are leveraging the power of Korean idol groups such as BTS and Blackpink.

Eighteen luxury brands, including Chanel, Dior and Gucci, have appointed K-pop stars as their global ambassadors.

Some members of the Arnault family, behind Italy's luxury empire LVMH, are known to be huge K-pop fans.

Delphine Arnault, daughter of LVMH founder Bernard Arnault, named BTS’ Jimin and Blackpink’s Jisoo as global ambassadors, shortly after she became Dior’s CEO last month.

Chanel’s official ambassadors include Jennie of Blackpink, as well as G-DRAGON. She has been a Chanel ambassador since 2019.

K-pop idols have a huge fan base in Europe, Southeast Asia and South America as well.

“Fashion items Korean K-pop and TV stars have worn tend to sell out early,” said a fashion company official.

To catch up with the trend, duty free shops in Korea are preparing to open in-house idol goods stores to lure luxury brands.

NEW BRANDS ON THE WAITLIST

Other foreign brands are keen to muscle into the Korean market.

Department store officials in Seoul said they were being bombarded with requests by European embassies or their domestic agents to open new brand shops. Previously, they had little chance of meeting with foreign diplomats.

On the contrary, Korean fashion designers have not yet expanded beyond their home turf.

A fashion platform head noted their heavy reliance on K-pop and drama content for marketing, instead of building their brand identity and delivering brand value.

Write to Jeong-cheol Bae and Jong-Kwan Park at bjc@hankyung.com

Yeonhee Kim edited this article.

-

E-commerceSSG.COM joins race for top spot in luxury online shopping in Korea

E-commerceSSG.COM joins race for top spot in luxury online shopping in KoreaJul 04, 2022 (Gmt+09:00)

2 Min read -

RetailSouth Korean millennials pay premium for authentic luxury items

RetailSouth Korean millennials pay premium for authentic luxury itemsMay 31, 2022 (Gmt+09:00)

4 Min read -

Behind the ScenesSouth Koreans turned off by luxury fashion houses’ price hikes

Behind the ScenesSouth Koreans turned off by luxury fashion houses’ price hikesMay 11, 2022 (Gmt+09:00)

4 Min read -

-

The Deep DiveBehind Korea’s bizarre 'open run' race for Chanel bags

The Deep DiveBehind Korea’s bizarre 'open run' race for Chanel bagsJun 08, 2021 (Gmt+09:00)

long read