After a boom and bust, the chip industry Is regaining its health

Intel, Samsung and others see a semiconductor rebound as tech demand starts to recover

By The Wall Street Journal Nov 14, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The global semiconductor industry is bottoming out, executives say, signaling a rebound in some areas of technology and providing relief for the U.S. government, which is spending billions on expanding chip production.

In recent weeks, executives at Intel, Taiwan Semiconductor Manufacturing Co. and Samsung Electronics have expressed confidence that the worst is over for the chip industry, which had been in a prolonged slump.

South Korea-based Samsung, the world’s largest memory-chip maker, on Tuesday posted a 38% year-over-year drop in net profit for the third quarter, but it said customers were getting back to normal inventory and that production cuts had eased the supply glut. The company cited growing demand related to artificial intelligence and new personal computers and smartphones incorporating more memory as reasons for optimism.

“We think that the current recovery that we’re seeing will continue next year,” said Kim Jae-june, a Samsung memory-chip executive.

The prospect of a healthier industry is also reassuring to the U.S. government. Under last year’s Chips and Science Act, the U.S. is spending some $53 billion to promote semiconductor manufacturing, and U.S. allies including European nations, Japan and South Korea are backing their own chip industries with money or regulatory support. Those investments are built on the premise that semiconductors are a long-term growth industry.

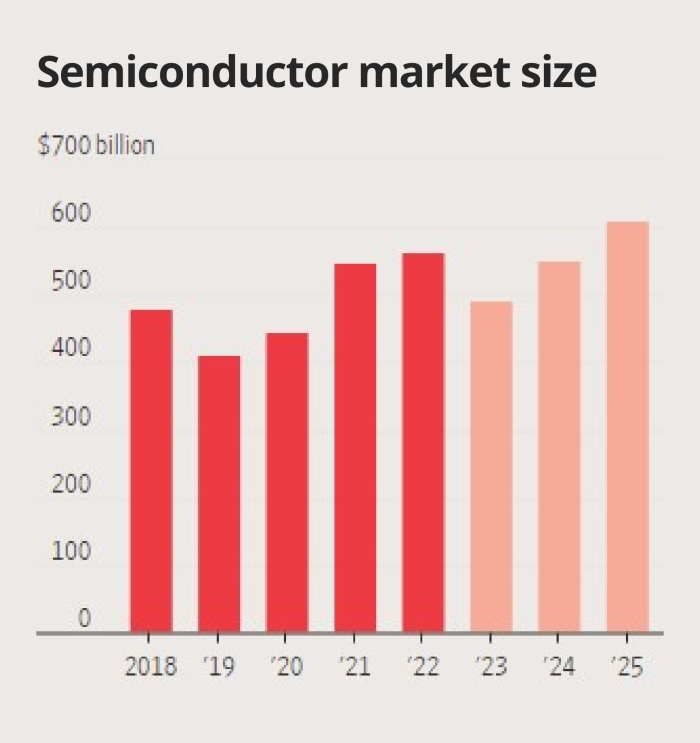

Semiconductor revenue worldwide is expected to fall by about 12% this year but rebound next year by more than 11% to roughly $550 billion, according to International Business Strategies, a chip-industry consulting firm.

The rebound would be the latest swing in an industry known for frequent boom-and-bust cycles. In the first year of the pandemic, demand soared for computers, smartphones, videogame machines and data servers that deliver streaming videos for the likes of Netflix. The result was a shortage of chips. Panic buying by chip customers fattened bottom lines even more for semiconductor makers.

The cycle shifted in early 2022 with rising inflation and the war in Ukraine among other factors. Consumers and corporate tech departments pulled back spending, and many electronics makers were left with too much inventory.

Semiconductor firms—with the exception of those closely tied to the artificial-intelligence boom, such as Nvidia—cut production, delayed investments and instituted hiring freezes and layoffs. Operating profit at Samsung hit its worst level since 2009 earlier this year.Now, nearly four years after the pandemic started, something resembling normalcy is returning, although executives caution that the recovery likely won’t be as rapid as the downturn that struck last year.

Intel Chief Executive Pat Gelsinger said in an interview that the company’s expectation of 270 million PC sales this year was on track, and that “we’re seeing very healthy behavior” going into the last quarter of the year.

Demand for PCs in the third quarter declined 7.6% year-over-year, but the rate of the annual decline has slowed, in a sign that the market is past its worst days, according to International Data Corp., a tech-market researcher.

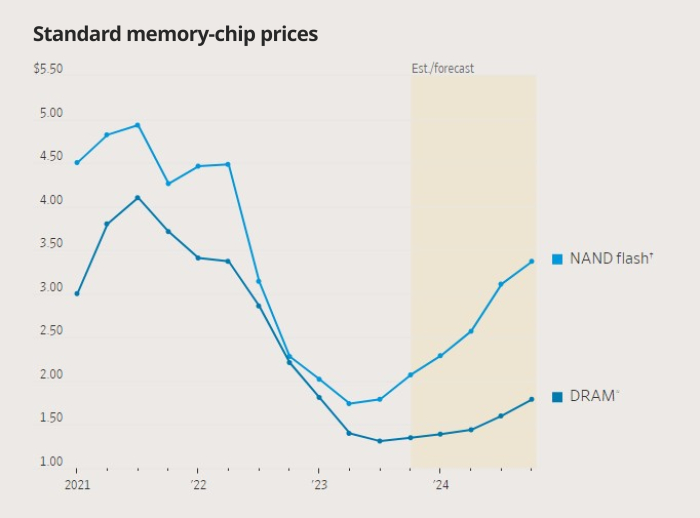

Memory chips, which are more commoditized than other types of chips, generally experienced the sharpest price falls. SK Hynix, which is No. 2 in memory chips after Samsung, said demand was reviving and its business in DRAM chips, which enable devices to multitask, swung to profitability in the July-September quarter.

Still, few executives see an immediate return to the frenzy of 2020. Smartphone demand is still weak and geopolitical tensions persist across the globe. Economic uncertainty in China could limit demand for many products, including smartphones.

Electric-vehicle sales also aren’t rising as fast as some chip makers had predicted, which is leading to a re-evaluation of short-term growth among suppliers to that industry. ON Semiconductor, which makes chips for cars, energy infrastructure and other industrial uses, saw its share price fall by nearly 22% on Monday after it pointed to signs of dampened electric-vehicle demand because of high interest rates and economic uncertainty.

“Although we had a very strong quarter in automotive, we’re starting to see signs that because of demand, inventory [of chips] is going to take longer to drain,” Chief Executive Hassane El-Khoury said in an interview.

Advanced Micro Devices, a chip maker that competes with Intel, on Tuesday gave a muted outlook for its fourth quarter, citing weakness in areas including chips used in videogaming. But the company suggested that the PC market was improving and forecast more than $2 billion of revenue from its advanced AI chips next year, spurring a 6% climb in its shares early Wednesday.

“We’re now kind of at the bottom, though not yet in the active growth stage,” said Handel Jones, chief executive of International Business Strategies.

For now, demand appears to be picking up for chips used in corporate server farms and those used in artificial-intelligence computing, IBS projects.

Microsoft posted stronger-than-expected growth in the cloud-computing business in the third quarter. At the same time, AI is expected to continue to drive demand for graphic-processing chips made by the likes of Nvidia and AMD, as well as the specialized, high-end memory chips that support them.

In another bright spot, one cause of uncertainty eased in October when the U.S. took steps permitting TSMC, Samsung and SK Hynix to continue importing U.S. equipment for their chip factories in China so they can keep producing there.

Revenue in the global chip industry is expected to surpass $1 trillion by 2030, powered by growth in next-generation technologies ranging from AI to autonomous driving, according to IBS.

“The fundamentals of the industry are super strong,” said Ajit Manocha, a former chief executive of contract chip maker GlobalFoundries who now heads an industry trade group for chip-equipment and materials makers.

- Chieko Tsuneoka contributed to this article.

Write to Jiyoung Sohn and Asa Fitch at jiyoung.sohn@wsj.com

and asa.fitch@wsj.com

-

-

EconomySouth Korea to boost aid for chipmakers to $23 billion, expanding extra budget

EconomySouth Korea to boost aid for chipmakers to $23 billion, expanding extra budgetApr 16, 2025 (Gmt+09:00)

-

AutomobilesSouth Korea announces emergency support for auto sector against US tariffs

AutomobilesSouth Korea announces emergency support for auto sector against US tariffsApr 09, 2025 (Gmt+09:00)

-

EconomyChina says it is aiming to coordinate tariff response with Japan, South Korea

EconomyChina says it is aiming to coordinate tariff response with Japan, South KoreaApr 02, 2025 (Gmt+09:00)

-